This indicator hints at incoming Bitcoin price reversal

According to Feeling, Bitcoin didn’t see much use launching January, as token circulation and address activity have remained declining since the start of 2022. The chain analytics company points out that an increase in these metrics might as well signal a price reversal for Bitcoin.

Bitcoin resumed its declines after reaching highs of $47,967 on Jan. 1. Several days of declines finally brought Bitcoin to lows of $39,950 on Jan. 10 as investor sentiment soured. The Crypto Fear and Greed index has since shifted to ”extreme fear” as panic reigns in the market.

U.Today previously reported that Bitcoin’s price fell on January 11, as Goldman Sachs expected the U.S. Federal Reserve to raise interest rates higher than it previously announced.

Although the price of Bitcoin has slightly recovered to trade at $41,883 presently, apparent indecision by the market still weighs on the price action as seen by the Doji candlestick formed on the daily chart.

On what could be the next step for the price of Bitcoin, a crypto analyst is of the opinion that “if the $ 40,600 level holds, an upward continuation to $ 42,600 and potentially $ 46,000 is on the table.” “

Bitcoin’s network growth remains a key item to watch

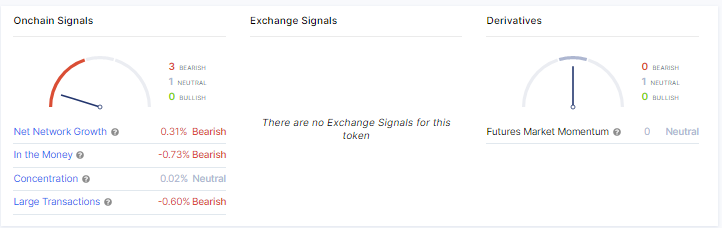

According to IntoTheBlock analytics, Bitcoin’s net network growth remains in negative territory. The net network growth indicated by IntoTheBlock provides a view of both user engagement and growth.

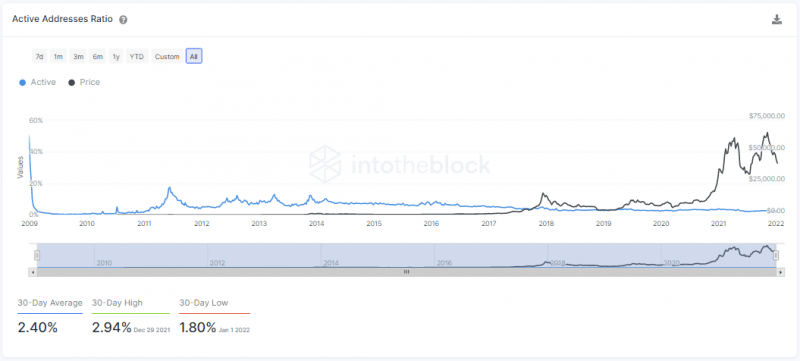

Bitcoin has yet to match the rise seen in active addresses in early November 2021, hitting a 30-day low in this key metric on January 1. The Daily Active Addresses (DAA) indicator tracks the number of new addresses, the total number of active addresses, and zero balance addresses.

Daily Active Addresses (DAAs) are a useful way of tracking network activity over time as growing DAAs signal greater blockchain usage. As such, DAAs can often be a leading indicator of price action—demand for network usage might boost demand for the blockchain’s native token.