The institutional interest required for major assets like Bitcoin and Ethereum is no longer new. Since the latter stages of 2020, accredited investors became more and more evident with digital assets, as institutions started to diversify their portfolios. Yet since the drop in May 2021, these investors have kept a low profile, without taking the slightest plunge.

Now, recently JP Morgan came out with a report, suggesting that institutions are currently keener with Ethereum than Bitcoin. While the narrative is not completely early on, a more in-depth analysis can shed some light on whether investors are genuinely interested in Ethereum.

JP Morgan’s Ethereum claim; valid?

Recent reports from the investment bank suggested that investors were currently dropping their Bitcoin futures position and pivoting towards Ethereum increasingly. Last month, BTC futures on CME traded below the price of an actual bitcoin, which may have weakened institutional demand.

Now amidst that scenario, it was identified that the 21-day average on Ethereum futures premium increased by 1% over the price of Ethereum, indicating healthier demand for Ethereum against Bitcoin at the moment.

Additionally, the Crypto Compares report also suggested that Grayscale ‘Ethereum Trust (ETHE) was the top-traded digital asset product in September. The average trading volumes increased by 29% to $250 million, rising above GBTC for the first time.

Heavily traded commodities, however, did not mean that institutions came right after.

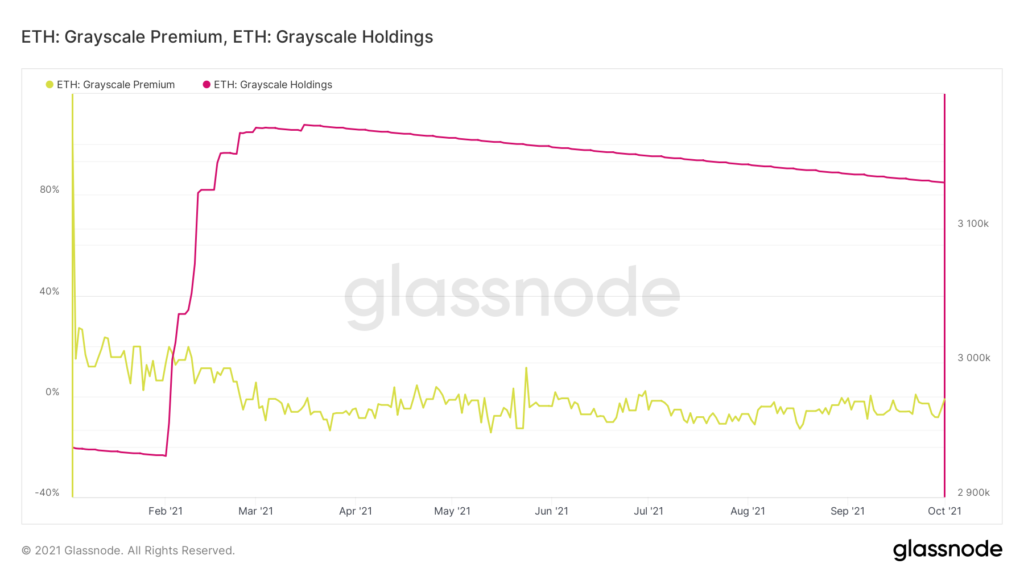

Grayscale’s inflow continues to drop alongside holdings

According to glassnode data, Ethereum’s grayscale premium has remained negative, indicating that the platform has not improved in terms of product expansion from a cost-effective standpoint. Additionally, it was observed that ETH grayscale holdings have continued to reduce in the charts, which meant institutional interest wasn’t significant on the platform to retain or buy back at the current moment.

Now, speaking of long term sentiment, ETH might see its institutional positions increase due to its current ETH 2.0 staking ownership.

At press time, 6.6% of the Ethereum circulating supply is locked in ETH 2.0. What this does is it improves investor sentiment, in terms of essentially creating a supply shock. With respect to other PoS digital assets, Ethereum is the most recognized and moving fundamentally forward in the development direction.

Therefore, over time, institutions may become more obvious and transparent with their interest in ETH, but as of yet, they have yet to clearly step ahead of Bitcoin in terms of accredited positions.