Over the past few years, September has usually been a drawdown period for the collective industry and Sept 2021 was no different. Ethereum was down 12.58% for the month, but in October it caught up very quickly.

At press time, the asset was already up by 12% for the month. With more than 25 days to go before the conclusion, price volatility can shift the market. However, there were indications that the asset could be closer to its ATH, as the bullish momentum was currently in favor of the larger Altcoin.

Structural Bounce-Back for Ethereum

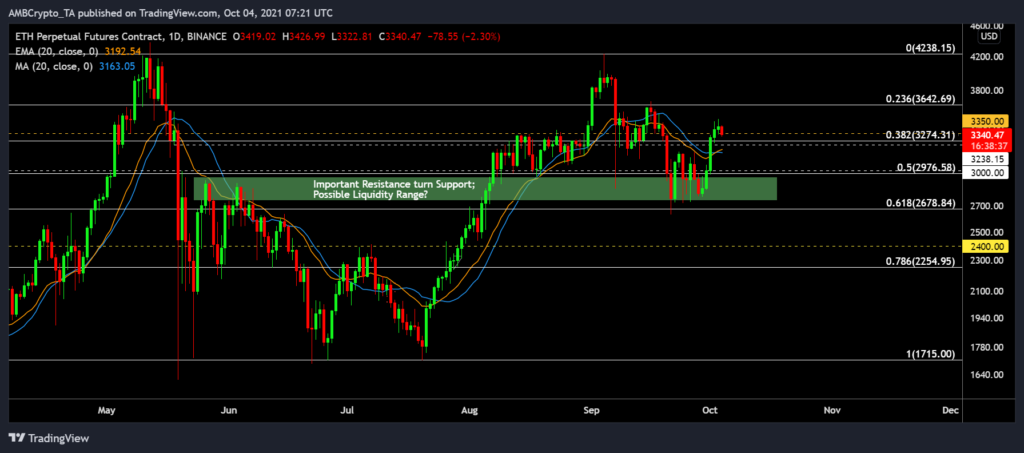

During the August rally, Ethereum came really close to breaching its previous ATH level of $4350 but fell short and retraced from ~$4200 in the month of September. However, the rebound zone of the asset can be seen as an important range.

The $2900-$2700 range act as a strong resistance during the May corrections but Ethereum wasn’t able to breach above and eventually dropped under $2000. After rising above $ 3,000 last month, the asset found support in the same $ 2,900 to $ 2,700 range (shown in the chart above) over the past week, before declining exceed $ 3,000 again.

Hence, an inference can be drawn that this range might be the liquidity zone from which Ethereum drew bullish strength. While a retest of $ 3,000 was still possible, the recovery of the $ 2,900 to $ 2,700 is significant.

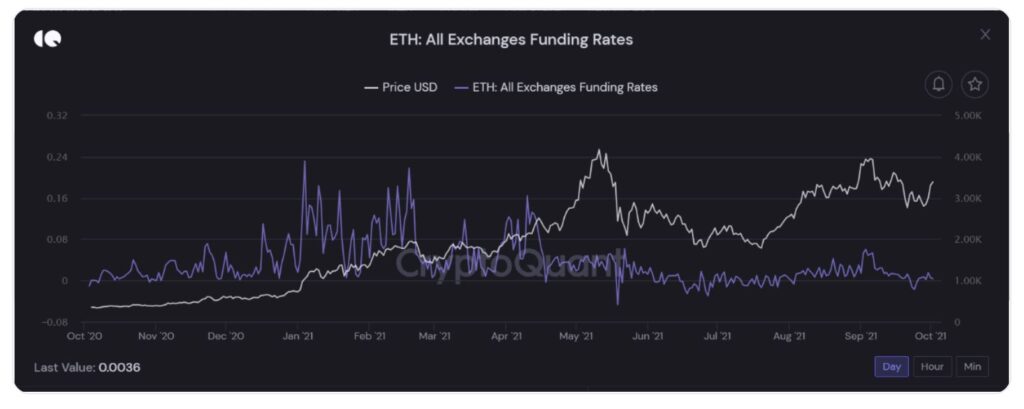

Funding Rate and Open Interest is rising

Such a narrative was currently causing a shift in the derivatives market as well. Crypto quant data suggests that all open interest on exchanges rose after the recent price change, as the narrative turned bullish across the space. However, a major spike was observed in the funding rate, which turned strongly positive at press time.

With more and more long positions open at the time of release, positive sentiment may further fuel the bullish momentum in the coming weeks. This may allow Ethereum to eventually reach or cross its previous all-time high.

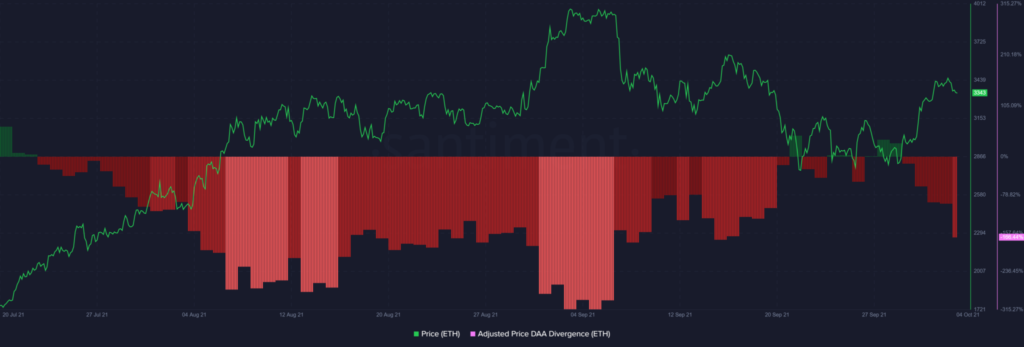

Be different from DAA though

The bullish signals were evident, it’s important to keep in mind that when it comes to daily active addresses. There was currently a bearish divergence, which could get triggered into a sell signal if the prices are not able to push forward soon. Therefore, the next few weeks could be critical for Ethereum as volatility could make or break the uptrend.