Bitcoin has been caught in a sideways sample for over 2 weeks now. At a time when most people are looking to take profits, there are also those who are still skeptical of the price falling. Nonetheless, that is solely seen in sentiment and never information.

In fact, an analysis of on-chain metrics seemed to suggest that despite prices slowing down their rally, selling remains almost non-existent. And this isn’t the case only for BTC.

Bitcoin and Ethereum’s HODLing continues

The development of accumulation could be very well-known and it continues to develop. But now, HODLing has become the new trend as people remain bullish about the top 2 cryptocurrencies. In the event you have a look at the HODL waves, you may observe a peculiar development of particularly younger cash being HODLed.

Coins younger than 3 months have been preferred by the market for HODLing. The decline in numbers signifies that the market doesn’t wish to spend till the volatility is excessive.

This is the case for ETH too. These younger cash account for 15% of the circulating provide of BTC and 12.5% of ETH.

And, this HODLing is plausible since right now, volatility is at an absolute low. For Bitcoin, it’s at a 3-month low of 45%. And for Ethereum, volatility is at a 6-month low of fifty%.This creates the necessary atmosphere for HODLing to continue.

However, is it supported by traders?

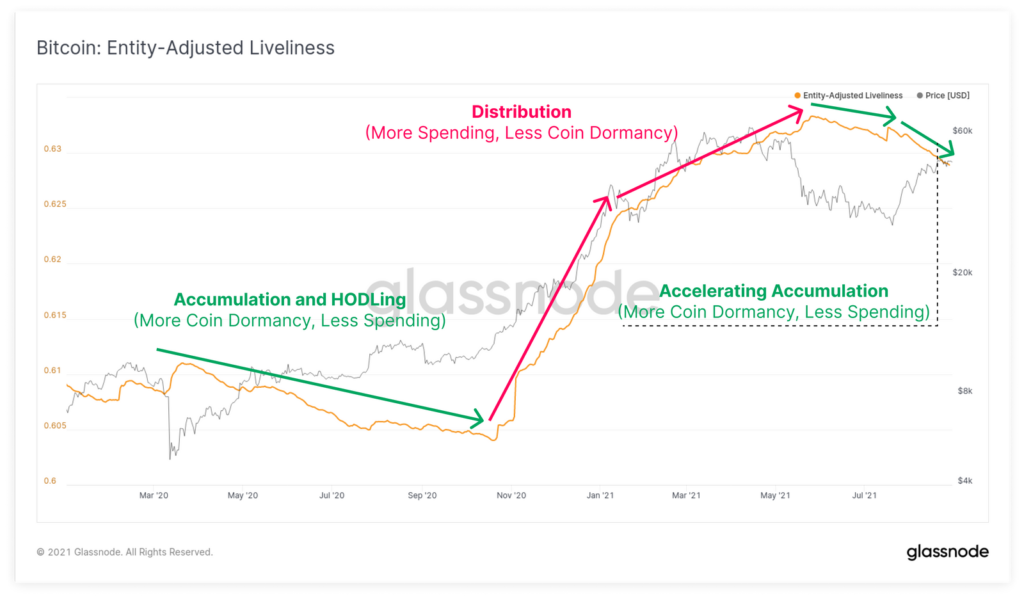

Indeed. Liveliness shows that for both the assets, there has been a significant increase in dormancy, as opposed to coin days being destroyed. The identical has been happening for over 3 months now.

Accelerating accumulation results in higher HODLing which leads to fewer coins being sold for both BTC and ETH.

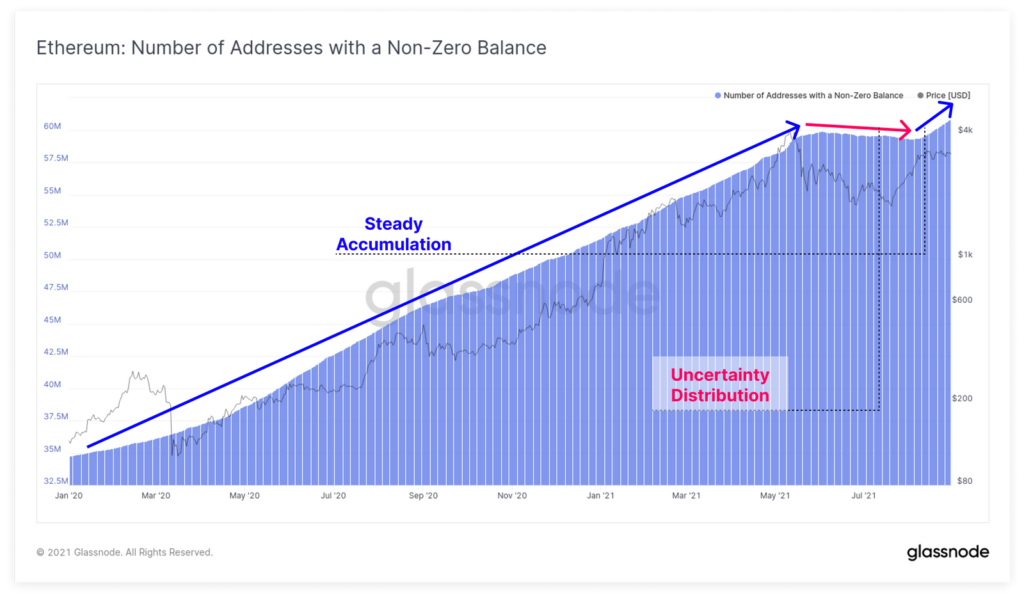

The traders’ notion can also be seen from the regular rise witnessed by the variety of addresses with balance. These figures represent the involvement of investors drawn out of market performance and not trend.

With the transaction volumes being as little as $20 billion for ETH, the narrative has some help. For Bitcoin, the volumes have been low despite the spike witnessed last week when volumes touched $397 billion. Nonetheless, they’re now again all the way down to a median of $30-$50 billion.

This HODLing is mostly from mid-term holders and not long-term accumulators. So long as these figures are maintained, HODLing might be maintained.