The market’s top two cryptos have been moving independently of late. While Bitcoin’s path has seen a lot of consolidation, Ethereum has been climbing the charts over the past week. As both Bitcoin and Ethereum holders looked reluctant to sell-off at a crucial time amid anticipation of a price rise, on-chain metrics offered an interesting insight into the larger market sentiment.

Some interesting divergences for the two measures of the major coins posed a complex question: Do the same ones project bullish or bearish divergences? However, supply dynamics for BTC and ETH have been flashing both bearish and bullish signals. Ergo, it’s important to weigh the same against market sentiment to get a clearer picture of the future.

A strong trend for bulls

An observation of the accumulation and HODLing patterns allows better visualization of the long-term picture. The same revealed that the current activity on Bitcoin and Ethereum is similar to the stable pre-bull accumulation range established between mid to late 2020. Despite the prices returning to higher trading ranges, the demand for block space on both Bitcoin and Ethereum has been well below recent peaks.

A glass knot report also found that entities active on the Bitcoin network were around 275,000 per day, around 35% lower than the January peak. The same for Ethereum was down 33% from its May peak, sitting at around 450k addresses per day.

A drop in waves of young HODL coins for Bitcoin and Ethereum seemed to indicate that the market prefers HODL and not to spend. Young BTC represented only 15% of the coin supply and saw a very strong downtrend. For Ethereum, young coins trended down towards the long-term low of 12.5% of the circulating supply.

Additionally, an increasing proportion of middle-aged coins for ETH and BTC suggested an increase in the illiquid supply.

Adoption, interest, accumulation, and HODLing

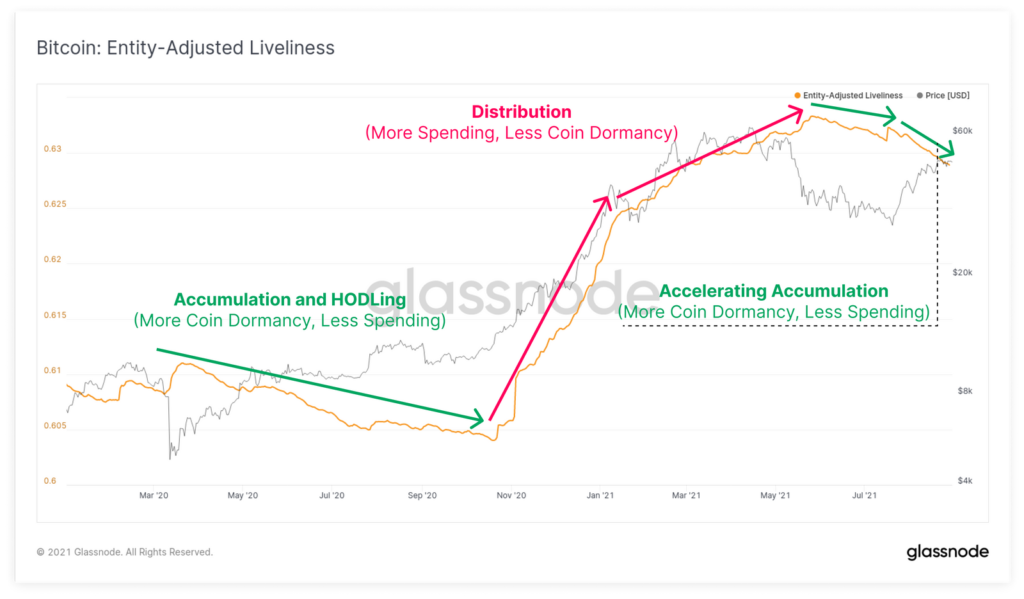

Both Bitcoin and Ethereum have seen a downtrend in liveliness since June. This suggested less expense and more coin dormancy (coin maturity was accumulating). Liveliness maps out whether more coin days are accumulated (HODLing) or destroyed (spending) by the total coin supply.

