The state of the broader crypto-market hasn’t been winsome lately. The diminishing returns offered by the best coins, including Bitcoin, Ethereum, and Cardano, have also triggered a drop in the global cryptocurrency market capitalization. In effect, the state of the on-chain metrics for most of these cryptos has started withering already.

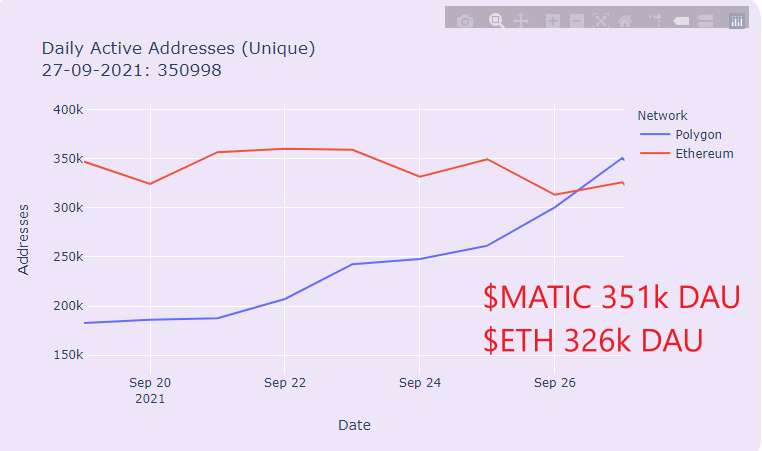

However, Polygon’s story was slightly different. He has, in fact, been on a record binge lately. The network managed to eclipse Ethereum’s layer-one in daily addresses for the first time yesterday. This, in itself, is a quite remarkable feat achieved by the network.

Even though direct parallels are drawn here, it shouldn’t be forgotten that the network’s aim is to aid Ethereum and not compete with it. As such, Polygon is an L2 solution that runs on the Ethereum network to process transactions faster.

It also makes it easier for applications built on Ethereum to work with other blockchain platforms. The increased adoption of this cross-chain scalability solution is indirectly a boon for Ethereum.

Polygon has also been able to secure many high profile partnerships in recent times. Coinbase – one of the world’s most prominent crypto-exchanges, for instance, recently announced that it’s planning to integrate Polygon’s Ethereum scaling solution to reduce prices and settlement times on its platform.

Additionally, companies like EY have also started to rely on Polygon’s solution for their blockchain products.

The network has also been making rapid strides on the NFT front, alongside Ethereum. Dolce and Gabbana, for example, recently chose the Polygon network for its NFT auctions.

So, are good days for MATIC already here or is the hype and hoopla merely ad interim?

All that glitters is not gold

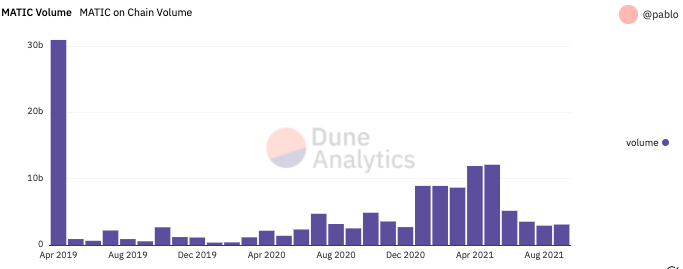

Despite the aforementioned set of positives, there are a few things that are currently going off the rails for the network. Unique depositors to MATIC, for starters, have been on the decline since mid-August. The same is nowhere close to its May levels.

Additionally, on-chain volume has also spent more time near its lows lately. This essentially implies eroding user interest across the board.

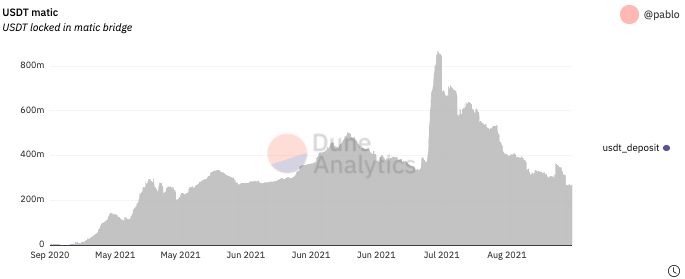

Liquidity on the network has also declined. Consider This – As of mid-July, over 800 million USDT was stranded on the MATIC bridge. The same, however, stood at 2.7 million, at press time. This, again, is not a healthy sign.

If Polygon continues to struggle to keep up with its on-chain front, MATIC may have to bear the long-term repercussions. After recording a weekly HIKE of 0.5%, MATIC was trading at $1.09 at press time.

Thus, until and unless the state of the aforementioned parameters improves, the rally of MATIC would not be sustainable.