The price of bitcoin is down 16% over the last 30 days and since the crypto asset’s all-time high (ATH) on November 10, 2021, bitcoin has lost more than 38% since it surpassed $69K per unit that day. Meanwhile, crypto advocates are furiously debating whether this is a bitcoin bear market or if the bull market is still intact. To many observers bitcoin’s current market cycle is not complete, as no solid peak had formed, and speculators still expect another bubble to come to fruition.

The Four Phases of the Price Cycle – Bitcoin traders discuss the position of the cycle, trader insists “early February will be the move”

Many digital currency traders pay attention to the ups and downs and the four stages of the market cycle. The stages include the accumulation phase, the uptrend phase, the distribution phase and the downtrend or capitulation phase. You could say that the accumulation phase took place 666 days ago on March 12, 2020, when the price of bitcoin slipped below the $ 4,000 mark per unit area. On that day in March, the World Health Organization (WHO) announced that the world was facing the Covid-19 epidemic and called it a “pandemic.”

On that day, otherwise known as ‘Black Thursday,’ global markets worldwide were roiled and the crypto economy shed billions in a matter of no time, but the crypto economy recovery and accumulation phase started the very next day. The price of bitcoin (BTC) continued to uptrend and moved steadily into the markup phase as BTC had finally surpassed the $20K 2017 all-time high. By January 7, 2021, BTC’s price touched $40K for the first time in history. In mid-May, BTC’s price made it to the $66K zone for the first time and slipped below that region shortly after.

The price of Bitcoin slipped below the $ 40,000 area around September 21, 2021, and people have claimed that the highest price has yet to be reached. They were right because 50 days later the price of bitcoin (BTC) hit a high lifetime price of $ 69,000 per unit on November 10 of last year. Still, crypto advocates believe the bull cycle is not over and another parabolic uptrend may be in the cards. Most bitcoiners try to measure cycles by taking advantage of the time between the BTC halving cycle.

Typically, because of bitcoin’s scarcity, the price rises before the reward halving, and the next halving is expected 850 days from now on May 6, 2024. That’s still more than two years away and people wholeheartedly believe that the bull market that led BTC to $69K is still in play. Bitcoiners are still expecting a double-bubble similar to 2013 where the price exceeds the $69K zone and peaks higher. Crypto market pundit Bobby Axelrod thinks that in early February observers will witness the next big move.

“This next step, this next 60 day cycle begins,” Axelrod tweeted. “Early February will be THE MOVE. The place where the bitcoin price ends after the next move should be the top of the IMO cycle. At least I’ll treat it as such.

Crypto Advocates Expect a Bitcoin Price Rebound — ‘Price Crash Means the Upside Surge Is Sooner to Come’

Crypto supporter Colin, host of the Youtube show “Colin Talks Crypto” thinks the market cycle has been lengthened. “Because of the apparent lengthening cycle of this bull run, I now think it is *more likely* for us to see a $300,000 bitcoin price than a mere $100,000 bitcoin price,” the Youtuber said on January 5. The same day, Colin tweeted:

I’m happy that the price of bitcoin is crashing, not because I like the price to go down, but because it means it is rising faster. It’s like, “let’s end this crash so we can move into more bullish territory!”

Many other crypto supporters feel the same way. The Twitter account dubbed “Wicked Smart Bitcoin” wrote: “Perfect place to bounce IMO. Rekt everyone who longed at $43k and now everyone short (expecting a break down to $40k) will get rekt. Choppity chop chop. Don’t trade or use leverage. Just buy spot, self custody, and HODL for a cycle or two. Let hyperbitcoinization do its thing.”

“The vomit in the middle”

The Twitter account called @therationalroot shared a chart of all bitcoin’s price cycles and record price positions (ATH) recorded during the cycles. “The 2021 cycle has given us 32 blue points (ATH) so far,” bitcoin advocate noted. “We had 72 in the 2017 cycle and 52 in the 2013 cycle. Let the fireworks for 2022 begin. Trader, entrepreneur and investor Bob Loukas described the cycle as a “mid-point vomit”. Loukas said:

Day 31 of the bitcoin Cycle, the midpoint puke. The overlay is the Cycle from May 23rd – July 20th 2021. Not a fan of overlays, I don’t trade off them, but similar conditions. I think $40k was always the more important level. More important is the early [February] timing.

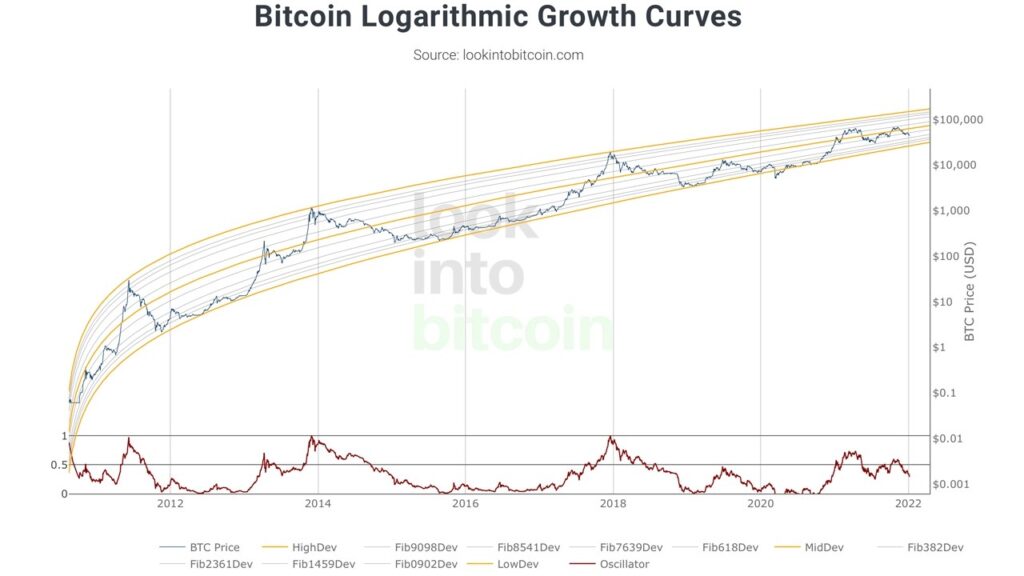

Currently, Bitcoin’s log growth chart shows three bull runs with extreme peaks, but the current cycle looks incomplete and almost indecisive. The chart shows that there have only been two times in bitcoin’s price history where it slipped below the yellow dev low line, and the last time that happened was March 12, 2020 (Black Thursday). The end of the chart and the yellow line of low dev indicate that the price of BTC will not drop below $ 25,000 if it maintains the power law corridor pattern without deviation.

It’s safe to say that most bitcoiners even with the most advanced technical analysis skills are unsure of where bitcoin’s price is headed. Tai Zen, the crypto trader, entrepreneur, and CEO of the trading web portal cryptocurrency.market says people should wait until the bear market to acquire altcoins.

“Bitcoin is on sale for under $ 50,000 (laser eye price),” Zen tweeted. “We don’t recommend buying coins in the middle of a bull market. However, if you have the extra cash and itchy to get into crypto, the only coin I would buy is BTC. [and] nothing else, ”added Zen.