Options market analysis

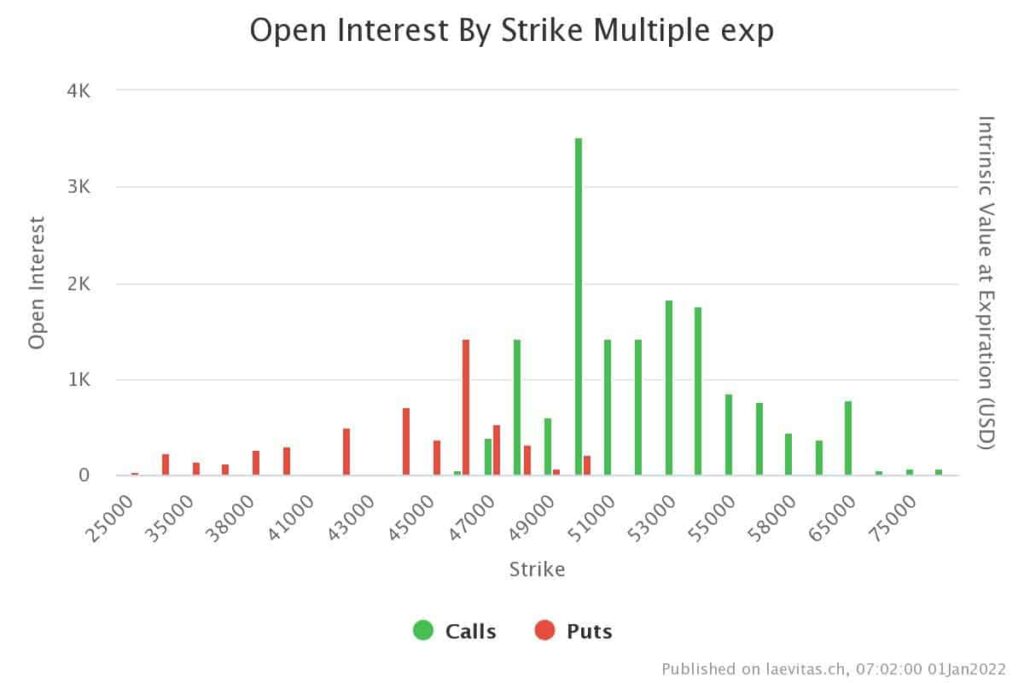

After bitcoin fell to $ 42,000 on December 4 following Omicron fears, its price could not exceed $ 52,000 in the past month. BTC is now trading at $ 47,000. Short-term ATM implied volatility peaked at 94 and currently sits at 66.

Calls for a $50K strike price have the highest open interest for 2,3 & January 7th expiries. Lots of calls were sold for these expiries over the last few days. It seems that low demand in the spot market caused option traders not to be optimistic about an increase in price higher than $54K for the expires in the first week of January.

Technical analysis

On the daily period, bitcoin completes the withdrawal of the broken trendline (yellow), both price and RSI. But we cannot yet say that the correction is complete. The price should form a higher and break the blue trendline in the price chart and the RSI. This resistance in the RSI is the intersection of the SM100 and the 50 baseline, and its crossing indicates that the bears are pulling out of the market.

Over the lower period, the price fluctuates mainly in a rectangle (yellow box). In the short term, a safe point could be the breakout of the downtrend of the RSI and the MA21, as happened on December 21 and led to an 11% increase.

On-Chain Analysis

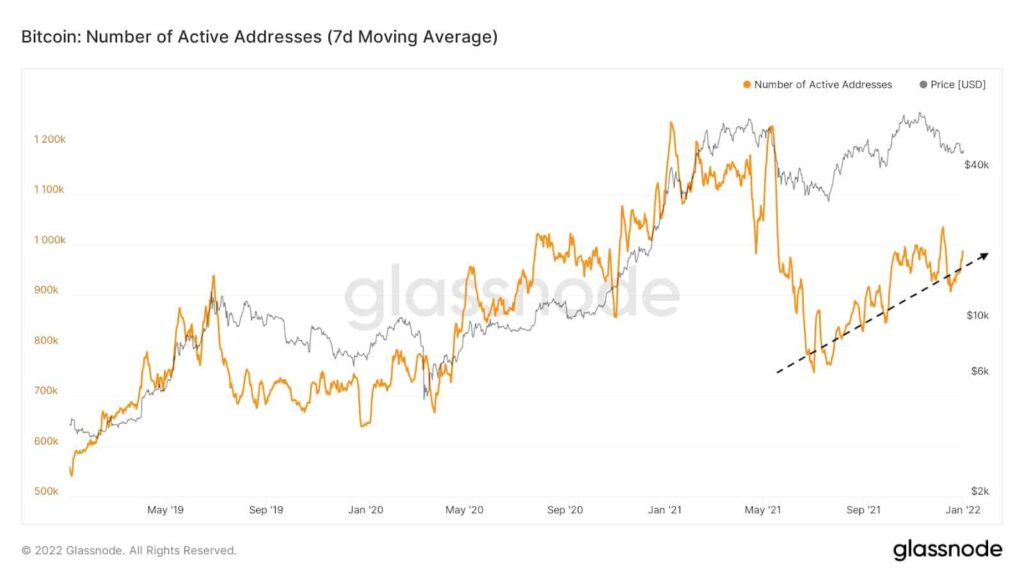

Despite the neutral to negative sentiment of the futures market, the mid-term and long-term indicators in on-chain data are positive. Alongside the continuing hashrate recovery, the weekly-averaged number of active users is growing. This trend confirms that demand is still in the market, and any catalyst could initiate another rally.