Ethereum has amazed everyone, not just the people in the crypto-community, but also those outside with its growth. According to CoinMarketCap, the ETH current market value passed 21% – its highest level since August 2017. In fact, ETH’s market value share reached 31.17% in June 2017.

Now, as Ethereum’s popularity hiked, so has the cost of doing business on the network – Gas fees, the amount of gwei (a fraction of ETH) charged per transaction, has steadily risen, despite there being declining trends from time to time.

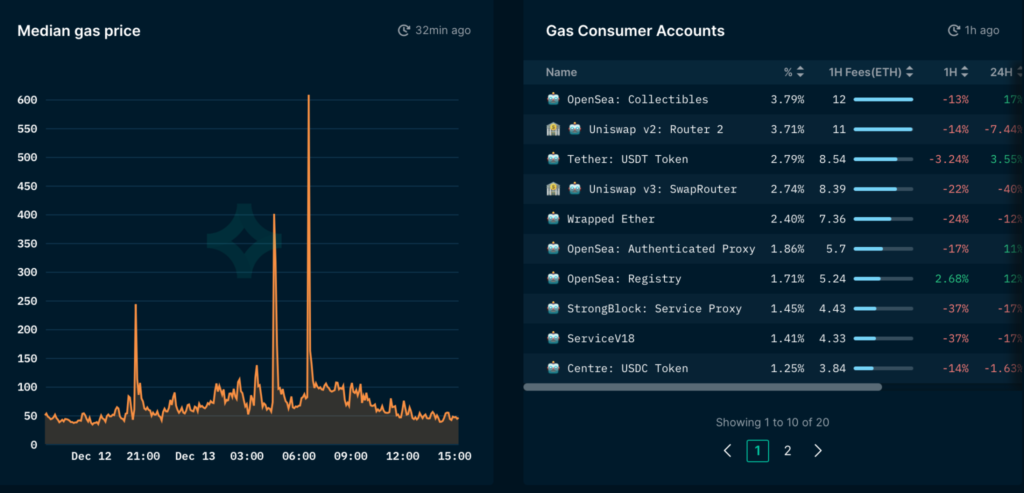

The attached plot can be used to highlight the same.

Needless to say, the raging debate over Ethereum gas fees is going to go on for a long time. Especially since Su Zhu, co-founder of Three Arrows Capital, slammed ETH on the same in the past.

“Gas fees can’t be avoided”

Joe Lubin, Co-founder of Ethereum and the CEO of ConsenSys, has a completely different perspective, however. During a recent interview, he claimed,

“High fuel costs are the key to success. They are a growing pain, they are something that cannot be avoided.

In fact, he further shed light on ETH’s overall success with an interesting analogy. He opined,

“When a new technology is successful, it always has problems scaling up. So whether it’s CPU cycles, screen space, or memory, software engineers are essentially going to maximize the capabilities of the technology. And it turns out that we are seeing consumers maximizing the capabilities of technology.

Any solutions?

As expected, Lubin also addressed the question of Ethereum 2.0. According to the exec, it should arrive by “Q2 or possibly slipping into Q3 next year.” Also, he argued that it will help address both transaction costs and energy use. Solana, Avalanche offer fast transactions with inexpensive gas fees. Alas, even those protocols aren’t immune to rising fees.

“We are already seeing scalability happening at Layer 2, and at Layer 2 we are seeing hundreds and soon tens of thousands of transactions per second that are actually very inexpensive: they are inexpensive for Solana and Avalanche. . “

He went on to add,

“Those are both cool systems, Solana and Avalanche, and as they get more utilized by consumers, we’re seeing transaction fees creep up to $1 and $2 for those technologies. Ethereum is going to be the blockchain of blockchains. It’s going to be the major digital asset settlement layer, it’s going to be the coordination layer for many different Layer 2 technologies.”

Regardless of the fee aspect, ETH continues to grow rapidly. It is approaching the 200,000 validators on the network. Now, with ETH 2.0 and the transition to a proof-of-stake mechanism, that number will grow exponentially.

“The barrier to entry is very low, so anybody will be able to do it.”

This, in fact, has certainly been the case, with Ethereum emerging to be the winner against the rest of the market in many people’s projections. Galaxy Digital CEO Mike Novogratz, for example, in an interview introduced support for ETH over Bitcoin.

“People see Ethereum as a technology bet. Ethereum becomes more promising compared to Bitcoin as the Fed stops pumping cash into the economy.”

Will it help ETH to outperform BTC? Well, not anytime soon.