Bitcoin and Ethereum accumulation continues in the spot market as the focus now shifts towards the derivatives market. Here a few interesting observations can be made, each of which shows us how futures and options have affected the spot market. And vice-versa. Those looking for profits in Bitcoin and Ethereum might find the derivatives market as an alluring opportunity.

How does the market look?

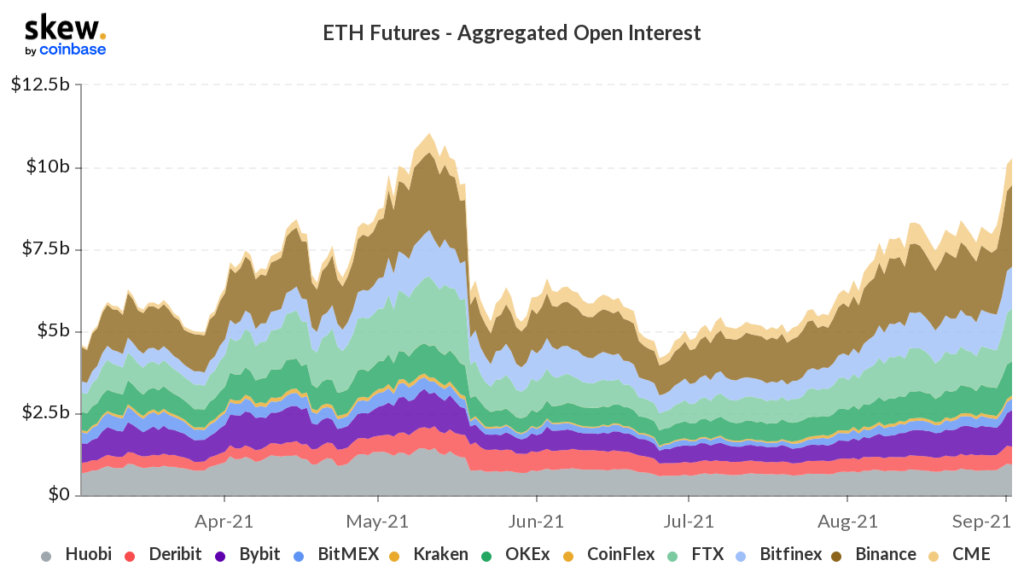

Right now, the market has been at its best for a long time. Bitcoin and Ethereum investors are in a strong position as Open Interest [OI] reached new heights today. Futures OI for BTC seemed to be at a 4-month high of $17 billion. The same was the case for ETH, with the OI standing at $14 billion.

That being said, it should be noted that the ETH market is in a very different position than the BTC market, varying in many ways.

The ETH market has been very bullish

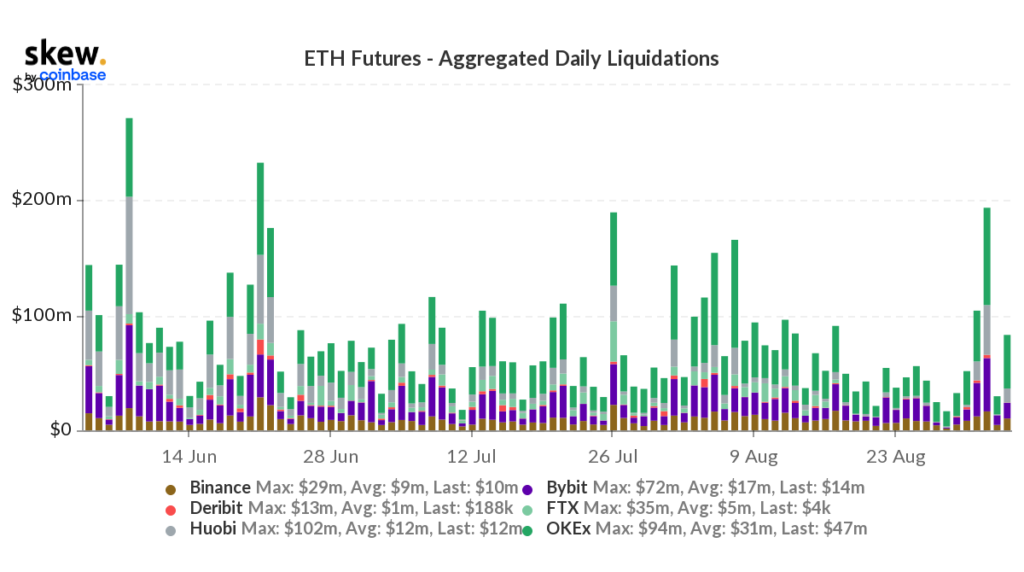

Volumes on 31 August and 1 September were almost close to Bitcoin’s levels of $41 billion. These volumes are unusual for ETH as they mostly stay in the $ 30 billion range. Plus, over the same time frame, when ETH volumes were close to BTC’s, daily liquidations touched a 3-month high of $194 million.

