Litecoin holders are mostly in profit while whales stack more coins

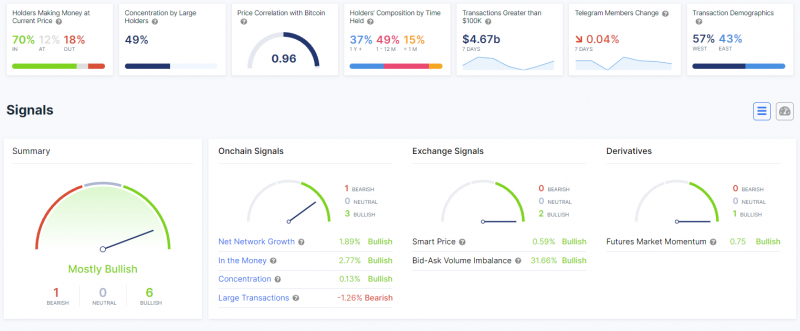

On-chain data provided by IntoTheBlock for the Litecoin cryptocurrency simultaneously shows three bullish indications for the coin. The mentioned indications are net network growth, the number of addresses “in the money” and the concentration of funds.

Net network growth

According to the data provided on the chain, the net growth of Litecoin’s network is currently up 1.89%. The metric measures the change of the total number of Litecoin addresses.

Following a continuation of a positive trend on the metric, the number of Litecoin holders is increasing dramatically, which is also reflected in the coin’s trading volume, which has grown almost 100% since the start of the month.

In the money

While the volume of funds for Litecoin is progressively rising, it is important for them to remain “in the money,” which means staying above the entry point on the market. Currently, 70% of Litecoin holders stay in the money, which is the average value of an asset moving in the uptrend.

Only 18% of traders and investors remain at a loss in the current market. Twelve percent of market participants are ‘in the money’, which means they have just entered the market or have been keeping their positions open since September, when Litecoin was trading at the same price.

Concentration of funds

The concentration of funds signals changes in the whale-tier positions on the market. As large addresses stack up rather than spending funds, the metric is seen as bullish. The absence of selling pressure on the market allows assets to move.

While the overall data on the chain is positive for Litecoin, it is most likely related to the general sentiment in the market, which remains bullish for altcoins and Bitcoin. Cryptocurrency market capitalization has increased by $700 billion since the end of September and is continuously increasing.