The last couple of days have been quite eventful for Ethereum. In less than a week, the price of the largest alt in the world managed to rebound from $ 2.8,000 to $ 3.5,000. Whenever Ethereum has pumped in the past, more often than not, the whole altcoin gamut has followed suit.

With most of the alts recording a pretty decent week, the aforementioned storyline unfolded again.

A twist in the tale

There was a point in time when having Ethereum Classic (ETC) in one’s portfolio made sense if one had Ethereum (ETH). However, this narrative gradually started to become redundant.

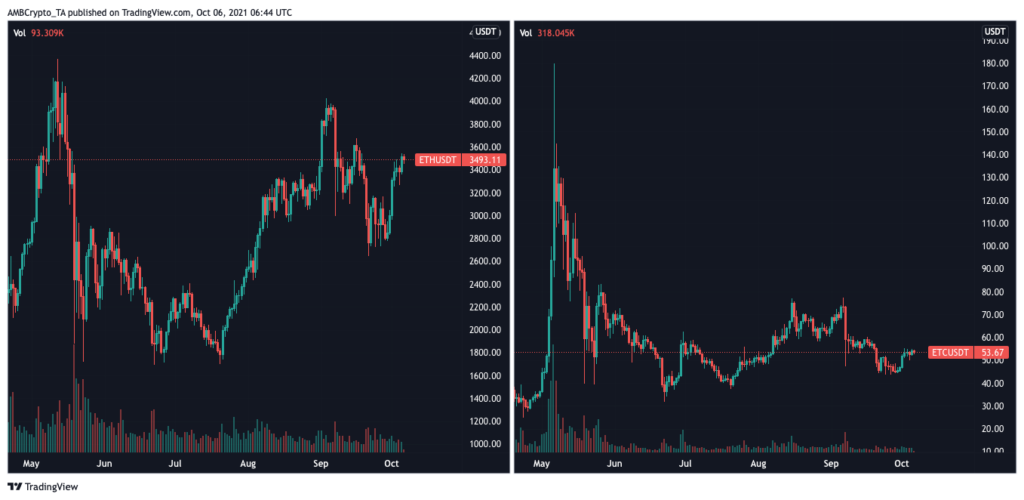

The ETC market has lost the volatility charm and in effect, the alt’s candles on the daily chart have become quite compressed. In fact, even during the recent drops in September, its price has remained stagnant in its “comfortable” range of $ 40 to $ 70.

Ethereum’s price, on the other hand, has been making huge leaps since the beginning of this month.

Even though ETC’s pattern on the chart still coincides somewhat with that of Ethereum, it should be noted that ETC has not been able to catch up with Ethereum’s growth rate.

In effect, investors have been bearing the burden of the former’s stagnancy. Over the past three months, for example, Ethereum has returned investors over 64% while ETC’s numbers were only 7%.

Ethereum’s appreciation catalysts

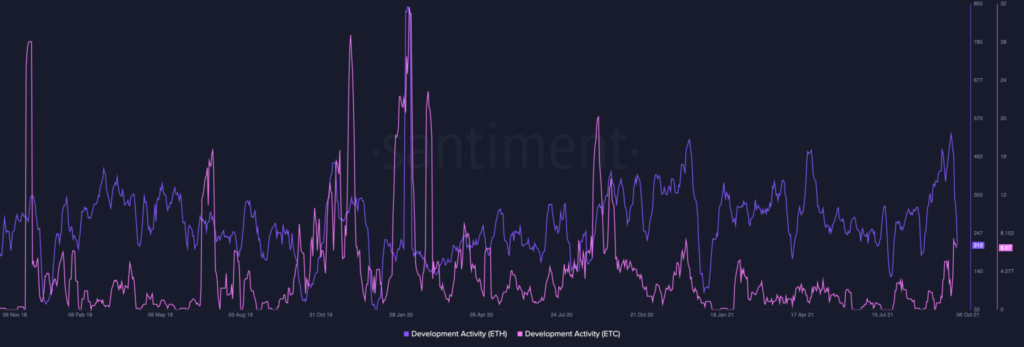

Ethereum’s organic growth can, by and large, be attributed to its network upgrades and developments. On the macro level, its development activity has been fairly consistent.

Conversely, after recording massive spikes here and there in the 2018-2020 period, Ethereum Classic’s activity on this front has been quite unimpressive. Even though the same has seen a slight uptick in recent times, it should be noted that it has not been anywhere near its previous highs.

For any network to remain relevant amidst growing competition and changing trends, more sophisticated versions ought to be introduced. Ethereum has been able to respond well to the same. The network, for instance, underwent its London hard fork in August. Its Altair upgrade is expected to be activated this month.

However, nothing much is in the pipeline for Ethereum Classic. To make matters worse, ETC Cooperative recently withdrew its support for the ETC treasury project. It also declared that ECIP-1098 is no longer a viable proposal.

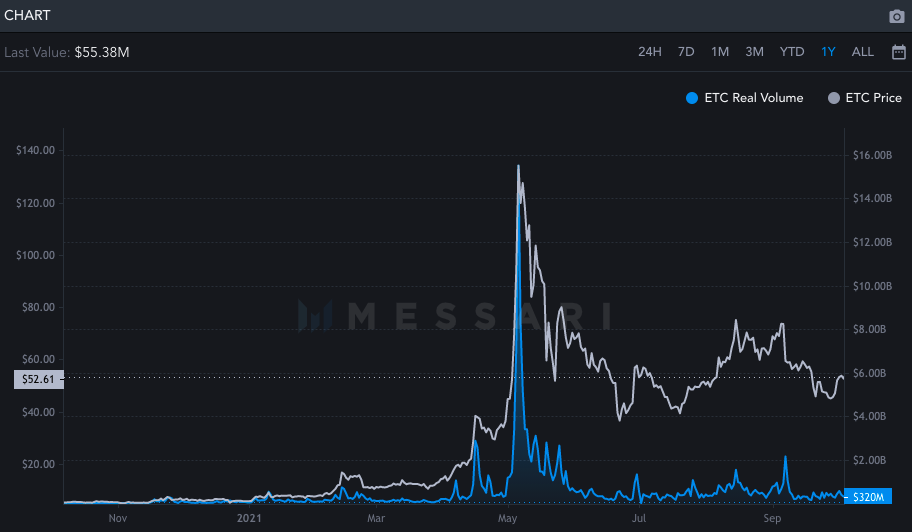

In addition, Ether benefits from the support of institutional players. Just last week, the cumulative institutional inflows amounted to over $20.2 million. Alas, the Ethereum Classic market is quite devoid of such support.

In fact, the withering interest of retail participants has also been quite prominent on the volume traded chart.

Closing remarks

So, if volatility continues to remain low, development activity does not accelerate, and additional capital does not flow into the market, Ethereum Classic would not be able to follow Ethereum in the next altcoin rally.