The Graph (GRT) price prediction

GRT, the coin of decentralised indexing protocol The Graph, has a price of $0.43 but even with today’s (4 February) rise of 8% it is still in the grip of a long term decline.

That is despite recent news that it has acquired $50m by selling off GRT from its treasury. It says the money will help it “aggressively onboard the brightest minds in web3,” fund product and protocol development, and “provide a runway for the strategic initiatives of the Foundation”,

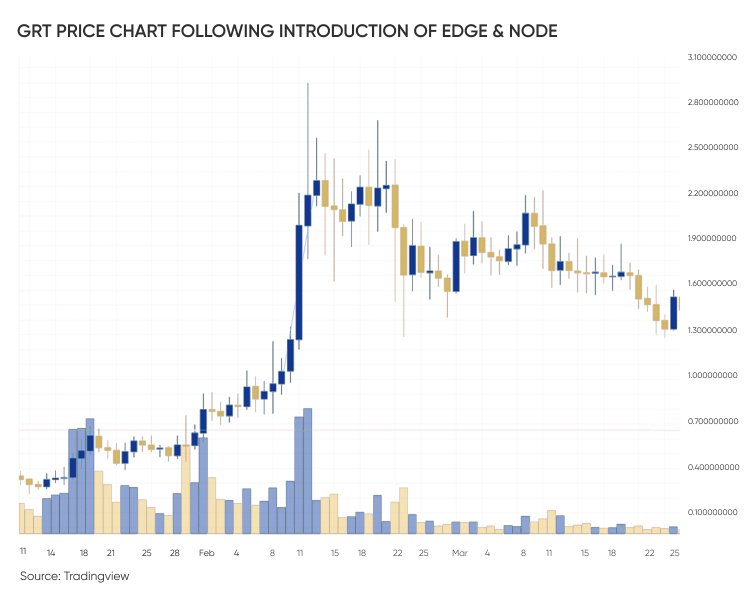

The Graph has been working hard to establish itself as a crucial component of the global decentralised finance (DeFi) infrastructure by simplifying the process for indexing and querying data from blockchains. That hope at its launch took it to an all-time-high level of $2.88 on 12 February 2021.

However The Graph remains confident of its future. It says it that in the year since its launch it “has blossomed into a vibrant ecosystem collaborating on organising data for web3. The next year looks even brighter.”

So, what does the future hold for the GRT and The Graph? Is it worthy of a place in your portfolio?

The Graph Price Predictions: 2022-2026

Currently, the price of GRT trades around $0.56 with positive momentum despite the huge volatility residing in other currencies. At the beginning of the last year, The Graph was trading around its major support level of $0.4. On February 12, 2021, the GRT coin marked a sharp spike and registered an all-time high at $2.88. However, after that, it continuously traded with negative sentiment and price started to decline following the bearish trend till last August. Novice finds it hard to trade in bear markets.

The Graph Technical Analysis of Technical Indicators

In the last August, the GRT price plunged around $0.44, but later, it has initiated a price recovery, as seen in the above GRT price chart of daily time frame. After that, the trend continues, and the GRT token has managed to stay above its resistance level of $0.6. The 7 days change in the crypto can be referred through the overview table. The Graph price analysis made few days ago reveals the correction in the Graph price.

According to The Graph price forecast, the GRT coin price is set to hold a benchmark for its performance by overcoming all hurdles and attracting a major investor community surpassing all expectations. After hitting a high of $1.35 in last November, the GRT price has marked significant correction. And over the past few days, the coin has managed to stay above $0.51. According to our the technical analysis of The Graph, the Simple Moving Average lines for 50 and 100 days made a crossover last month. Based on this crossover, the coin might trade sideways over the next few days. Moreover, the formation of current GRT price and Exponential Moving Average (EMA) confirms the weakness in the price trend.

According to our GRT price analysis, if the market turns favorable, the GRT tokens are set to break all barriers and perform exuberantly, scaling the peak as aforesaid. Transgressing all limitations over this year, it would surely show signs of fortune for its investors as per our cryptocurrency price predictions. Backed by robust smart contract, the GRT price forecasts for the end of the year 2022 stay around $0.82.

The Graph Price Prediction 2022

According to The Graph crypto price prediction, the token is expected to grow by $0.66 in mid year, the GRT may face bumps in-between but will overall trade to manage bullish support growing between $0.68 and $0.70 by November 2022. Considering there are no sudden jolts or a stony path ahead for the crypto market, The Graph is all set to affirm its strong position as a major attraction among its investor community. The road ahead is full of petals provided the investor confidence keeps booming, resulting in a major push to The Graph price taking the GRT token to cross all barriers scaling $0.82 as per our price predictions for one year.

The Graph Price Prediction 2023

The Graph has established a fast, reliable network and works with the user experience of the product. Investors turn bullish for this crypto as its features can help the GRT coin to record massive growth in the future. If the drive for functional crypto continues into 2023, the price may even see a paradigm rush in the first half and hit the $0.99 mark next year. According to The Graph (GRT) price prediction, The graph price would add another milestone reaching new ATH in the future.

The Graph Price Prediction 2024

There are quite a few price predictions that The Graph might record new high around $1.12. However, this only happens when the coin will be able to cross its past major resistance level. With ongoing technological upgrades of the ecosystem. The Graph holds a promising future. Still, traders should do their own research before investing in GRT. The price of the Graph coin might trade above $0.80 in the year end.

