The month of August has, by and huge, aided the restoration of many of the market’s high cryptocurrencies. The 30-day returns for Bitcoin and Ethereum, for instance, reflected positive values, 22.35% and 35.95% respectively, at the time of writing.

Given the excessive threat related to HODLing these crypto property straight, institutional traders have been on the look-out for different much less dangerous crypto-investment merchandise like ETNs, ETFs and ETCs. In fact, the crypto industry has been growing at a much faster pace when compared to other financial products that expose investors to traditional assets.

A deep dive into stats reveal that Bitcoin and Ethereum funding merchandise stay the most well-liked picks for traders. However, which crypto among the two is actually leading the race?

The ‘AUM’ tug of war

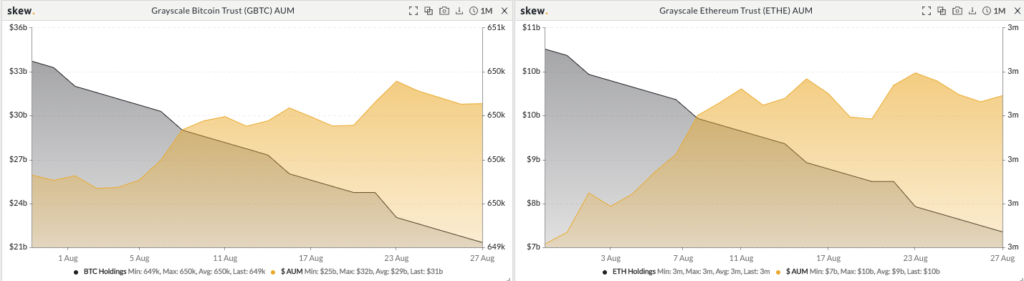

As per information from CryptoCompare, the whole AUM throughout all of the funding product sorts grew by 57.3% over the previous month. Ethereum based products grew at the fastest rate (72.8%), to $13.8 billion and attained its yearly peak with respect to the market share in this space. But, Bitcoin stays probably the most dominant crypto, as its AUM mirrored a cumulative of over $38.1 billion.

Among all major institutions, Grayscale’s trusts continue to hold the lion’s share in the aforementioned assets. Skew’s information additional identified that the worth of ETHE’s AUM grew at a a lot sooner tempo (42.8%) when in comparison with that of GBTC (19.2%) over the previous month.

The ‘volume’ tussle

Daily aggregate product volumes witnessed the largest one-month increase since May (up by 46.6%). The surge was largely led by Ethereum merchandise. For instance, ETHE’s daily volumes witnessed a 105.9% spike, while GBTC’s volumes rose only by 17.4% in the same time window. Actually, CryptoCompare’s report talked about,

“Other Bitcoin products saw their volumes slide – ETC Group’s BTCE and XBT Provider’s Bitcoin Tracker Euro (BTC/EURO), dropped (by) 14.8% and 23.9% respectively.”

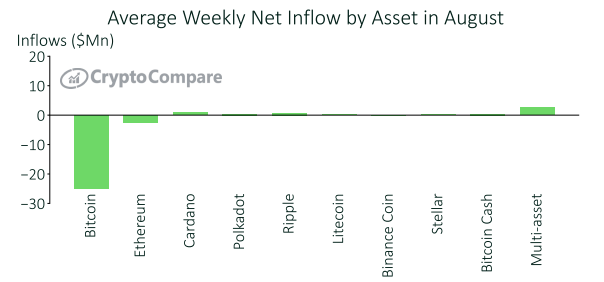

Well, volumes take into account both inflows and outflows. Therefore, at this stage it needs to be famous that digital asset funding merchandise skilled weekly internet outflows of $22.5 million till the third week of August. The same was largely driven by outflows in Bitcoin and Ethereum products. Apparently, alongside multi-assets, single-asset merchandise entailing XRP and Cardano (ADA) witnessed net-inflows.

ETCs, ETNs and ETFs

Among top Exchange Traded Notes and Exchange Traded Funds, ETC Group’s BTCE product was the most traded product, followed by VanEck’s Bitcoin product (VBTC). Notably, 21Shares’ Ethereum ETN (AETH) skilled the biggest share enhance in buying and selling quantity (up by 137.4% to $2.5 million) over the previous month.

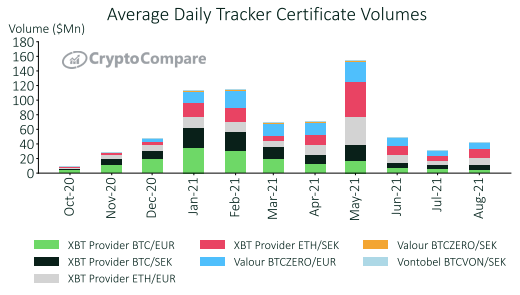

As far as Exchange Traded Certificates are considered, XBT Provider’s Ethereum Tracker One (ETH/SEK) product became the highest traded ETC product in August. This was adopted by XBT Supplier’s Ether Tracker Euro (ETH/EUR) product.

Even though Bitcoin continues to dominate the investment product space at this moment, a blind eye cannot be turned towards the pace of Ethereum’s advancements. Evidently, the latter class has carried out notably properly when in comparison with the previous over the previous month. ETH is gradually stealing BTC’s “institutional-interest” thunder.