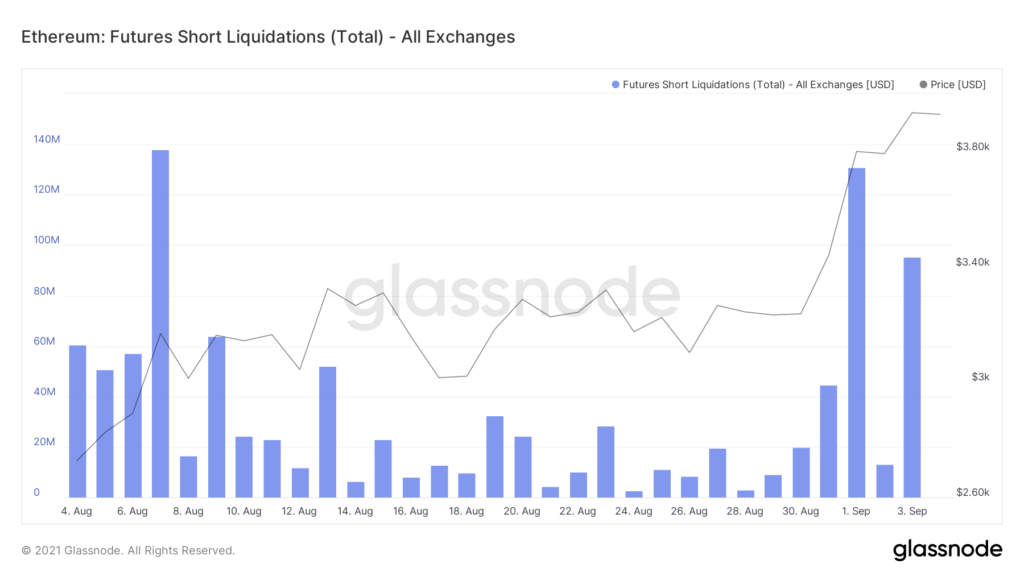

However, if you take a closer look you will notice that most of these closeouts were from short contracts. Short liquidations for Ethereum rose to a monthly high of $130 million.

This happened mainly due to the rally in ETH over the past 2 days, a period in which ETH rose 18.81%.Right now, people are demanding stability from Ethereum’s market.

BTC market has been steadily bullish

At the time of writing, daily volumes were still within the normal range of $ 100 million. Bitcoin OI in Perpetual Futures contracts also hit an 18-month high of $14.157 billion.

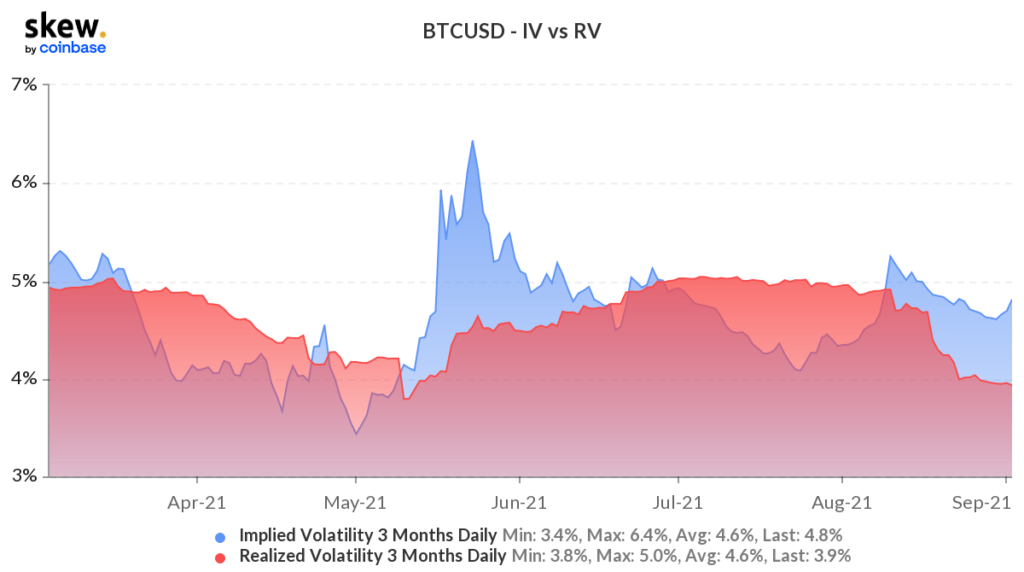

These are good numbers for a bull market for over a month now. Even the Implied Volatility to Realized Volatility spread seemed to be at its highest level of 0.9%, a level last seen on 30 May.

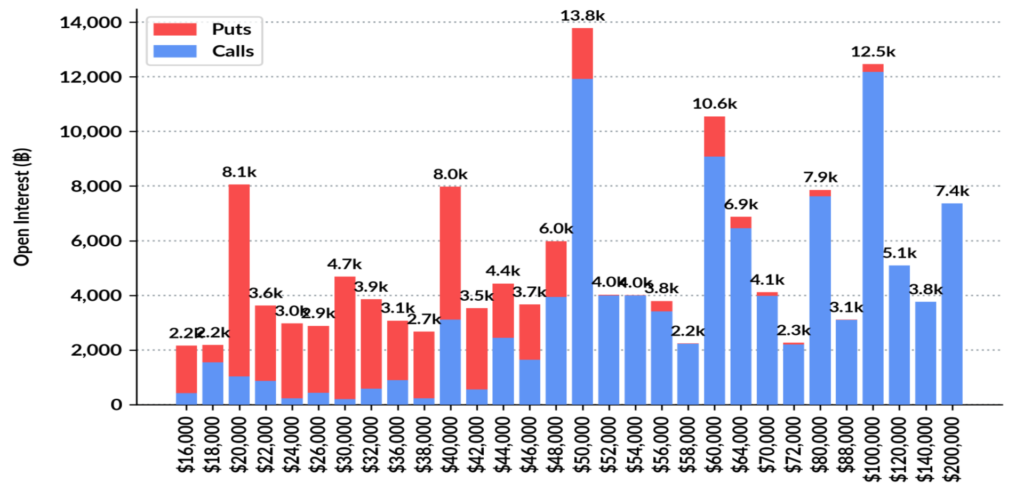

One of the main reasons for this is that the BTC spot market has been rising steadily, rising “only” 4.83% in the past 4 days. Plus, with Bitcoin crossing $50k again, the OI by Strike’s 12k Call contracts for $50k seems to be turning profitable as the 24 September expiry inches closer.

Overall, the derivatives market is currently very profitable.