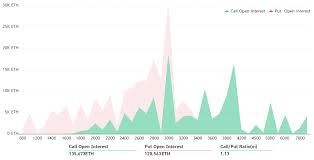

Ether (ETH) will face a critical $820 million monthly options expiry on Friday, Aug. 27. That would be the first time that $3,000 and better choices may have an actual preventing probability, even though bulls seem to have missed a good opportunity to dominate the expiry because they were too optimistic about Ether’s price potential.

It’s unclear why $140 million of the neutral-to-bullish name choices have been positioned between $3,800 and $8,000, but these instruments will likely become worthless as the monthly expiry approaches.

Competition and the success of interoperability-focused protocols impact Ether price

The Ethereum community has struggled as a consequence of its personal success, which consistently leads to network congestion and transaction fees of up to $20 and higher. Moreover, the rise of nonfungible tokens and decentralized finance imposed additional stress on the community.

Maybe some of the inflow that was supposed to move Ether price up went to its competitors, which presented stellar performances recently. For instance, Cardano (ADA) surged over 100% quarter-to-date as traders anticipate its long-awaited sensible contracts to launch on Sept. 12.

Solana (SOL), another smart contract contender, captured one-third of the inflows to crypto investment products over the last week, in line with CoinShares “Digital Asset Fund Flows Weekly.”

Lastly, layer-two scaling solutions like Polygon (MATIC) have also seen 150% gains after efficiently bringing DeFi projects into its interoperability pool and launching a decentralized autonomous group (DAO) to scale tasks on the software program growth kits.

Notice how the $3,000 level vastly dominates Friday’s expiry with 30,900 ETH option contracts, representing a $100 million open curiosity.

The initial call-to-put analysis shows a slight prevalence of the neutral-to-bullish call instruments, with 13% larger open interest. Nonetheless, bears appear to have been taken abruptly as a result of 83% of their bets have been positioned at $2,900 or decrease.

To succeed, bears must push and maintain Ether value beneath $2,900

Nearly half of the neutral-to-bullish call options have expiry prices set at $3,500 or higher. These devices will grow to be nugatory if Ether trades beneath that value on Friday. The options expiry happens at 8:00 am UTC, so traders might expect some price volatility nearing the event.

Beneath are the three more than likely eventualities that may possible occur and their estimated gross consequence. Keep in mind that some investors could be trading more complex strategies, including market-neutral ones that use calls and protective puts. Consequently, this estimation is considerably rudimentary.

The simplistic analysis weighs the call (buy) options against the put (sell) options available at each strike level. So, for instance, if Ether’s expiry occurs at $3,050, each neutral-to-bullish name choice above $3,000 turns into nugatory.

- Below $2,900: 36,360 calls vs. 32,700 puts. The online result’s just about balanced.

- Between $2,900 and $3,000: 36,770 calls vs. 20,320 puts. The online consequence favors the neutral-to-bullish devices by $48 million.

- Between $3,000 and $3,200: 55,660 calls vs. 8,320 puts. The online consequence favors the neutral-to-bullish devices by $147 million.

- Above $3,200: 62,260 calls vs. 1,490 puts. The online consequence favors the neutral-to-bullish devices by $197 million.

Bears will attempt to reduce the injury, and luckily for them, the honeypot for a favorable price move doesn’t look worthwhile of a significant effort from bulls.

As for the excessively optimistic choices merchants, they need to higher rethink their technique for the September expiry. The Ethereum network seems to be its own biggest enemy because the increasing adoption has fueled the rise in competitors’ decentralized finance applications.