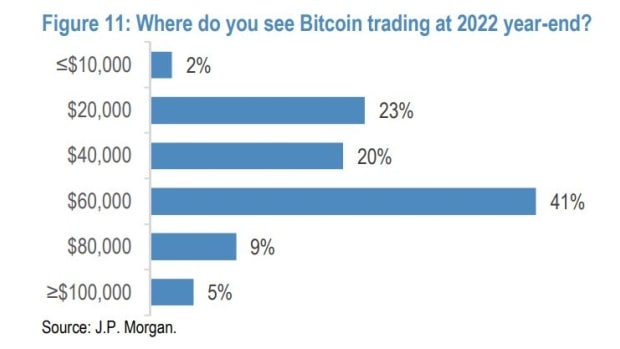

According to a recent survey, the vast majority of JPMorgan customers don’t expect bitcoin to hit $ 100,000 in the next 12 months. Still, over 40% of participants expect the asset to be around $ 60,000 by the end of the year.

JPMorgan Clients Do Not Expect BTC at $100K This Year

The largest cryptocurrency by market capitalization did not manage to climb to the often-touted milestone of $100,000 last year despite numerous predictions from experts and analysts. In fact, bitcoin finished 2021 on a downtrend, which continued in the first days of 2022.

However, some analysts and supporters of the asset still believe that it can reach this price point within the next 12 months.

In contrast, most clients of the US multinational bank JPMorgan Chase & Co are skeptical of such a scenario, according to a recent poll reported by Bloomberg. Only 5% see bitcoin trading at over $100,000 before the end of 2022.

Nikolaos Panigirtzoglou – a strategist at the bank – said he was not surprised by the decline in his clients regarding the future of BTC. In his view, the “fair price” of the coin is between $ 35,000 and $ 73,000, and that depends on what investors assume about its ratio of volatility to gold.

It is worth noting, though, that the top answer, with 41%, is bitcoin to trade at around $60,000 by the year’s end, or approximately 40% increase of the current price of the asset.

Contrary forecasts

Unlike JPMorgan clients, Nayib Bukele – the pro-bitcoin president of El Salvador – predicted a price of $ 100,000 for the major cryptocurrency sometime in 2022. He also envisioned at least two other countries would follow his country’s path and adopt BTC as legal tender in the current year.

Nexo’s Co-Founder Antoni Trenchev also sees the asset reaching the six-digit milestone. According to him, such a price surge will be fueled by the rising institutional adoption and will happen by the middle of 2022.

Additionally, the 35-year-old Bulgarian felt that bitcoin is an inflation hedge equal to gold. The current inflation rate in most countries is increasing dramatically, which could be another reason for the value of BTC to rise in USD.