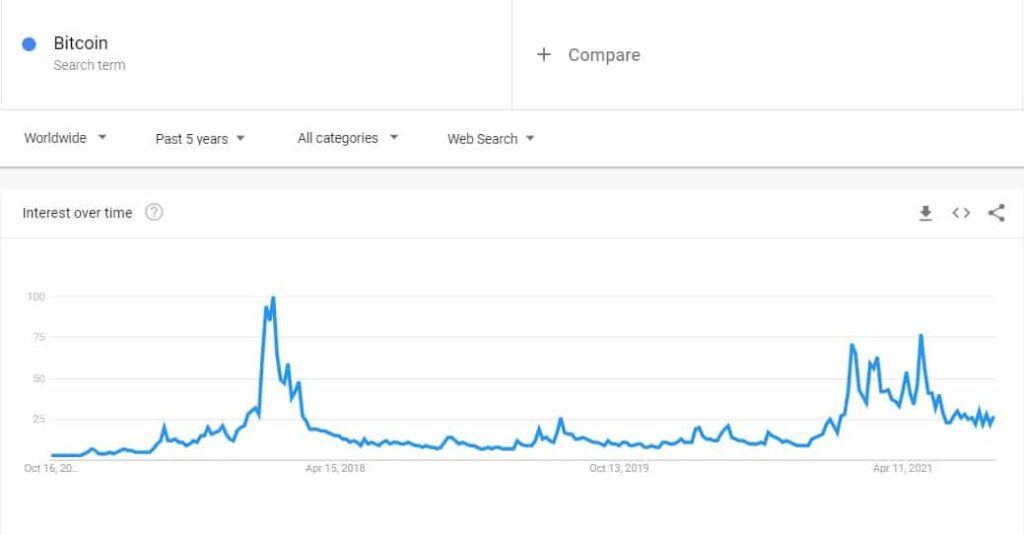

Although the price of bitcoin has risen by more than 35% in the past two weeks or so, retail investors have yet to gain the upper hand. Google trends data shows that the number of queries on the search engine is still a long way away from the previous heights.

No Hype Yet: Google Trends

On September 30, BTC fell below $ 41,000 for the third time that week. Now, less than two weeks later, BTC trades above $56,000 after marking a new five-month high at $57,000 earlier today.

Such impressive price increases over relatively short periods of time usually attract the masses. This doesn’t seem to be the case, now, at least according to data from Google Trends.

The number of “Bitcoin” requests on the world’s largest search engine is still relatively low and has barely increased since early October. It pales in comparison to the yearly highs reached in mid-May – shortly after BTC’s price had peaked above $65,000. Needless to say, it’s even further from the historic peak of December 2017.

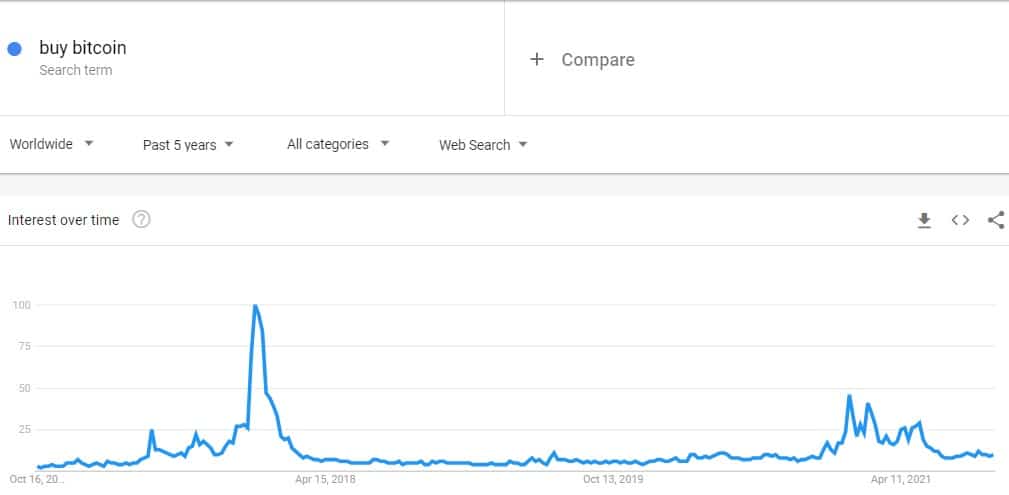

Furthermore, the global “buy bitcoin” searches have also stalled in the past several weeks, showing once again that retail investors’ appetite towards the cryptocurrency is still not present.

This data only reaffirms previous reports claiming that the recent price spike is due to institutional investors rather than individuals. It also goes to show the potential increases that could be hiding behind the corner once smaller investors get back to the scene.

Greed has arrived

While the hype around BTC has yet to gain the attention of retail investors, general feelings about the asset have turned to “greed” territory after a hiatus of several weeks. This shows the popular Bitcoin Fear and Greed Index, which outlines the overall sentiment based on surveys, volume, social media engagements, and more.

The metric also tends to move with the price of BTC. For example, it had dropped into a state of “fear” and even “extreme fear” in September during the aforementioned sub-$41,000 drop.

The last time it hit “greed” levels above 71 was in early September, when the asset traded above $ 50,000. It’s worth noting that going into any of the two extreme ends – fear or greed – is typically followed by a price adjustment in the opposite direction. Nonetheless, the Index still has room to see “extreme greed” now.