There’s a earlier than and after in a single explicit Bitcoin indicator that could possibly be signaling bearish worth motion within the brief time period.

As stated by many experts, the current bullish momentum can only be supported by strong demand, in any other case, BTC’s worth may transfer sideways or danger returning to its former vary beneath $40,000.

The amount of on-chain activity is a useful indicator to measure say demand. As the primary cryptocurrency by market cap climbed to its all-time excessive, above $60,000, the network saw a rise in its number of transactions.

This was most likely triggered by a FOMO impact from retail traders leaping into the crypto house for worry of lacking out on future beneficial properties.

This phenomenon was driven by Elon Musk promoting Dogecoin, the boom in the non-fungible token (NFT) sector, and the yield supplied by some DeFi protocols competing with Ethereum.

Bitcoin benefited from this new wave of investors adopting cryptocurrencies, and digital assets. Thus, a mix of institutional and retail curiosity and capital allowed BTC’s worth to achieve a brand new ATH. Transactions fees at that moment skyrocketed.

This occurred proper till the second when BTC collapsed within the first of three capitulation occasions unfold out throughout Might, June, and July. On-chain activity dropped with the market and has been unable to recover since.

As seen beneath, information from explorer Mempool.house exhibits that charges have gone from 100 sats/vB to round 7 sat/vB for a high-priority transaction. Via Twitter, analyst Mr. Whale said the following on the decline in Bitcoin’s on-chain activity:

Information exhibits there’s just about no demand for Bitcoin proper now. The BTC mempool has been flatlining for weeks, which is even worrying some bulls. We’re in for one more huge crash, but most are too grasping to confess that.

Bitcoin On-Chain Activity At A Low, Whales Take Over The Market?

Then again, pseudonym analyst “ChimpZoo” sees the opposite facet of the coin. The analyst believes the lack of on-chain activity could be bullish for BTC’s price based on 2 reasons.

First, this means a decline in retail participation or {that a} low quantity of BTC’s provide is being held by “weak arms”. The large inflow of retail investors experience in the first months of 2021, some analysts believe, led to speculation, high funding rates, and a high level of over-leverage trading positions.

All these elements accelerated Bitcoin’s dropped from its ATH and operated as bearish catalyzers. Recent price action to the upside lacks those variables, which could suggest that this rally could be more sustainable.

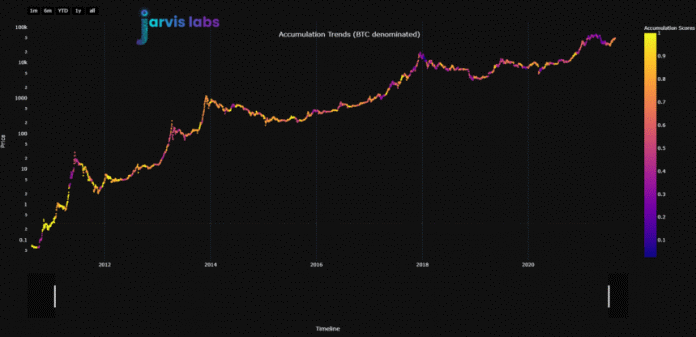

As well as, ChimpZoo claimed that the dearth of on-chain exercise and the rally level to a rise in whale exercise, and in robust arms coming into the market. This is supported by Jarvis Labs’ Accumulation Trends metric.

As seen within the chart beneath, prior to now 30 days Bitcoin whales have been accumulating extra BTC than smaller traders. The more yellow and closer to 1 on this metric, the more whales have been accumulating.

Thus, this might clarify the low on-chain exercise. Analyst Checkmate acknowledged that the market is at an uncertain point, but tends to incline more to the bullish side:

The divergence between onchain exercise and provide dynamics atm is just insane. Activity looks like a bear. Provide seems like a juiced bull. Truly a challenging structure to assess direction in, but in my view, supply dynamics trump activity. Reveals conviction and power.