After dumping below $41,000, bitcoin initiated an impressive leg up, resulting in tapping $44,000. Decentralized Financial Space tokens have seen even more noticeable gains over the past 24 hours, including a massive 30% increase in Uniswap.

Bitcoin Gained $3K in Hours

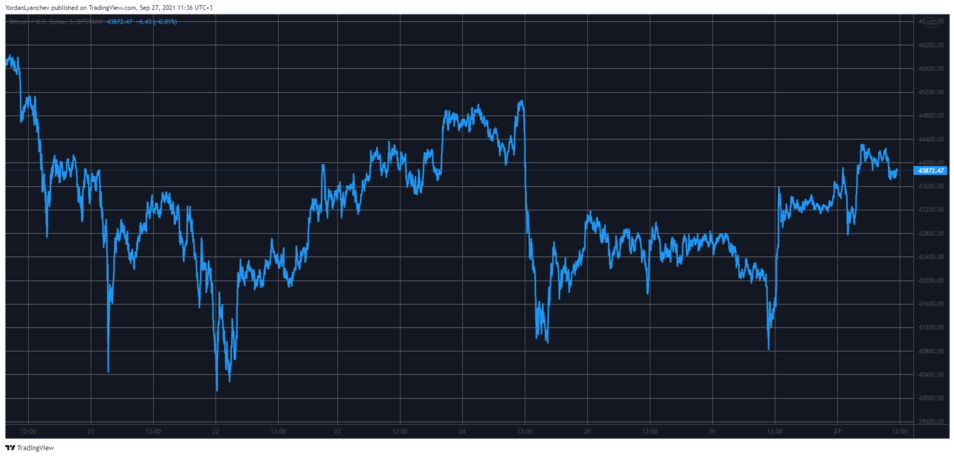

Unlike the previous weekends, this one wasn’t uneventful for BTC’s price. The cryptocurrency had just emerged from a bearish Friday in which it fell $ 4,000 within minutes following the FUD’s latest statement from China.

Bitcoin spent the Saturday aiming to recover most losses, but the bulls drove it as high as $43,000. Sunday, however, started again with heightened volatility.

BTC slumped by a few thousand dollars and dropped below $41,000 for the second time in two days. However, as the bears prepared to take him further south for $ 40,000, the situation changed.

In just a matter of minutes, bitcoin spiked by roughly $3,000 and neared $44,000. In the hours that followed, the asset went further and briefly passed the $ 44,000 mark. As of now, it has retraced slightly and stands just below it.

Bitcoin’s market cap topped $ 800 billion, while alts dominance fell to just over 42%.

DeFi Tokens Surge

Most larger-cap altcoins have mimicked BTC’s performance since late last week. Ethereum fell again yesterday to below $ 2,800, but an 11% increase took it down to around $ 3,100.

Binance Coin (8%), Ripple (6%), Solana (9%), Polkadot (7%), Dogecoin (4.5%), Avalanche (8.5%), and Luna (6%) are well in the green. Interestingly, Cardano only gained a modest 2.5% in one day, despite multiple new partnerships emerging from the top of the project over the weekend.

The most substantial increases are coming from tokens related to the decentralized finance space. Uniswap is leading the way with a massive 34% increase in one day. As a result, UNI has neared $25.

PancakeSwap (14%), Aave (16%), The Graph (14%), Compound (17%), SushiSwap (30%), etc. This could be linked to the latest activity from China, as reports suggest locals are now turning to DeFi products since the country banned trading in cryptocurrency – once again.

Ultimately, the cryptocurrency market capitalization has increased by more than $150 billion since yesterday’s low, but it’s still beneath $2 trillion.