The Graph Price Prediction 2025

The Graph is also active in community initiatives. Considering they keep up momentum garnering a significant market cap, their initiatives with a focus on education, outreach, and innovations may take the GRT price to an appreciable level of $1.27 as per our GRT price predictions.

The Graph Price Prediction 2026

According to our research and GRT price predictions, the price may reach to $1.2 in the year 2026 whereas, the Graph price would trade with an average of $1.15. With the five-year plan, investors can expect a profitable returns from their investment.

The Graph Forecast Beyond 2026

Cryptocurrency experts always plan for the long term rather than the short term investment. With a bit of patience and keeping the hopes high in the long term, investors can expect a turnaround by the end of 2026 as the adoption of The Graph would grow exponentially, by when the GRT coin would be no more a naïve entrant in the world of cryptocurrencies, but a seasoned player turning $2 as per our GRT price predictions.

GRT: everything you need to know

GRT is a token that powers The Graph, a decentralised indexing protocol used by blockchains such as Ethereum.

In a similar way to how search engines such as Google index the Internet, Graph protocol indexes blockchain data, grouping it into subgraphs on open application programming interfaces (API) that anyone can query via GraphQL, Graph’s programming language.

Subgraphs can be then composed into a global graph of all the public information. This data can be transformed, organized and shared across applications, enabling users to make a search using GRT tokens.

The Graph platform makes it easy to search for blockchain data through simple queries.

“Before The Graph, teams had to develop and operate proprietary indexing servers,” Graph says on its website. “This required significant engineering and hardware resources and broke the important security properties required for decentralisation.”

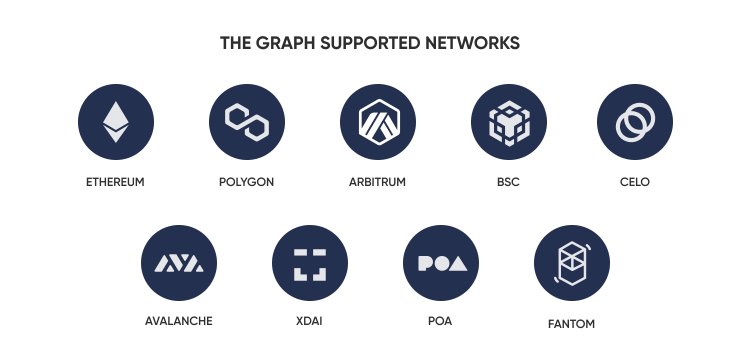

Currently, The Graph supports nine networks, including Ethereum, Polygon, CELO and BSC.

The Graph (GRT) analysis: Key growth drivers

- Software developments and improvements

As The Graph provides specific functionality to the blockchain ecosystem, any positive developments or improvements in the technology or software behind The Graph could push the GRT price higher.

In February 2020, for example, when The Graph introduced Edge & Node, a software development company that aims to help blockchain protocol development, the GRT token skyrocketed an eye-popping 144% in the four days after the announcement. Any further positive Graph crypto news from Edge & Node could give an extra boost to the price.

Most recently, The Graph announced it was offering a $2.5m reward to developers and ethical hackers to identify vulnerabilities and shortcomings in its protocol and help fix them. Any improvements of The Graph software coming out of this initiative has the potential to drive GRT price higher.

In the week of 17 December it offered two substantial grants: one goes to Semiotic AI whose team will join as a core developer and the $60 million grant over eight years is to support protocol R&D; the other is to The Guild which will use its $48 million grant to also contribute to subgraph and protocol R&D.

– Partnerships and expansion

Asked about the key drivers behind The Graph’s expansion that are likely to determine its price range in the coming months, Tim Frost, the chief executive and founder of DeFi-focused fintech Yield App, told capital.com that the token plays a valuable role in the DeFi ecosystem.

“The Graph itself is very important to the DeFi Industry if you look at the adoption of a number of blockchain protocols such as Polkadot,” Frost told capital.com.

Frost also mentioned that the rising inflow of capital into DeFi benefits The Graph’s popularity. “Many new users have joined these ecosystems in the past months, there is a noticeable float of capital to them, and their adoption has taken off,” Frost added.

On 18 February 2021, the company announced that it now supports additional blockchains Polkadot, NEAR, Solana and Celo – the price rose 5.15% that same day. If The Graph software continues to expand, potentially supporting the Bitcoin blockchain, GRT token could benefit.

In September it revealed that it has recruited 160 indexers, nearly 7,000 delegators and 2,200 curators.

In October The Graph announced it will support Arweave, a leading decentralised protocol that allows users to store data permanently and sustainably for a one-time upfront fee. This integration will allow indexed data from open APIs powered by The Graph, called subgraphs, to read and organise Arweave’s stored data. In other words, these subgraphs will read data stored on the Arweave protocol, allowing for quicker and more efficient access.

In early November The Graph announced at Solana’s Breakpoint Conference that its hosted service is integrating Solana. The integration, led by Streaming Fast, will use the Firehose to enable faster indexing. This came shortly after The Graph said it is preparing to support the Cosmos ecosystem. Led by Figment the integration will enable dapps built on the Cosmos network to use subgraphs by querying data.

On 24 November The Graph announced its hosted service will support zkSync, an EVM-compatible ZK-rollup scaling solution. “Once integrated, devs will use open APIs powered by the Graph Protocol, called subgraphs, to read and organise data on zkSync, allowing its dapps to efficiently query on-chain data.