The price of Bitcoin fell in one day losing $ 16,000 in value in hours, and the rest of the market followed suit. According to analysis firm CryptoQuant, several on-chain developments preceded the crash and could have predicted the dump.

The Three On-Chain Factors

As reported earlier today, BTC dumped from a daily high of $58,000 all the way down to $42,000, which became one of the worst crashes in terms of USD. While investors are looking into global developments for the reasoning, such as more fears from the new COVID-19 variant and the weekly stock market sell-off, CryptoQuant provided several on-chain possible reasons.

The first was the number of bitcoins sitting on the exchanges, which rose sharply a few hours before the decline. This metric has gradually declined over the past few months, leading to new lows. However, as the graph below shows, over 45,000 bitcoins were deposited in one day.

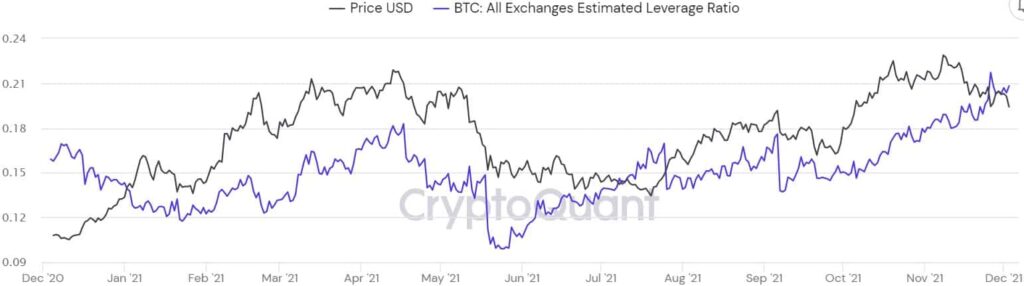

Secondly, the analytics company broached the All Exchanges Estimated Leverage Ratio, which tracks the open interest on all trading venues divided by their BTC reserve. Essentially, this metric shows the degree of leverage used by investors, which also spiked sharply hours before the crash.

As seen during the most severe hours of the crash, over-leveraged traders suffered the most, with total liquidations exceeding $ 2.5 billion per day.

The third metric was the Exchange Whale Ratio, which compares the top 10 largest deposits to exchanges with all other deposits. According to CryptoQuant, the indicator tends to stay below 85% in bull markets, while it in bear markets drops below 85%.

Interestingly, it has remained above 85% in recent weeks and even peaked north of 90% in recent days.

What Else Changed?

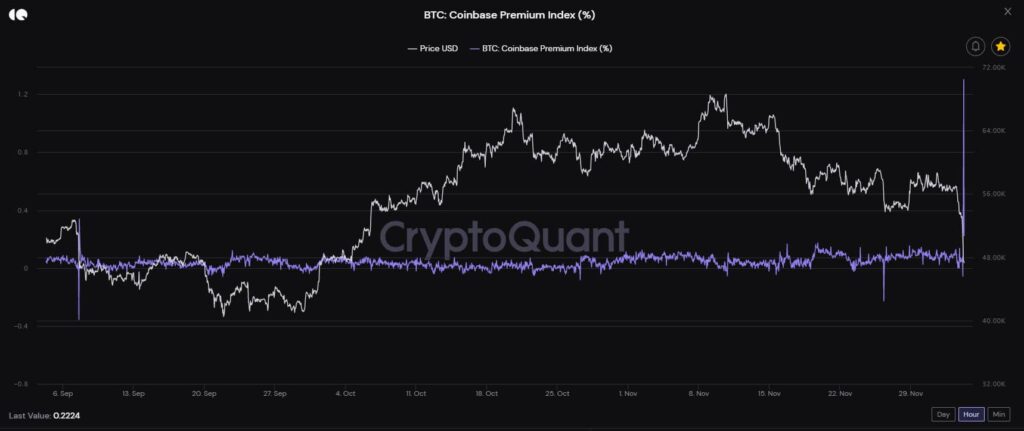

Such a massive price crash in a relatively short period led to other abnormal activities. For instance, the Coinbase Premium Index, showing the difference between the price of bitcoin on the largest US-based exchange and other trading venues, skyrocketed.

As a general rule, the higher the premium, the greater the cash buying pressure on Coinbase. Interestingly, Ethereum’s premium has also increased.

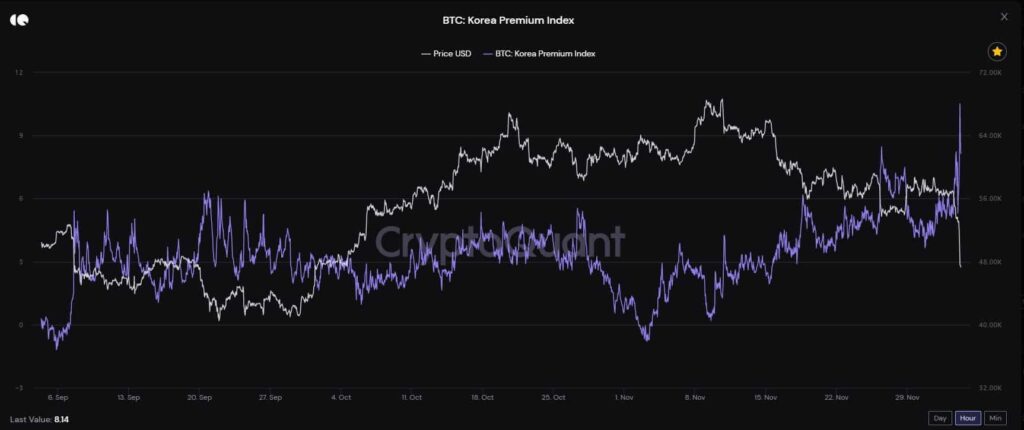

Wu Blockchain also outlined the premium on South Korean exchanges, which the journalist described as retail-oriented trading venues. As the picture below shows, this metric also increased rapidly, suggesting that retail investors rushed in to take a page out of El Salvador’s book and buy the dip.