SBI Group, the financial services company group based in Tokyo, Japan, has announced the launch of a crypto asset fund that consists of seven different digital currencies. The crypto fund launched by the Japanese company includes bitcoin, ethereum, xrp, litecoin, bitcoin cash, chainlink, and polkadot.

SBI Group’s new crypto fund operates 7 different digital assets

Three months ago, SBI Holdings, often referred to as SBI Group, revealed that the company was planning to launch a crypto asset fund. At the time, SBI announced that the new fund would launch in late November, but the official launch press release was released on December 17. In addition to the press announcement, SBI also released a more detailed summary of the digital currency fund.

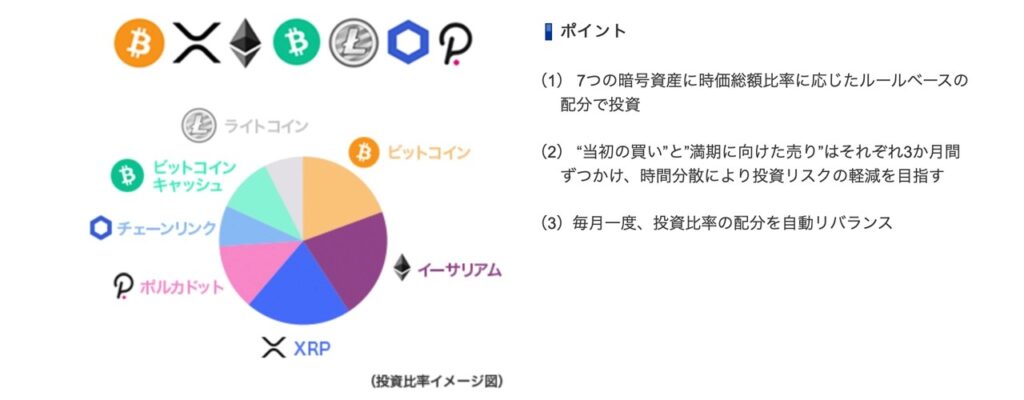

SBI’s crypto fund consists of bitcoin (BTC), ethereum (ETH), polkadot (DOT), chainlink (LINK), litecoin (LTC), xrp (XRP), and bitcoin cash (BCH). The financial services company is calling it “Japan’s first cryptocurrency fund for general investors.” Japanese investors need to “fully understand the nature of crypto assets and risks related to investment in crypto assets,” the press release explains.

The application period to invest in the new SBI crypto fund runs from December 17 to January 31, 2022. The fund will be managed as SBI Alternative Fund GK and the press release further explains that the future asset rebalancing may take place after maturity, but for now each crypto in the fund has a ratio of around 20% or less. SBI Group’s new crypto fund contract is between February 1, 2022 and January 31, 2023.

SBI Alternative Fund ‘Aims to Reduce Investment Risk by Time Diversification’

SBI has been involved in the crypto scene for many years now developing all types of products. The company has collaborated with Ripple, it acquired the UK-based crypto services firm B2c2, and SBI partnered with Boerse Stuttgart in 2019 to offer crypto services in Europe and Asia. In contrast to the early days of crypto, Japan’s crypto regulations have become stricter, slowing SBI’s crypto fund launch down a great deal.

“The ‘initial purchase’ and ‘sale at maturity’ will take 3 months each,” explains the press release from SBI. “Aiming to reduce investment risk by diversifying time.” Automatic rebalancing of the investment ratio allocation once a month, ”adds the financial institution’s announcement.

SBI’s new crypto fund has its own web portal and the fund was reportedly established on December 2, 2021. Interestingly, the SBI press release published on Friday mentions the possibility of SBI Group dealing with “Bitcoin futures ETFs,” while further mentioning the “widespread use of NFTs (non-fungible tokens) using blockchain technology.”