Contrasting price movements were seen by altcoins such as Ethereum, IOTA, and Uniswap. For example, the likes of Ethereum and IOTA recorded good points. Ethereum went up by 1.7% and revisited a multi-month excessive. IOTA was one of the biggest gainers after climbing by 30% on the charts.

Uniswap, alternatively, misplaced 2.7% of its worth and traded nearer to its $28.26 assist degree.

Ethereum [ETH]

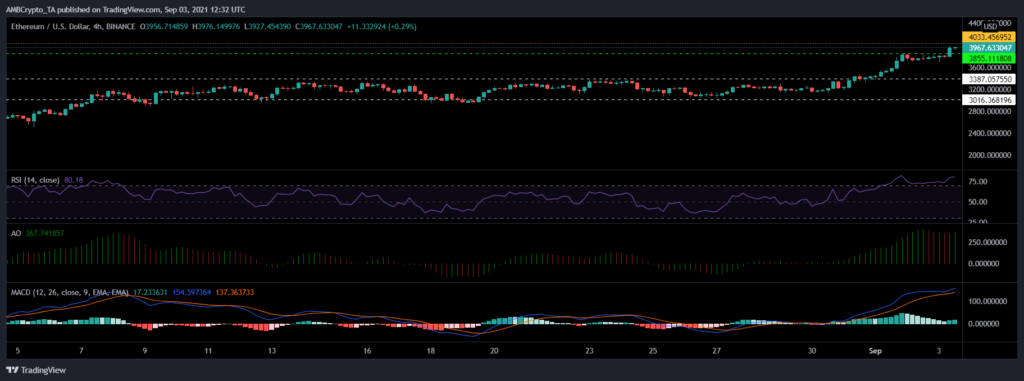

Ethereum reclaimed its multi-month high as it was trading at $3967.63. Over the last 24 hours, ETH has gained by about 1.7%.The overhead resistance lay at $4033.45. Ethereum had last hovered around this price level on 14 May. Technicals indicated bullishness.

Ethereum continued being overbought for the past 72 hours. The Relative Power Index was parked above the 75-mark. MACD also displayed green histograms and was last around the same level almost four weeks ago. Superior Oscillator displayed inexperienced sign bars after a collection of trades within the crimson.

A fall from the press time price level would drag ETH to trade near $3387.05 and then on $3016.36. Ethereum was final buying and selling across the latter value line round two weeks in the past.

IOTA

IOTA rallied by almost 30% over the last 24 hours and was trading at 1.56. It revisited this value degree after a period of three months. Its immediate resistance lay at $1.60 and then at $1.68. Parameters for IOTA pointed to excessive bullish value motion.

The Relative Strength Index stood above 75, indicating that IOTA was overbought. Chaikin Cash Circulation additionally depicted a rise in capital inflows because it was seen above the mid-line. Awesome Oscillator flashed a seven-month high with amplified green signal bars at press time.

A corrective value pullback can not often be overruled, in case of which IOTA would dip to $1.23 after which to $1.11. The latter price level has been a starting point for previous hikes noted over the last month.

Uniswap [UNI]

UNI dropped by 2.7% in 24 hours and it was buying and selling at $29.64. The altcoin seemed to be moving closer to its immediate price floor of $28.26. If the alt fails to trade above this level, UNI could drop to its one-week low of $25.47. Uniswap omitted combined buying and selling indicators on its four-hour chart.

MACD displayed red histograms after a bearish crossover. Superior Oscillator exuded crimson sign bars in correspondence with the above indicator.

On the contrary, buying pressure recovered as the Relative Strength Index hiked above 50.

If UNI’s shopping for energy continues to recuperate, the price will move up to retest the multi-month high of $31.20.