Ethereum and Bitcoin have long been the market’s most prominent projects, with both considered to be some of the best investment options in the space. With new traders coming into the market, nevertheless, new funding choices are coming to the fore as nicely.

In the past, ICOs were the big thing. Today, DeFi and NFTs may have just taken their place. And surprisingly, their performances make it look like DeFi and NFTs have change into invulnerable to the broader market efficiency.

DeFi over Ethereum?

While a majority of the market is still trading in red, DeFi protocols have seen an increase in usage. Stablecoin-centric DApps are main the ecosystem proper now. While Ethereum recorded a correction of 14.1%, DeFi TVL (total value locked) across all chains only fell by 5%, over the same time period.

What this implies is that of late, the DeFi area has been considerably unaffected by adjustments within the worth of ETH.

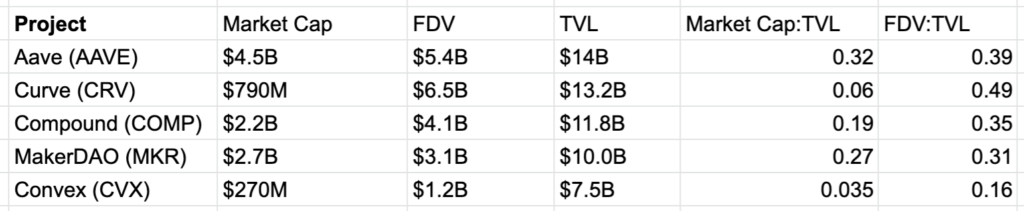

However, despite the TVL going past its May ATH, the top 5 protocols by highest TVL were still far from their ATHs at press time. Most notably, AAVE by 49%, Curve (CRV) by 43.7%, Compound (COMP) by 52.86%, MakerDAO (MKR) by 51.57%, and Convex (CVX) by 38.5%.

Their overall market values are significantly lower than their levels from May.

An enormous purpose for some divergence from DeFi can also be as a result of rise in NFTs.

What impact have NFTs had?

NFTs emerged as a major trend in the space following the emergence of Cryptopunks and Apes. In reality, 8 September noticed one of many largest NFT occasions in historical past.

Over 18k+ addresses competed to mint 7000 NFTs from a collection called The Sevens. This resulted within the highest recorded imply fuel worth, touching greater than 5k Gwei in merely 10 minutes.

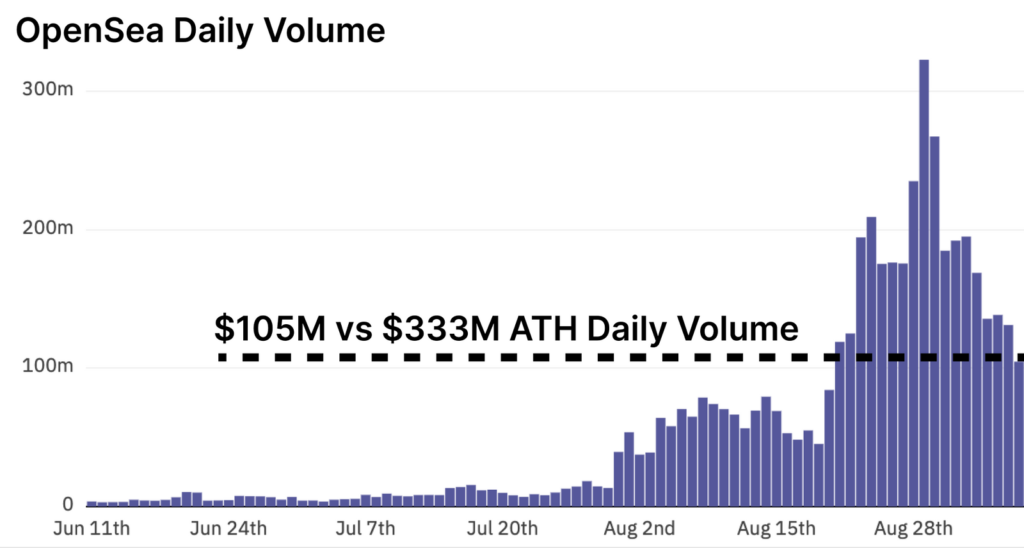

Despite the aforementioned, the broader NFT market has seen a pullback lately. In reality, day by day volumes have come all the way down to round $100 million.

One reason for the same is that top CryptoPunk and Ape (two of the biggest NFTs) holders have moved into HODLing mode, with fewer trades taking place recently.

That being stated, it’s nonetheless vital to do not forget that NFTs are nonetheless illiquid. Their value depends on the hype and as long as that hype stays, NFTs will have solid value.

As soon as the market curiosity fades, alas, their worth would possibly fall as nicely. Thus, investors beware.