Bitcoin remains range bound in lower timeframes trading at $54,277. The very first cryptocurrency by market cap records nearly no gains in the day-to-day chart, however an enormous 23.9% in the 7-day chart.

The general sentiment in the market has flipped bullish, as investors seem to be waiting for further appreciation in Q4, 2021, a period that usually works for the bulls.

Investment company QCP Capital believes BTC’s rate current went back to the mid $50,000 was because of a “short squeeze”. Triggered by a high number of liquidations in short positions, the big move to the upside has its origin on Chinese crypto exchanges.

In addition, QCP Capital discovered that organizations lagged Bitcoin recovered of the $50,000 as proof by the uptick in the Chicago Mercantile Exchange (CME) open interest and the boost on the premium for these derivatives versus the rate of BTC in the area market. QCP Capital declared:

The unusually large premium indicates an overwhelming amount of outright buying. Both elements integrated lead us to think that there has actually been big institutional purchasing of BTC in the previous week.

Additional factors seem to have worked out in favor of the Bitcoin bulls, as noted by the investment firm: the dissipation of uncertainty around Chinese real state company Evergrande, the very likely approval of a BTC ETFs based on CME Futures, BTC gaining more prestige as an investment vehicle, and others.

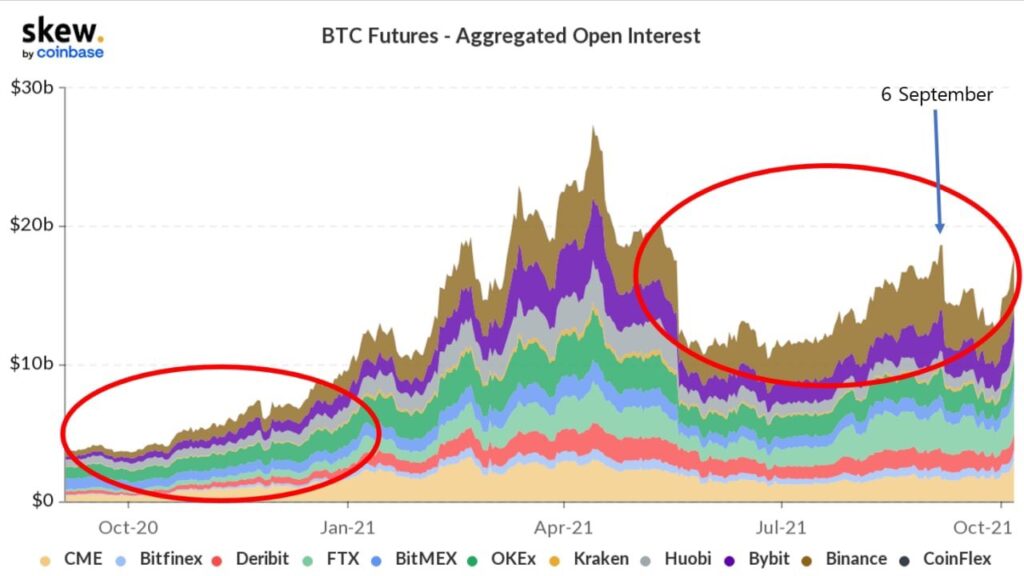

However, QCP Capital mentions some possible challenges that might avoid BTC from reaching its previous highs and beyond. First, the high amount of leverage in the crypto market as shown by the BTC Futures Aggregated Open Interest, 3x times more than in October 2020.

In previous months, BTC’s rate has actually taken substantial disadvantage action when the utilize in the futures sector reaches a specific point. In addition, QCP Capital stated:

The options market continues to indicate downside nervousness in spite of the spot rally. ETH threat turnarounds (RR) continue to be manipulated to the disadvantage (puts are more costly than calls). BTC has only just turned from a persistent downside skew to neutral.

What Could Work Out For The Bitcoin Bulls

QCP anticipates some short-term bearish rate action for Bitcoin. As seen below, the Tom Demark Sequential, a metric used to measure if a price move has been overextended to a certain direction, flashed a TD 13 sell signal on October 7th.

A different report by financial investment company CoinShares mentioned that there are 3 elements lineup for more gratitude in Q4, 2021: policy, adoption, and the macro environment.

On a previous occasion, the BTC Bulls have some but not all of these 3 factors in their favor, the report claimed. About policy, CoinShares thinks the U.S. is “starting to warm to crypto” due to specific declarations offered by the FED and SEC Chair, Jerome Powell and Gary Gensler, on cryptocurrencies.

In addition, El Salvador’s effect on driven BTC adoption could have been underestimated. Following the launch of the Bitcoin Law lots of nations, such as Ukraine, Brazil, Paraguay, and others, have revealed their desire to make BTC legal tender and might drive a new age of institutional adoptions. The company stated:

From an institutional perspective, our most recent survey representing US$400bn of assets under management (AuM), highlights growing institutional participation. Average portfolio weightings in digital possessions now represent 1.1% of AuM, although this differs substantially throughout various institutional financier types.

Finally, the macro-environment factors with high inflation, rising commodity prices, worsened employment conditions, and others could continue to be a tailwind for store of value assets, such as Bitcoin (BTC). CoinShares said:

(…) it is most likely that bitcoin will value versus those currencies, even if its acquiring power were to stay stagnant.