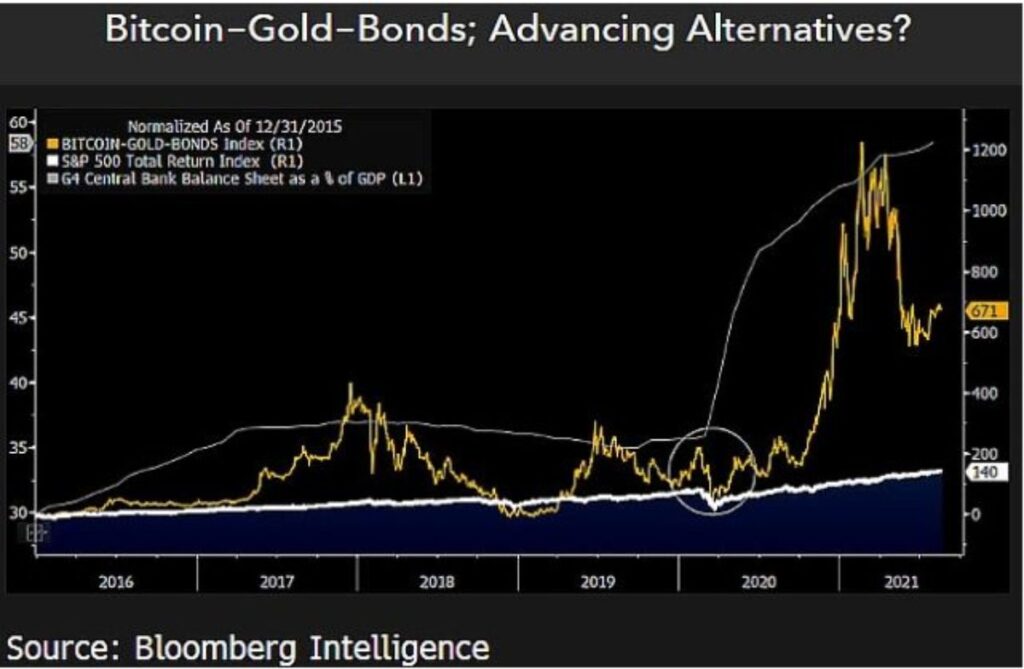

What’s defending an funding portfolio from potential inventory market volatility? As per Bloomberg Intelligence’s Mike McGlone, a merged exposure of Bitcoin (BTC), gold, and government bonds.

The senior commodity strategist, who sees BTC heading to $100,000, pitted derivatives in a brand new report representing the three safe-haven property towards the efficiency of the S&P 500 index, finding that the trio has been outperforming the benchmark Wall Street index at least since the start of 2020.

The Bitcoin-Gold-Bonds index took knowledge from the Grayscale Bitcoin Belief (GBTC), SPDR Gold Shares (GLD) and iShares 20+ T- Bond ETF (TLT). The three funds enable investors to gain exposure in the market without requiring to hold/own the physical asset.

Bitcoin extra worthwhile than gold and bonds

McGlone noted that Bitcoin did some heavy lifting in making investors’ risk-off strategy successful, including that their portfolios “seem more and more bare” with out the flagship cryptocurrency even when they continue to be uncovered to gold and bonds.

The statement took cues from the performance of Bitcoin, gold, and the 10-year US Treasury yield against the prospect of rising quantitative easing and debt-to-GDP levels. Since March 2020, Bitcoin has risen nearly 1,190%, which involves be extensively higher than spot gold’s 25.93% spike.

Meanwhile, the U.S. 10-year bond yield has jumped from its record low of 0.33% to 1.326% in the same period.

Nevertheless, regardless of a wholesome spike, the returns on the benchmark authorities bond have come to be decrease than the core U.S. inflation of 5.4%, suggesting that investors who hold bonds as safety against risky equities are making an inflation-adjusted loss.

Because of this, decrease yields have created avenues for corporates to borrow at meager charges for enlargement, thus giving equities a lift. Additionally, investors in the secondary markets have started moving their capital into non-yielding assets like Bitcoin and gold, anticipating higher payouts.

Yield rebound forward?

Former bond investor Invoice Gross, who constructed Pimco right into a $2 trillion asset administration agency, famous that bond yields have “nowhere to go however up.”

The retired fund manager said that the 10-year U.S. Treasury note yields would rise to 2% over the next 12 months. Due to this fact, bond costs will fall attributable to their inverse correlation with yields, leading to a lack of about 3% for traders who purchased money owed all throughout 2020 and 2021.

Federal Reserve purchased 60% of net US government debt issuance over the past year with its $120 billion a month asset purchase program to boost the US economy. Nevertheless, in August, the U.S. central financial institution introduced that it could decelerate its bond-buying by the top of this 12 months, given the prospects of its 2% inflation charge goal and financial development.