Shiba Inu loses its place at the top of the market

Negative sentiment around the Shiba Inu token remained strong after the token failed to recover after further falling in price. In addition to the disagreeable market performance, Shiba Inu lost its place in the top 10 large coins and tokens by market cap, losing to AVAX, Dogecoin and DOT.

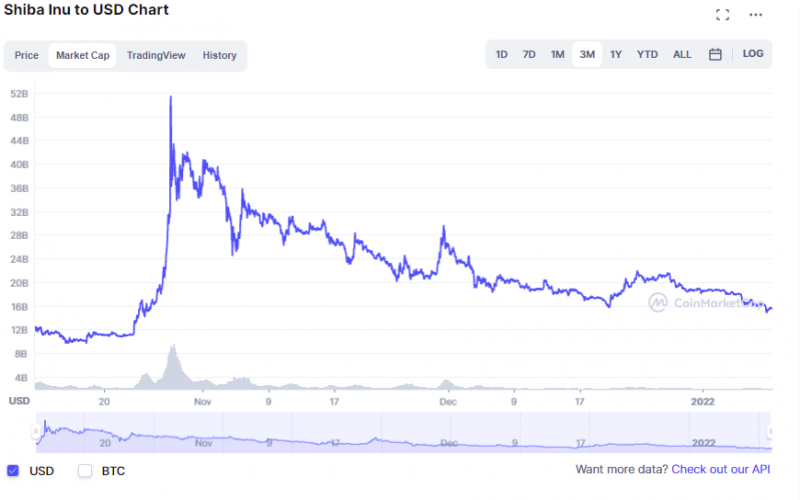

SHIB market cap bleed

During the last month, Shiba Inu’s market capitalization has been even more unstable than its price, with a sudden increase at the beginning of December and a strong plunge that began on Dec. 28.

During SHIB’s 1,000% rally, the token’s market cap hit $ 50 billion, overtaking industry giants like Solana and entering the top 5 according to CoinMarketCap. But due to the high volatility and the large number of short-term traders, the sudden drop in prices triggered panic sell streaks that caused the asset’s cap to drop to $ 17 billion.

The unexpected recovery began on Dec. 20, when the meme-token’s capitalization quickly increased from $15 to $21 billion in less than 5 days. But due to the absence of buying power from retail traders, the rally could not last long and ended shortly thereafter.

Shiba Inu market performance

While the asset yields large profits for some holders and investors, with the current state of the asset, the majority of traders and investors lose their money by holding SHIB. The token has lost over 60% of its value since its all-time high and doesn’t seem to show any signs of a recovery.

While whales and large addresses continue to buy the asset, most retail and private traders have exited the asset. The current composition of holders suggests that the assets is mostly being held by mid- and long-term investors, who are usually considered a healthy sign for a token or coin in a long term.