While reserve-based crypto assets like gold tokens and stablecoins have been able to weather the crypto market carnage over the last two weeks, rebase tokens like wonderland (TIME), and Olympus (OHM) have seen massive losses. Wonderland is down more than 96% since the crypto asset’s all-time high (ATH), and OHM is down over 95% since it’s own ATH. Furthermore, the Wonderland project is surrounded by controversy as it’s been assumed that one of the founding members was a former Quadrigacx employee.

Rebase token economy grows from $3.2 billion to $1.74 billion

The total value locked (TVL) across all the decentralized finance (defi) protocols in existence today is just under the $200 billion mark. While many defi projects have managed to stave off the recent crypto market rout, others have seen their valuations slide during the last two weeks. Lots of funds have moved into reserve-based crypto assets like stablecoins and gold-backed tokens in order to hedge against the price fluctuations.

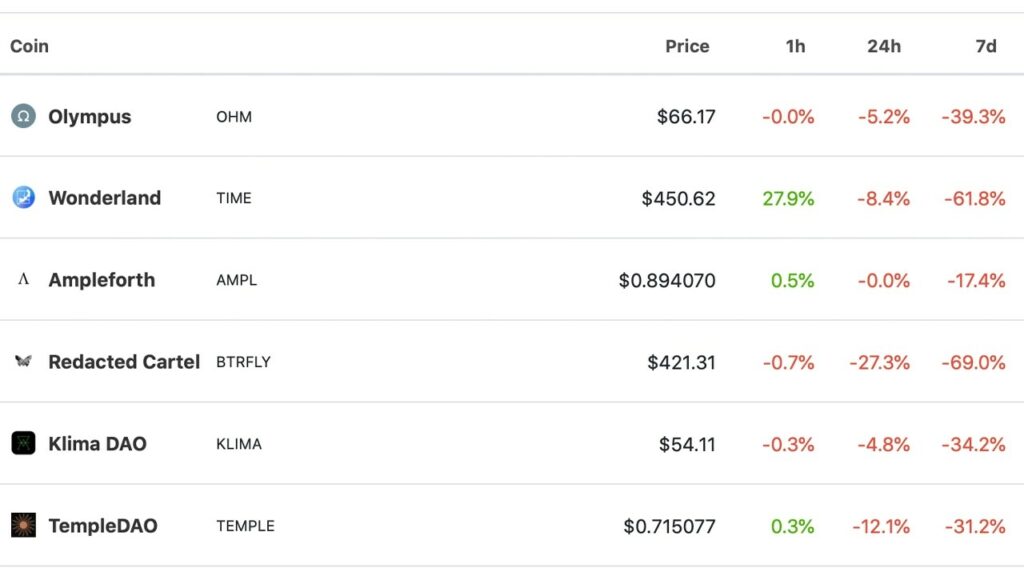

Stablecoins and gold tokens have been able to hold their pegs, especially to the specific asset the tokens are connected to, such as the US dollar or a .999 fine troy ounce of gold. On the other hand, reserve-based rebase tokens have suffered massive losses over the past few months and even more over the past couple of weeks. The full list of over two dozen rebase tokens listed by market valuation is worth $1.63 billion, as it lost 11% in the last day. The crypto asset Olympus (OHM) fell 39.3% last week and is down 95.3% from the crypto asset’s $1,415 per ATH unit.

Wonderland, an Avalanche project based on the Olympus protocol, has seen its two native crypto-assets wonderland (TIME) and wonderland (WMEMO) follow the same fate as OHM. TIME’s falter over the last two days has been worse than OHM’s drop, as weekly metrics indicate TIME’s price is down 61.8%. Wonderland (TIME) has lost 96.4% of its value since tapping a $10,063 ATH three months ago.

Project Wonderland shrouded in controversy

In addition to major losses, the creators of Wonderland have come under intense scrutiny lately. According to to a crypto supporter on Twitter, member of the Wonderland team @0xsifu or “Sifu” helped co-found the bankrupt Canadian crypto exchange Quadrigacx with its founder Gerald Cotten. Quadrigacx collapsed in 2019 and there was much controversy surrounding the deaths of Gerald Cotten and his associates. Sifu managed Wonderland’s treasury with the project’s founder, Daniele Sestagalli. In a blog post, Sestagalli confirmed the accusations regarding Sifu and further pointed out that Sifu should step down from his role in Wonderland.

Sestagalli wrote:

Now having taken some time to reflect, I have decided that he needs to step down till a vote for his confirmation is in place. Wonderland has the say to who manages its treasury not me or the rest of the Wonderland team.

Sestagalli too discussed community issues with Sifu on Twitter. “I have no prejudices about @0xsifu, he has become a friend and part of my family and if my reputation for judgment will be affected by his dox, so be it. All frogs for me are equal », Sestagalli noted. “As I fight for him, I will fight for anyone who has proven to me that they are a good actor despite the past,” he added.

Hardcore Wonderland supporters are referred to as “frogs” and besides the contentious issues with Sifu, frogs are also upset about the falling price. Wonderland-based Twitter threads and the team’s Discord and Telegram channels are filled with angry frogs.

“We shouldn’t have to pay for your misjudgment,” one individual said. wrote on Twitter. “Just offer [a] Clear refund or ship duty. You say he needs [a] second chance. Wake up, there are questionable actions in the project too.

The Wonderland protocol itself is also connected to popular defi projects like the stablecoin magic internet money (MIM), Popsicle Finance, and Abracadabra.money. As OHM, TIME, and WMEMO have shed enormous amounts of value, rebase token market caps below them have also shuddered significantly. Ampleforth (AMPL) shed 17.4% this past week and redacted cartel (BTRFLY) lost 69% in seven days. Klima dao (KLIMA) lost 34.2% over the last seven days and temple dao (TEMPLE) has decreased in value by 31.2% this past week.