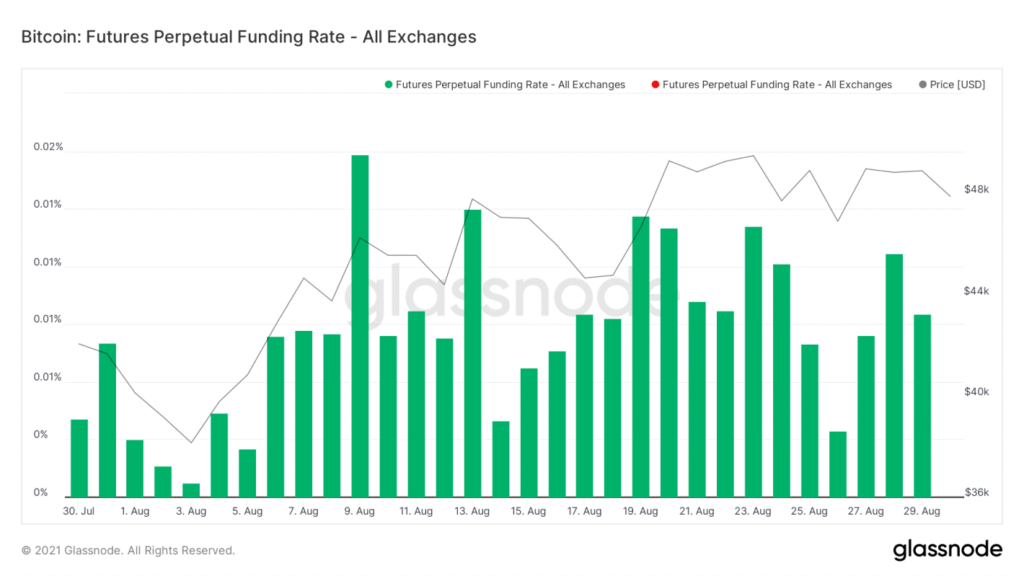

Since the beginning of August, BTC’s value has gone up by more than 30%. If its development is calculated from 21 July onwards, it will increase by 50%, but there is still a catch. Since 20th August, Bitcoin’s net recovery has been less than 2%.

Currently, there are a number of methods for recognizing such a lateral activity. Either, the consolidation is building towards a massive jump or there could be trouble for Bitcoin going forward.

With the help of an on-chain task, it is very difficult to assess temporary markets at the moment because there was no clear market framework. However, taking a macro-side approach, there might be more clarity in terms of analyzing BTC’s long-term direction.

How much is Bitcoin completely affordable?

According to Fair Value Deviation analysis, Bitcoin continues to be under the “bull-bear” flip, which determines the long-term rally. On existing, the FVD line continues below the sky favorable indication which implies that BTC is still verifying a corresponding favorable trend in the graphs.

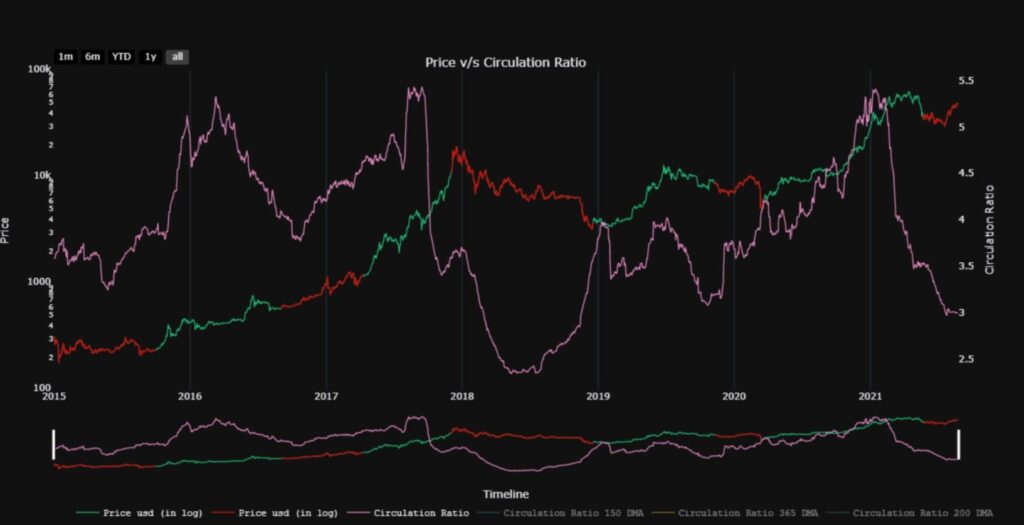

According to data, the circulation ratio is currently indicative of a sell signal. As far as information is concerned, blood circulation proportions are currently a sign of a sell signal. One of the inferences that can be drawn, is that the price is currently reacting to a relatively smaller supply in comparison to the early year rally.

This of the reasons that can be assumed is that the rate is currently responding to a rather smaller supply in contrast to the very early year rally.

One brings with it a greater variety of variability, as the rate responds to the radical activity of the energy supply.

However, the precise instructions must be encrypted in the next few weeks due to the fact that the BTC loan consolidation duration is currently more than 14 days. Trend, with the longer-term Bitcoin market a sign of bearishness, it may be much better for Dat to open a brand new regional that is announced sooner rather than later. Trend may be due to the fact that the cumulative