BeInCrypto examines on-chain indicators for Bitcoin (BTC), specifically Coin Destroyed Days (CDD) and Binary Coin Destroyed Days (Binary CDD). These indicators are used with the purpose of determining the age of BTC that are currently being transacted.

Despite the continued increase in the price of bitcoin, CDD is consistently showing low values compared to the past three months. This shows that old coins are not moving and that long-term bitcoiners are holding with conviction.

Bitcoin CDD

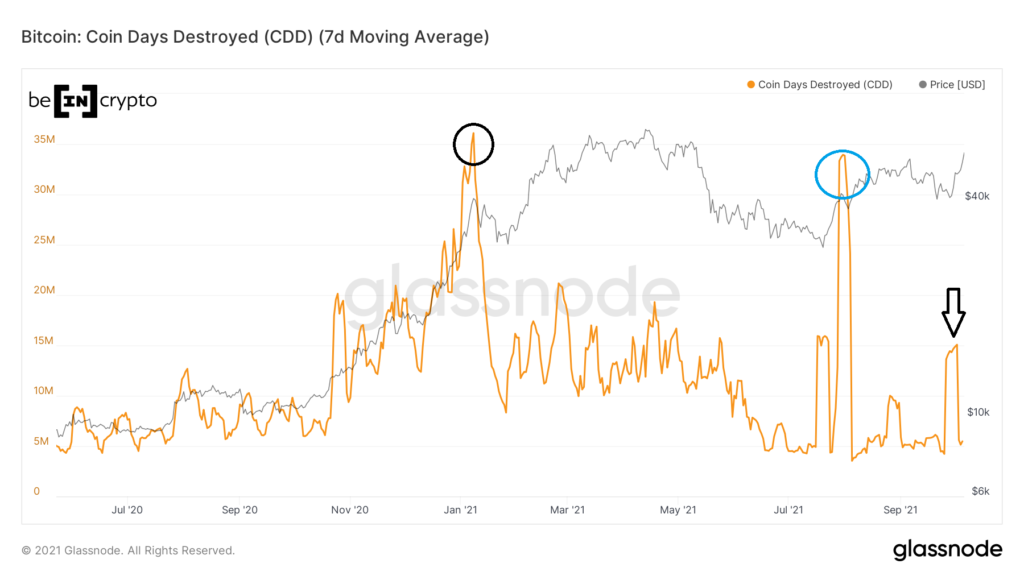

CDD is an indicator used to measure the life of coins that are traded. More specifically, it measures how many days a coin has ‘accumulated’ prior to being involved in a transaction.

These days are accumulated as long as a coin is not spent and are then destroyed after the transaction is completed.

The CDD values show the number of coin days that are destroyed each day. The higher the number, the more time these coins have accumulated before they are finally spent. The indicator often spikes prior to market cycle tops and during the first bounce after crashes. This is because long-term investors rush to liquidate their positions once they sense weakness.

When looking at the movement in the 2020/2021 bull market, there was a considerable spike on Jan 8, when the BTC price first broke out above $40,000. This was the first sign of profit taking since the CDD reached a value of 36 million (black circle).

Following this, there was another considerable spike on July 31 (blue circle). At the time, this was a bearish sign as the uptrend seemed like a rally of relief, due to the long-term coin selling.

However, during the current upward move, CDD has shown very low readings, reaching a high of 15 million (black arrow). This is comparable to the late May / early June 2021 readings when the price of BTC fell to $ 30,000.

So, even though the BTC price is increasing, the majority of coins that had remained dormant are not moving. This is a sign of strong conviction in the bull market.

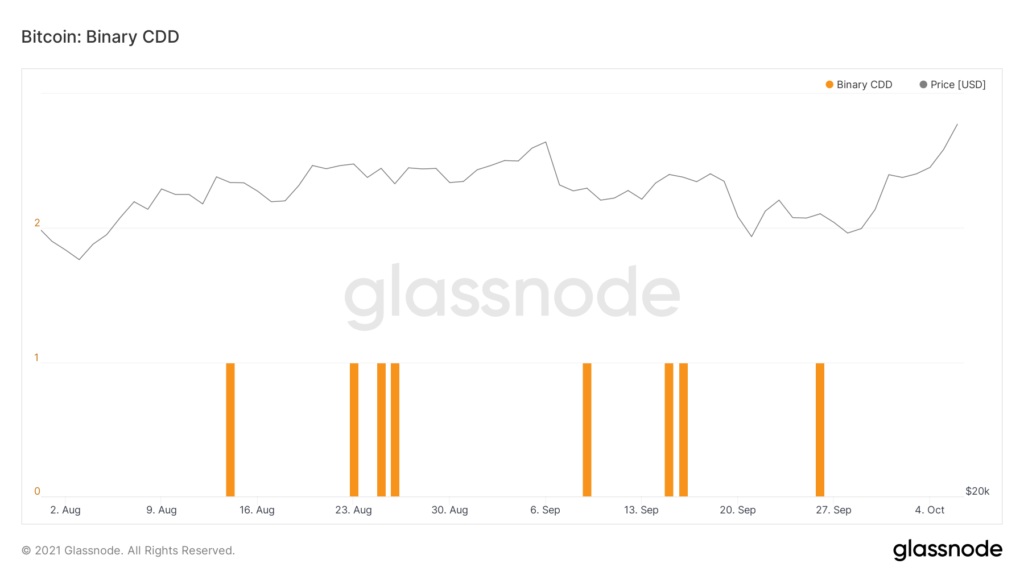

Binary CDD

Binary CDD takes an average of the CDD reading. It gives a value of one if a specific day’s reading was above the average and a value of zero if it was below.

Since Aug 1, only eight days have had readings higher than the average. This is considered a bullish sign, as the price of BTC rises, the average CDD falls. This confirms a strong bullish conviction in the market.