The digital asset ecosystem is broadly considered the subsequent generational type of wealth. Over the years, while there have been many critics, there have been many more that have accepted the intrinsic value of crypto-assets. Even so, these belongings aren’t immune to 1 type of habits – Whale Manipulation.

Instances of the same were observed during the bull run of 2017. It was evident during the DeFi season of 2020 too. And now, it might appear that NFTs may be the subsequent breeding floor for such habits.

In order to understand capital flows into NFTs, allow us to look into widespread NFTs initiatives to know if manipulation may be anticipated from this sector as properly.

NFT whales different than Bitcoin, Ethereum?

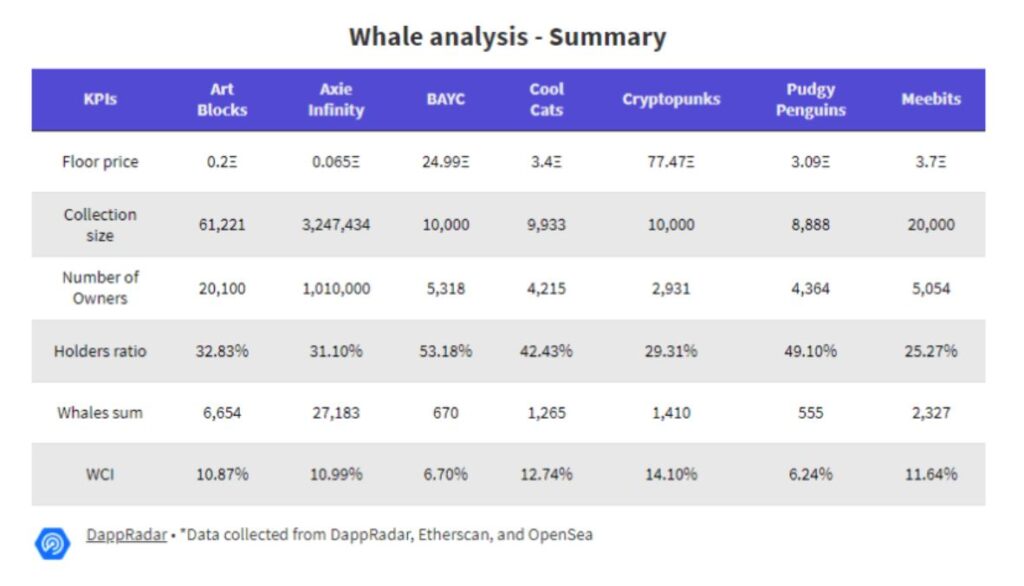

In a latest research carried out by Dappradar, a number of the widespread NFT initiatives equivalent to Crypto Punks, Axie Infinity, Pudgy Penguins, and Bored Ape Yacht Golf equipment, have been evaluated on the idea of whale focus index and distinctive holders ratio.

The whale concentration index or WCI underlines the number of NFTs held by top-10 wallets. What’s extra, the holder’s ratio measures the attain of a selected NFT undertaking. Hence, a high holders ratio and a low WCI would signal a well-distributed project that is less prone to market manipulation.

Now, in line with knowledge, Bored Ape Yacht Membership or BAYC and Pudgy Penguins had the best-distributed collections within the NFT area with whale focus indices being 6.24% and 6.70%, respectively.

Ethereum-based popular NFTs called CryptoPunks had a higher whale concentration as 1410 NFTs were owned by 14 wallets. Nevertheless, CryptoPunks additionally had a large market cap of $3.1 billion, at press time. Ergo, the probability of manipulation stays low.

Another popular NFT that recently recorded massive sales was the Axie Infinity collection. Its area has one of many largest userbases with 3 million. However, Axie Infinity is also well distributed, with the collective whales worth only over $1 million.

How much of a risk are NFT investors running?

Now, in line with knowledge, from some extent of manipulation, the risk is decrease for NFTs for the reason that assortment which does lead in direction of concentrated provides are premier NFT collections. Hence, the risk is significantly reduced.

Nevertheless, buyers ought to make a remark that NFTs are nonetheless a nascent area. One where the value is largely dependent on market interest and is highly illiquid. So quite than manipulation, an aggressive dump in worth may very well be a much bigger concern.