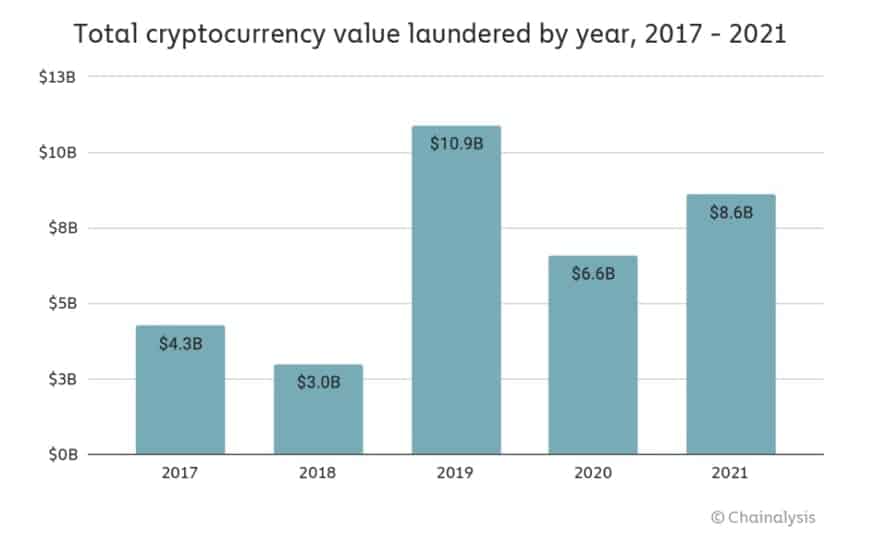

Blockchain-based data platform – Chainalysis – estimated the total value of cryptocurrency laundered in 2021 to be $8.6 billion, which is 30% more than in 2020. According to the company, however, such an increase is somewhat expected given the considerable growth of the asset class in the past year.

Crypto Money-Laundering Is on The Rise

In its most recent report, Chainalysis informed that cybercriminals dealing with cryptocurrencies share one common goal: move their “ill-gotten funds to a service where they can be kept safe from the authorities and eventually converted to cash.”

In line with the industry’s rapid expansion in 2021, illegal operations involving bitcoin and altcoins have also increased, the company noted. While in 2020 bad actors laundered $6.6 billion in digital assets, that number rose to $8.6 billion in 2021.

Nearly 17% of the $8.6 billion were transferred to Decentralized Finance applications, up from 2% in 2020. The report added that mining pools, high-risk exchanges, and mixers also saw significant growth in value received from illegal addresses.

Chainalysis explained that these numbers only count for funds from “native cryptocurrency crime,” including darknet market sales or ransomware attacks.

“It’s more difficult to measure how much fiat currency derived from off-line crime – traditional drug trafficking, for example – is converted into cryptocurrency to be laundered. However, we know anecdotally this is happening,” the company concluded.

Crypto-Based Crimes in 2021

Theft and scams have remained the top type of cryptocurrency crime over the past year. The wallets associated with the theft sent almost half of their stolen funds to DeFi applications, amounting to more than $750 million in total digital assets.

This might be related to the fact that more cryptocurrencies were stolen from such protocols than any other type of platforms last year. On the other hand, scammers send most of their funds to addresses at centralized exchanges.

The darknet market, terrorist financing, and ransomware were among the other top forms of crime in 2021. Like scammers, criminals operating in these sectors sent the majority of their funds to wallets on mobile platforms. centralized negotiation.

It is worth noting that due to regulations like the Travel Rule, digital asset businesses in many nations had to conduct additional compliance checks and reporting to transactions exceeding $1,000 in value. Unsurprisingly, illegal addresses send a disproportionate number of transfers to exchanges just under that $1K threshold.