After a rather impressive market rally and some exciting new all-time highs by some altcoins, the market couldn’t escape consolidation. At press time, on the every day chart, Bitcoin and Ethereum had shed round 3% of their values.

Though, as the larger market consolidated, Ethereum noted an independent trajectory. Not when it comes to worth motion, however on-chain information that painted a fast restoration from these losses. Though, with the price looking bearish, can certain bullish metrics turn the situation in Ethereum’s favor? Let’s treasure out.

Is Ethereum the safer guess?

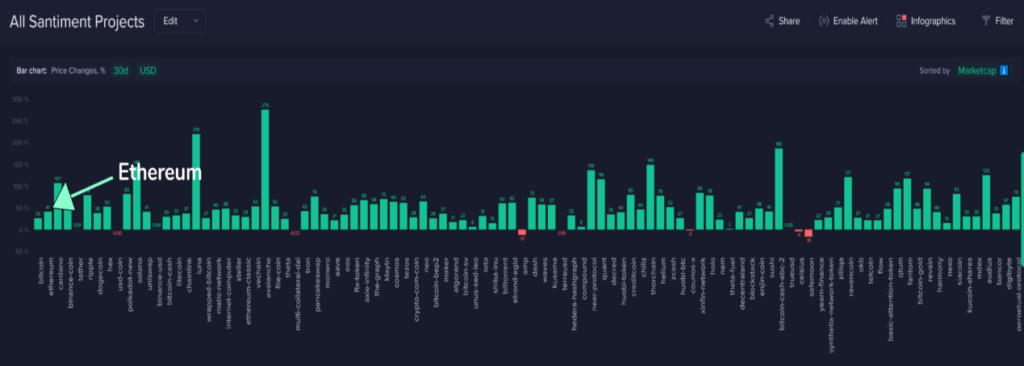

The market was on hearth this final month and a few altcoins shined brighter than others. The London hard fork on the Ethereum blockchain gave it a much-needed push both in terms of price and social sentiment. No matter that, though, Ethereum’s run, in response to a Santiment report, has been “comparatively boring in comparison with the altcoin increase.”

In fact, it has projected gains of only 41% compared to others like Cardano, Terra, and Avalanche, over the past 30 days.

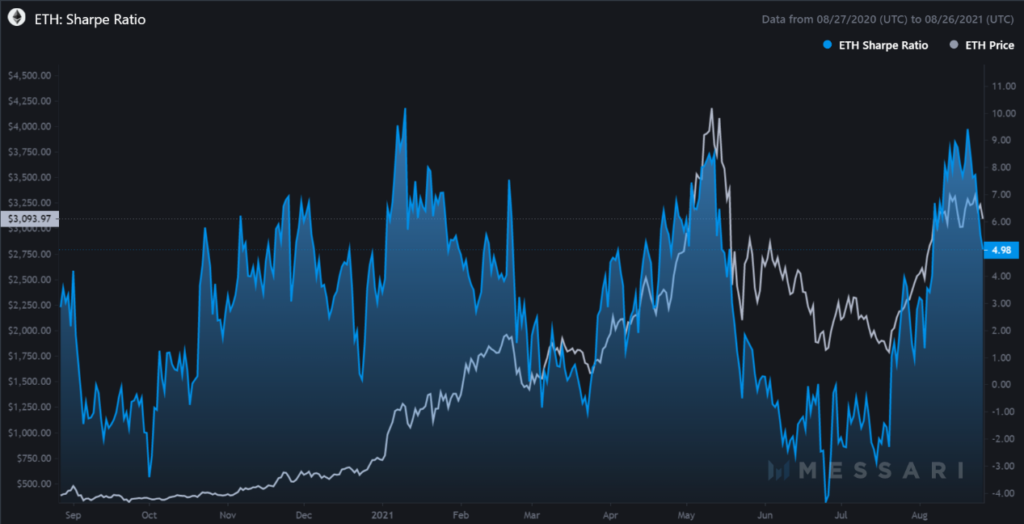

On the upside, the report additionally highlighted that for the aforementioned causes, ETH is actually much less of a danger to carry now. This, especially when compared to something like Cardano or other assets that have been absolutely roaring this month.

Notably, nonetheless, on the time of writing, Ethereum’s Sharpe ratio had dipped by nearly 50% over the past week. Ethereum’s Sharpe ratio had a value of 4.98, while the same for Cardano was 8.3 and 7.6 for BNB.

Ethereum testing its assist ranges at press time might have fueled this drop within the Sharpe ratio. Normally, the greater the value of the Sharpe ratio, the more attractive the risk-adjusted returns will be. The identical was increased for altcoins like Cardano and BNB, on the time of writing.

Nevertheless, as previously touched upon, ETH’s ratio seemed to have an upside to it as well, fueling a possible northbound move.

Ethereum can go up if…

Ethereum’s token circulation breached its two-month excessive ranges newly. This is a good sign, one that can pull up the asset’s price if it slumps below $3k.

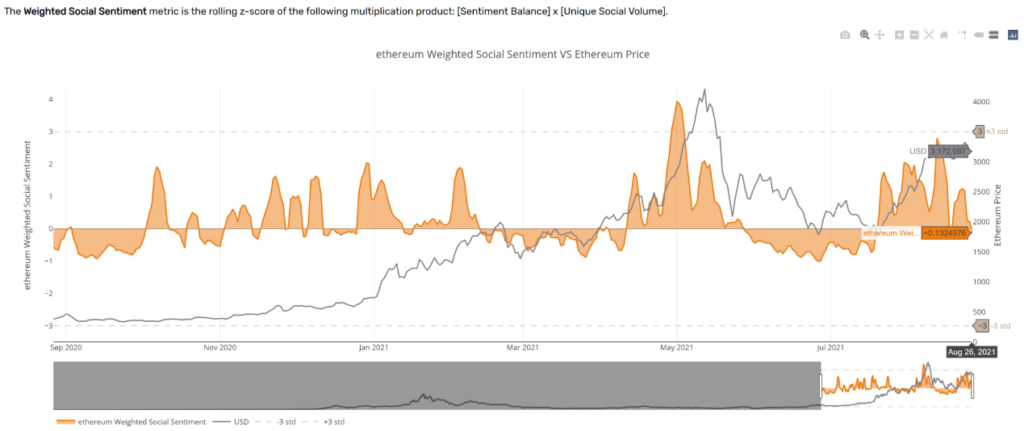

Additionally, ETH’s weighted social sentiment, after being euphoric for over 4 weeks, indicated that the gang had lastly edged into adverse territory in comparison with historic averages. An additional push into the negative territory would be a great sign that a price bottom is on the horizon. This might additionally act as an excellent dip shopping for alternative for patrons within the mid-short time period.

Though, notably, the NVT for Ethereum hit a 3-month ATH. This meant that the community was overvalued on the time and {that a} reversal might be in retailer if increased values aren’t famous quickly.

If this is in fact the highest value the NVT notes, Ethereum could see a short-term correction. Nevertheless, a push from the bulls might avert the identical.