Over the last couple of months, layer-two protocols have seen impressive growth in terms of participation and higher network activity. However, in the midst of the larger market drama, the tussle between L1 and L2 solutions has also tightened.

Ethereum, at the time of writing, was oscillating above $3,200, noting daily gains of over 5%. Conversely, L2 protocols like MATIC had gained 8% in 24 hours at the same time.

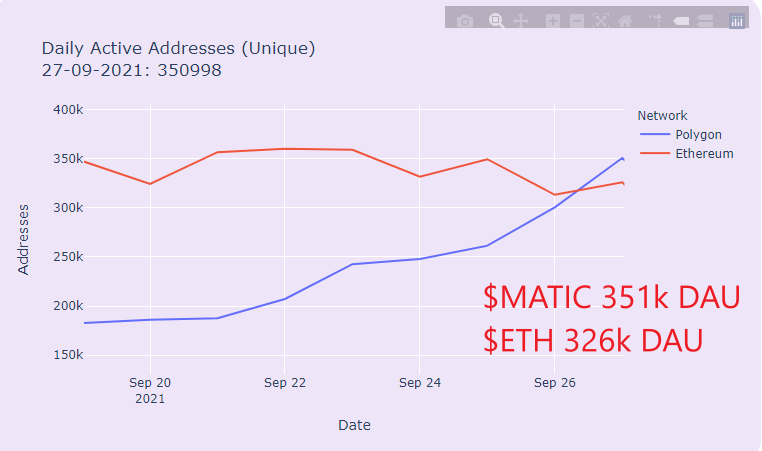

That wasn’t it though. The L1 v. L2 debate intensified further as Polygon (MATIC) saw a 330% surge in daily active unique addresses over the last three months, briefly surpassing Ethereum for the first time ever. What did this mean for MATIC though?

More participation, more activity

Polygon co-founder Mihailo Bjelic recently revealed that the number of unique addresses active daily on Polygon exceeded that of Ethereum. He further highlighted that Polygon had 351,000 daily active addresses whereas Ethereum had 326,000 briefly last Monday.

Notably, the number of active addresses on Polygon has jumped 330% in the last three months, while that of Ethereum has decreased by 12%.

As per data from Polygonscan, MATIC’s active addresses reached the highest number of 423,586 addresses on Monday, 27 September. At the time of this writing, however, Ethereum was ahead of MATIC in the tally and was up nearly 54,000 addresses.

The continuing NFT mania has also been a contributing factor to MATIC’s activity growth. In fact, on September 30, Dolce & Gabbana’s inaugural non-fungible token (NFT) collection, the Collezione Genesi, reached around $ 5.65 million in a sale.

The group of nine NFTs was launched on the luxury marketplace UNXD, which is built on the Polygon network.

What do the metrics say?

After the two major market crashes in September, Polygon initially appeared to be struggling to keep up with the consolidating market. However, in relative terms, the altcoin was holding up well. MATIC did not fall below the crucial $ 1.05 bar and hit higher lows on the 12-hour chart during the last week of September.

The MVRV 30-day for MATIC highlighted a return from the negative zone for the asset. However, its MVRV still noted a reading of -8.8%.

It appeared that while the rally was in place it was comparatively slower as the asset’s MVRV was still down 26% from its September 4 high point. What’s more, MATIC’s network growth also saw the low levels of June-July on 29 September. However, that too seemed to pick up at a slow pace.

Additionally, while MATIC’s total value locked has almost halved since its mid-June all-time high of $10.54 billion, it did see a slight uptick, with the same having figures of $4.27 billion, at press time.

While the increase in activity on Polygon can be largely attributed to Ethereum’s transaction fees which have skyrocketed again in recent days, other measures for Polygon have shown no major signs of rising prices. medium-short term price.

Ergo, even though recovery is in play, MATIC needs to flip its immediate resistance levels into support and sustain a position above the same for decent gains.