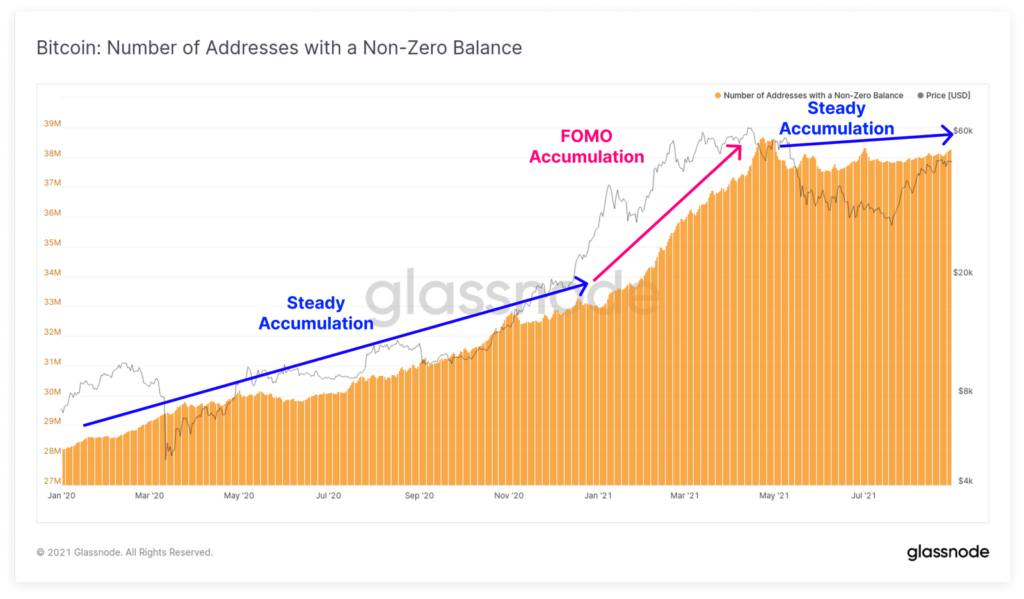

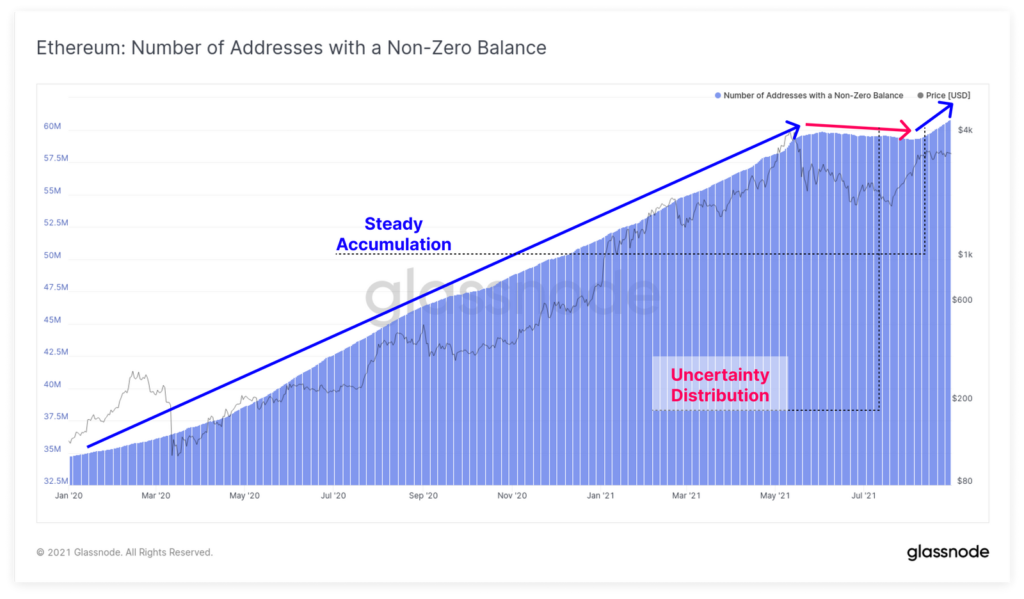

Now, even though the accumulation has been visible since May, a more accurate signal of adoption, interest, accumulation and HODLing is the steady growth of non-zero balances.

Bitcoin’s non-zero addresses, for instance, have been on a steady uptrend since July. They were over 38 million and were heading towards an ATH.

Ethereum also made a new all-time high of 60.7 million addresses with a non-zero balance. While the divergence between price and on-chain activity is historically abnormal for a large-scale bull market, it is not an uncommon sign for pre-bullish and pre-supply-squeeze momentum.

Supply dynamics for the top two cryptos suggested that an extremely robust underlying demand was present in the market. This could be quite constructive for prices if the trend continues.