Top altcoin, Ethereum was trading at $3800 after an exponential rally amid which it tested the $4,000 psychological level on September 3. It has managed to remain robust, protecting properly above $3750. It it manages to recover above $3,860, a retest of the all-time high would be next on ETH’s cards.

So, how far can the Ethereum rally go? The answer to that can be found in the following metrics.

Highest community valuation in over a yr

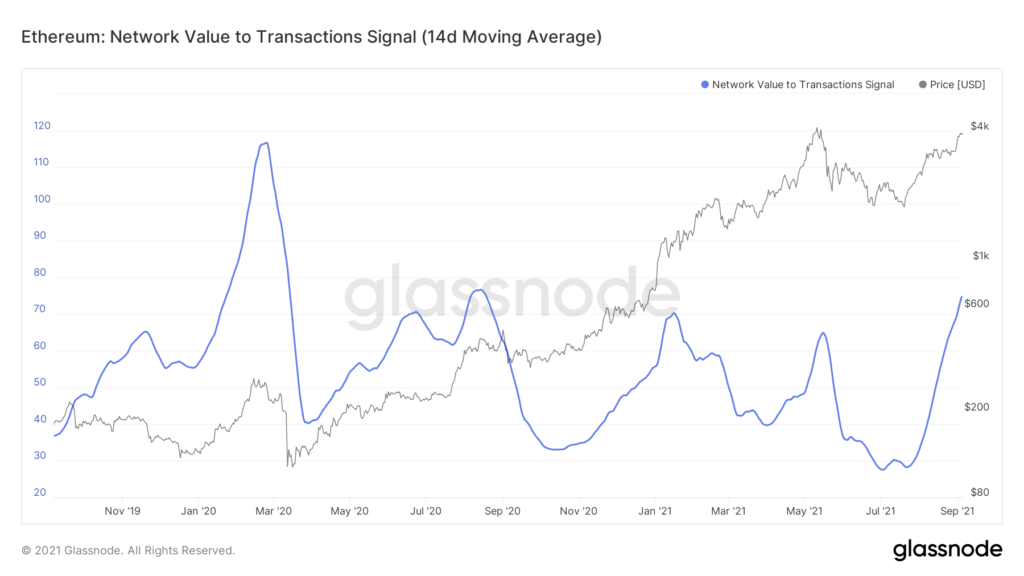

Ethereum’s NVT sign (14 day MA) just lately reached a 17 month excessive, final seen in August 2020. A high NVT value suggests that the network valuation is outpacing its transaction volume. When NVT is excessive, the community worth is properly above the worth being transferred on the community, whereas it could symbolize a possible bubble, within the case of Ethereum it represented professional progress levels, alongside robust worth motion.

Notably, over the past two years, whenever the NVTS saw a parabolic growth, Ethereum showed a sustained rally with massive price gains. An identical pattern was noticed in direction of the start of January 2020 when Ethereum rose by nearly 140% in only a month.

Interestingly, this time too, a 140% rise from a low on July 20 will take the alt near $4300 which is around an ATH of $4,337.10. Thus, a robust NVTS trajectory with about 140% in good points might take ETH to its ATH and possibly above, it if the rise in NVTS continues.

However, a fall in Ethereum’s active addresses taking it to an all-time low of eight months is a worrying trend but a push in active addresses can push the rally further. An increase in lively addresses, earlier than ETH sees its ATH, can be essential.

The future of ETH futures looks good

Apart from the high network value, other factors influencing ETH’s price are the open interest and daily volume of ETH futures. Based mostly on data from Skew, ETH choices quantity was growing over the past week. In fact, on September 1, Ethereum saw the highest peak in options volumes followed by another small peak two days later.

Additional, Ethereum’s Open Curiosity in Perpetual Futures contracts reached a 13-month excessive of $589,275,968.65 on Okex. On other exchanges too, ETH futures’ aggregated open interest was high, with the total being close to its May ATH of 10.9 billion. At press time, the entire Futures Aggregated Open Curiosity stood at 10.6 billion. Those looking for profits in Ethereum might find the derivatives market, an alluring opportunity.

ETH’s path to ATH

The top altcoin reaching its ATH will be critical to the rise of Defi, NFT marketplace tokens, and other altcoins. Additional, ETH might improve the general market capitalization of Defi with a number of initiatives following ETH carefully when it comes to worth motion and correlation. For now, ETH was around 30% away from its ATH. Nevertheless, a push from spot merchants and an increase in lively addresses might guarantee its journey upward.