Ethereum struggled to the touch the $4000 mark and was consolidating with a rise of 0.9%.Some altcoins, however, started to decline owing to longer periods of trading sideways. As an illustration, DOT moved nearer to the worth flooring of $$28.94.

Chainlink, too flashed range-restricted price action and was trading close to an immediate support level of $30.37 with chances of falling near its one-week low price level at $24.30.

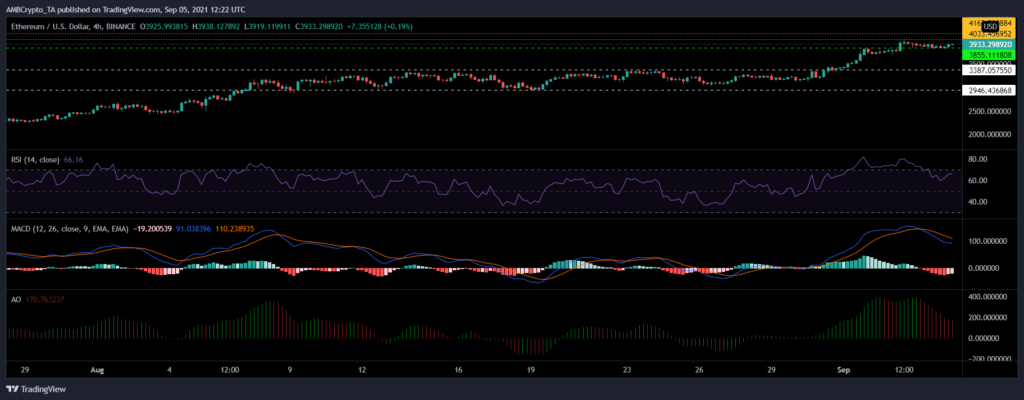

Ethereum (ETH)

ETH/USD, TradingViewEthereum’s worth motion has been consolidating with minor good points of 0.9% over the past 24 hours. It was priced at $3933.29. It toppled over its price ceiling of $3855.11, and a break from the consolidation could push Ethereum to revisit the multi-month high of $4033.47.

Technical indicators, nevertheless, pointed that bearish worth motion hadn’t fizzled out utterly but. Relative Strength Index was positioned above the 60-mark as buying strength remained bullish. MACD flashed pink bars on its histogram.

Awesome Oscillator flashed red signal bars indicating negative price action. If the bearish perspective holds true, Ethereum would dip under $3855.11 and commerce close to $3387.08. Failing to remain above the $3387.08 price level would push ETH to its one week low of $2946.43.

In different information, Twitter might probably permit Bitcoin and Ethereum to allow receiving suggestions via Tip Jar characteristic.

Polkadot (DOT)

DOT traded in a range-bound manner and dipped by 0.8%. It was trading at $32.70. It was buying and selling at $32.70. The altcoin stood notches under its weekly excessive of $33.37. If DOT’s price action remains consolidated over upcoming trading sessions, chances are that the altcoin could dip to $28.94.

Failing to maintain at $28.94, might drop DOT to a 4 week low of $25.22. The technical indicators appeared bearish for the coin. MACD underwent a bearish crossover and displayed pink bars on its histogram.

Awesome Oscillator flashed red signal bars. Capital inflows dipped because the Chaikin Cash Movement parked under the mid-line. If DOT reversed its price action on the upside, the overhead resistance was at $33.37, toppling it, DOT could aim for $34.41.

Chainlink (LINK)

LINK fell by 0.2% whereas consolidating over the past 24 hours. The asset was priced at $30.54 and with a continued downtrend, LINK might fall to $30.37 and then to $27.77. If LINK is unable to carry its costs above $27.77, it’d commerce close to its weekly low of $24.30.

Key indicators signified a negative price action. MACD displayed pink bars on its histogram. Awesome Oscillator also flashed red signal bars.

Bollinger Bands remained tight, which signifies that worth volatility would stay low over upcoming buying and selling periods. On the reverse side, LINK could find resistance at its three-month high of $31.22 and the attempt to retest the $32.22 price level.

With reference to current developments, Bored Ape Yacht Club initiated an adoption with Chainlink’s Verifiable Random Operate (VRF) to offer airdrops on the platform. This integration could lead to the increased interest of investors.