After outperforming Bitcoin and most assets in November, Ethereum appears to have taken the road south. The best altcoin, even after the recent massive sell-offs, has held up above the crucial $ 3,955 level. However, it has lost more than 10% in the past four days, with Ethereum trading at $ 3,780.60 at the time of writing.

While the larger market didn’t anticipate Ethereum’s fall under the $3800 level after the alt’s price rose 7.5% in November to $4,631, reaching a market capitalization of $549 billion at the end of the month. So, could this be ETH’s fall from grace or just a dip-buying opportunity?

Moonovember of ETH

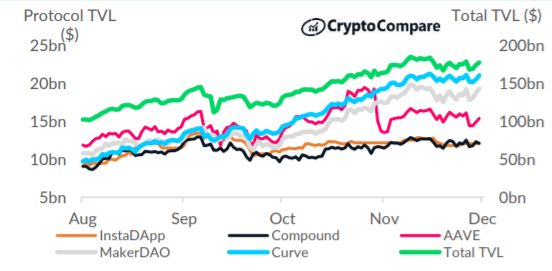

Over the past month, the 50-day and 200-day moving averages closed the month up 19.7% and 7.4% from the previous month, at $ 4,268 and $ 3,153 respectively. While average daily USD volumes totaled $ 1.39 billion, up 11.5% from the previous month. Defi’s growth over the past month has also helped ETH’s trajectory, with the Ethereum network’s total locked-in value (TVL) rising 8.68% in November to $ 78 billion.

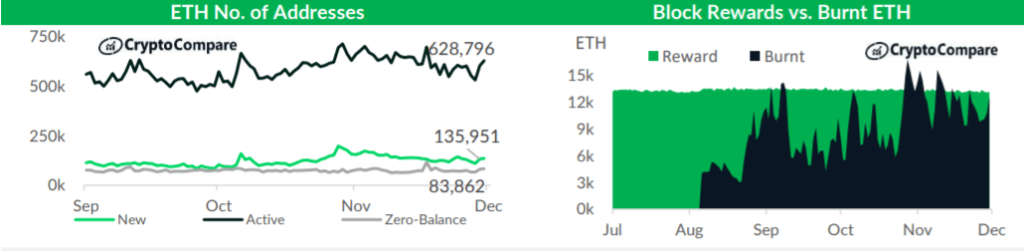

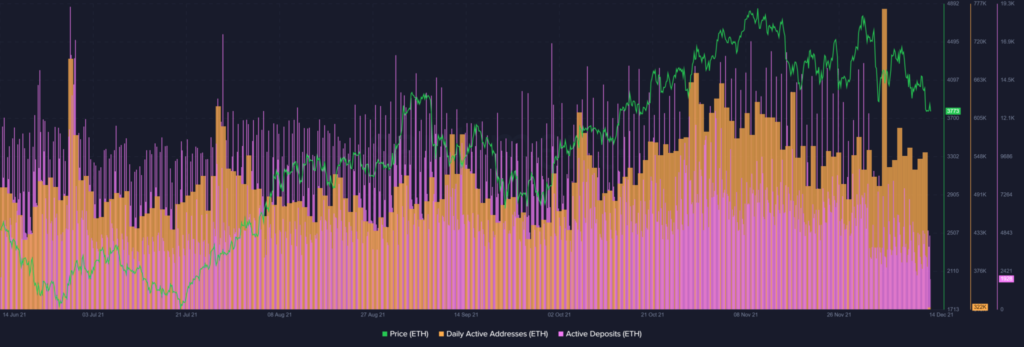

Further, average daily active addresses on the Ethereum network grew 5.30% in November to 624K, while new addresses also grew 10.8% to 139K, presenting a healthy growth in on-chain participation. Data highlighted how Ethereum was deflationary for 8 days in November, as the network burnt a daily average of 12.1K ETH throughout the month, noting 23.5% monthly growth.

If network growth continues at a similar pace with the influx of new and existing participants, the price could pull enough from the lower levels.

However, with whale addresses depositing ETH to exchanges the current situation tilts towards the bearish side. Data from whale alert highlighted that 29,300 ETH (worth $112,127,387) was transferred from an unknown wallet to FTX as ETH’s price oscillated around the $3700 mark.

But, a reversal could be in play

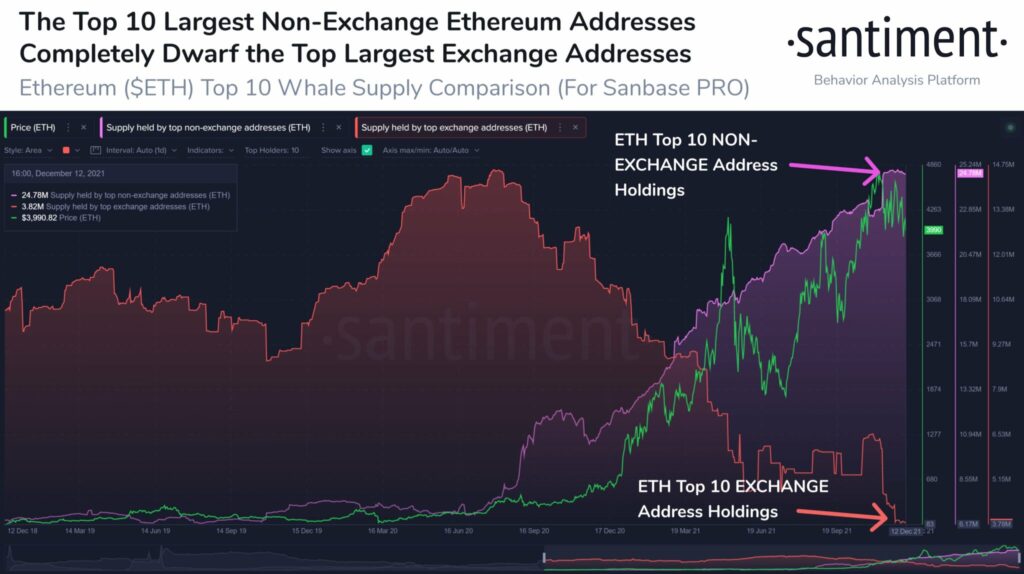

Sanbase data shows how the macro bullish trend remains intact, as the 10 largest Ethereum addresses on the exchanges hold a cumulative amount of $ 3.82 million ETH, which is the lowest level since the exodus. Meanwhile, the 10 largest no-exchange addresses hold a cumulative total of $ 24.78 ETH, approaching the $ 26.63 ETH seen at the ATH level in June 2016, supporting the long-term bullish argument.

Further, it could be seen that active addresses for ETH had maintained well while active deposits saw a downfall. If active addresses pick up and the downtrend in active deposit continues a recovery could be expected sooner.

Notably, during April’s price run, ETH’s active addresses rose while active deposits fell, pushing prices above the $ 2,000 level.

Thus, while Ethereum being near $3700 could be a good dip-buying time, as it has acted as long-term support, it’ll be best to wait for on-chain activity to pick up. A spike in daily RSI, which has been in a downtrend, could also act as a good indicator for trade entry. In the short term, while volatility is expected from the asset, ETH could make a come back soon enough.