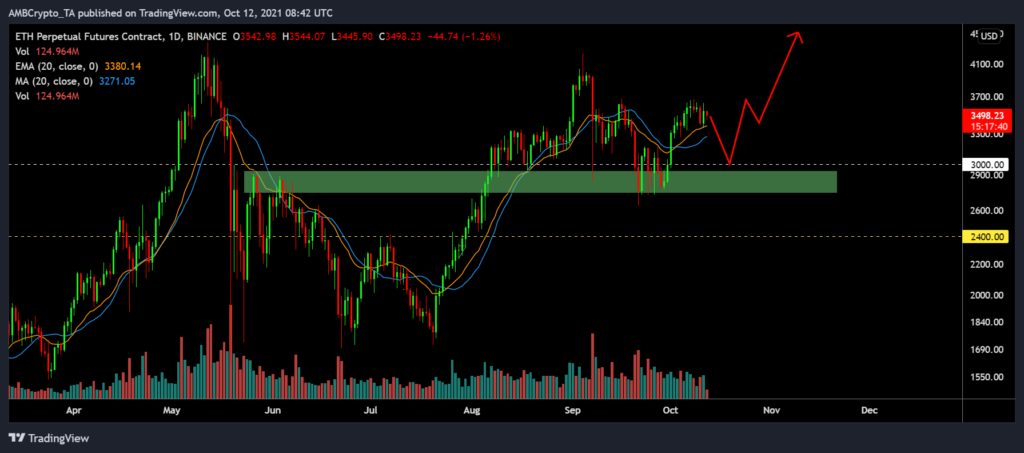

Ethereum is in a bit of a pickle at the moment. After rallying at $ 3,600 earlier in the month, the asset hit a new high at $ 3,640, a familiar resistance since mid-September.

The resistance has been tested a couple of times in the past week and now ETH is subtly suggesting a potential correction. While no damage has been done to its bullish structure, a drop to $ 3,000 could be in play for fundamental reasons, one of which is of great importance, namely institutions.

Ethereum Whales’ Bull-Game remains strong

It is important to note that certain on-chain metrics remain strongly bullish for Ethereum. According to Health, the top 10 no-exchange whale addresses continued to pile up and blocked more ETH than the top 10 exchange addresses, which is a good bullish sign.

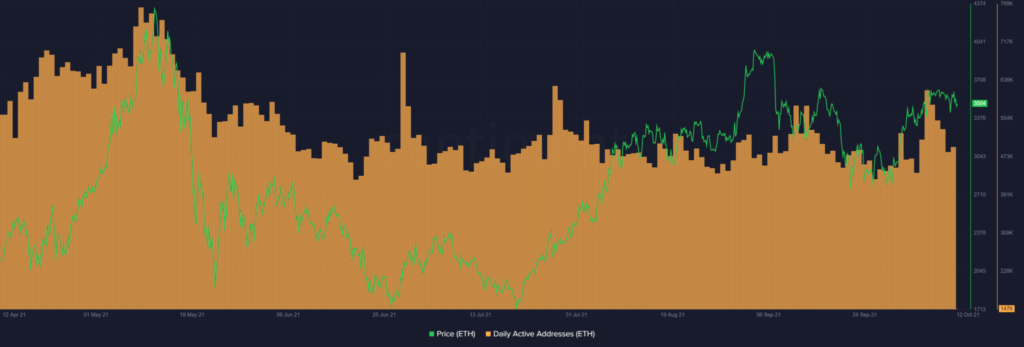

Daily active addresses for Ethereum also continued to display bullish divergence as the price of ETH dipped a little since September, but active addresses have continued to rise in the charts. So overall, the chain stories remain positive, but a $ 3,000 slide could also be lucrative for the image in the long run.

What do the Survey and Inflows say?

So according to a recent survey, Digital Asset Bi-Monthly Fund Manager by Coinshares Research, close to 42% of investors regarded Ethereum to possess the most compelling growth curve.

The investigation accounted for nearly $ 440 billion in assets under management, and one common reason for Ethereums’ expected growth was network diversification.

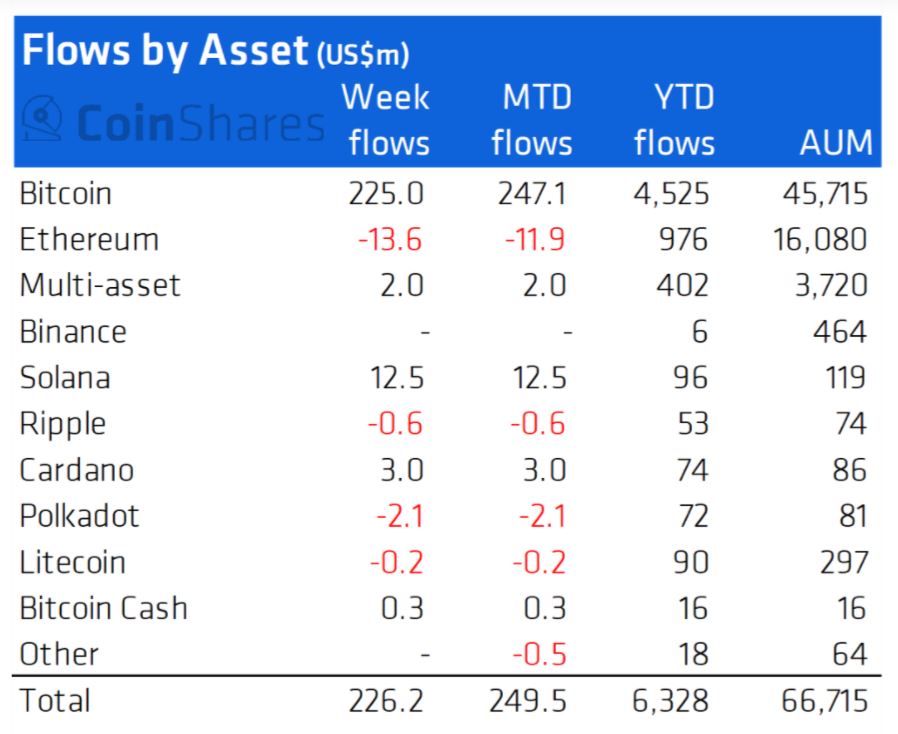

Now, on the flip side, Coinshares recent weekly fund inflows pictured a different scenario.

The data showed that Ethereum recorded minor cash outflows of $ 13.5 million, indicating that institutions may cash in right now. While Bitcoin recorded strong inflows of $ 225 million.

Is there a silver lining to this?

Yes, this is where the institutions can actually drive the value down to $3,000, just to push it back up. The intrigue of qualified investors must be understood from a long-term perspective. Unlike retail investors, institutions do not panic in the market, and they are more likely to buy into the asset when it is at a local bottom or in a liquidity zone.

The bit highlighted in the chart is the recent liquidity area for Ethereum at around $ 2,700 to $ 3,000. This could fundamentally be the prime recovery position for Ethereum, as institutions may look to fill their bags in this price range. However, the price can also move structurally above it, so it is essential to Do your own research.