On-chain knowledge exhibits large Ethereum outflows of 60k ETH on spot exchanges. Such deeply damaging netflows may very well be a bullish sign for the coin.

Ethereum All Exchanges Netflow Exhibits Enormous Detrimental Spike

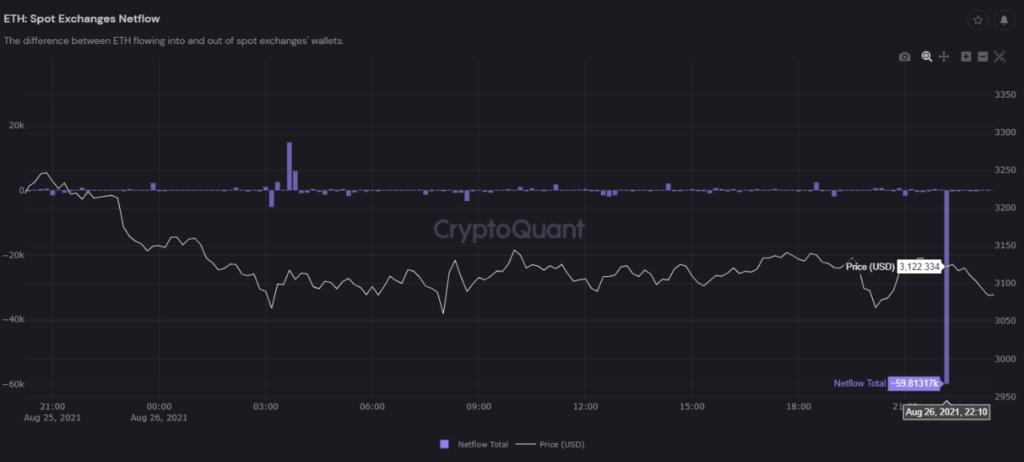

As pointed out by a CryptoQuant post, the Ethereum all exchanges netflow showed a negative spike yesterday as 60k ETH exited exchanges.

The all exchanges netflow is an indicator that’s outlined because the distinction between the change inflows and the outflows.

The “inflow” is the amount of Ethereum moving into exchanges from personal wallets. A rise on this worth implies a rise within the provide of ETH for promoting functions or altcoin buying.

The “outflow” is just the opposite; it’s the number of coins exiting exchange wallets. When this metric strikes up, it’d imply there’s a shopping for stress out there as extra buyers retailer their cash exterior exchanges.

As the netflow is the inflow minus the outflow, a positive value indicates more ETH is moving into exchanges than out. Equally, a damaging worth implies the opposite.

Now, here is how the chart for the Ethereum all exchanges netflow looks like:

Wanting on the above graph, it looks like the indicator is displaying a damaging spike in the intervening time. But what could such a value mean for the price?

Properly, as defined earlier than, when the netflow turns damaging, it means the web quantity of ETH is directed out of exchanges than in.

Investors pulling out their coins from exchanges could be because they feel a buying pressure in the market right now. Such a state of affairs may imply there’s a bullish sentiment among the many market.

Will There Be An ETH Supply Shock Soon?

Some analysts think an Ethereum supply shock might hit soon as massive amounts of the crypto continues to be burnt after the London hardfork.

The ETH change reserve, an indicator that exhibits the entire variety of cash held on exchanges, can be persevering with to say no as outflows dominate the inflows.

At the time of writing, Ethereum’s price floats around $3.1k, down 3% in the last 7 days. The under chart highlights the tendencies within the value of the cryptocurrency over the previous three months.

While the price is going down right now and looks bearish, the demand for Ethereum is only increasing when there isn’t enough supply. This might show to be fairly bullish for the market within the long-term.