The price of Ethereum (ETH) gas has been falling since October, here’s why

Ethereum (ETH), the second cryptocurrency, is often criticized for high transactional fees (gas). At the same time, on average, transactional fees are plunging for six weeks in a row.

Average Ethereum Gas Fees Lose 50% In Less Than Two Months

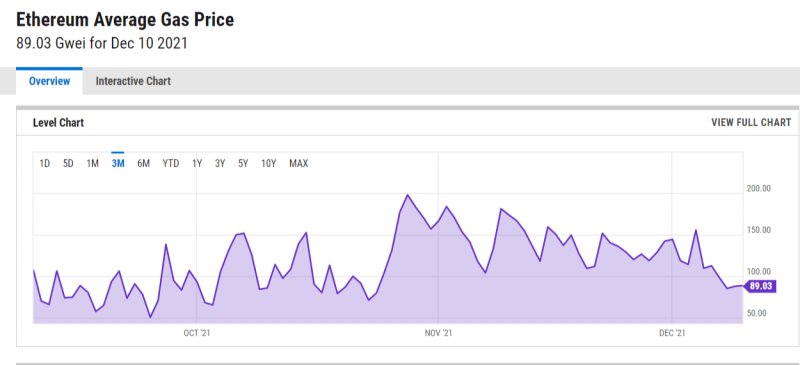

According to data shared by third-party trackers, Ethereum gas (ETH) – the dynamic commissions charged to all Ether and ERC-20 transactions – has fallen since the end of October.

Its last peak was registered on October 28, 2021, at over 190 Gwei. As such, the average value of transaction commissions lost more than 50% since the last local high.

Typically, the dynamics of Ethereum gas (ETH) fees are associated with the activity of Ethereum and ERC-20 token holders. The more activity, the higher the gasoline costs.

Therefore, the unusual negative dynamics of average Ethereum (ETH) fees can likely be attributed to the poor performance of Ether, which makes it less attractive for traders and contributes to the general stagnation of crypto markets.

L2 platforms lose TVL: the segment had exploded since May

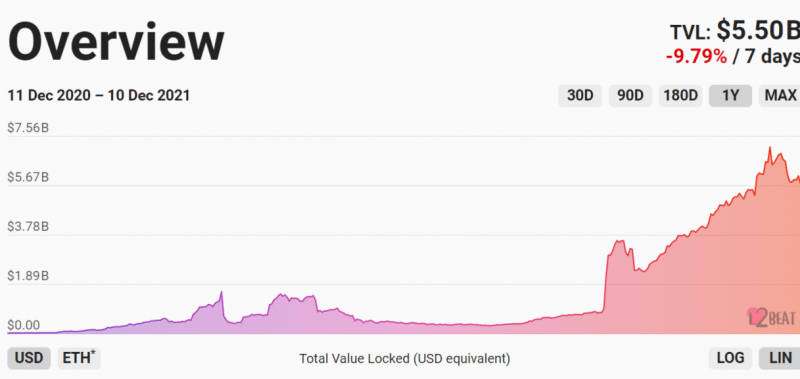

Another interesting process dominating the Ethereum (ETH) segment is the mid-term collapse of Layer 2 platforms in terms of total locked-in value (TVL).

According to the leading second-layer tracker L2Beat, the aggregated TVL of mainstream scalability protocols rallied by 10x in three months between late August and late November.

Then, in just two weeks, this volume plunged from $7.1 billion to $5.5 billion. Arbitrum Network, the Optimism-based Boba Network, dYdX and Loopring account for half of this volume.