Number of Chainlink holders keeps setting new highs

InTheBlock Analytics reports that while the number of Chainlink holders continues to hit new highs, many more are demonstrating their belief in hodling.

The on-chain analytics data provider notes that despite the price slump, the number of ”hodlers” (Chainlink addresses that have held for more than a year) have increased. Presently, 279,440 addresses are now holding Chainlink for over a year. This figure represents 43.9% of the total holder composition, IntoTheBlock notes.

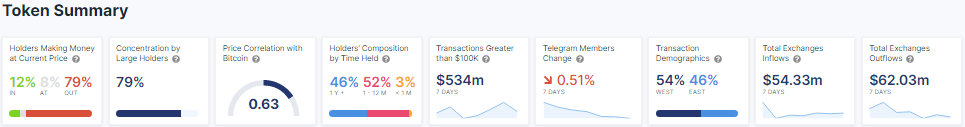

The importance of these addresses can be seen in the IntoTheBlock indicator Holder Composition by Holding Time. Forty-six percent of holders have held their LINK tokens for over a year, and 52% for the past year, while a mere 3% have held them for less than a month.

Chainlink remains under whales’ radar

According to WhaleStats data, Chainlink (LINK) ranks among the top tokens purchased by whales in the last 24 hours. The cryptocurrency market tumbled alongside traditional markets in a sell-off that saw longs liquidated. Bitcoin and the majority of altcoins were losing value at press time.

Additionally, LINK remains the most traded token, Uniswap the most widely held, and FTT the largest token position by USD value among the top 1,000 ETH wallets tracked by WhaleStats.

Large investors typically use dip periods to accumulate their favorite tokens. Blockchain data tracker WhaleStats reports Chainlink (LINK) buying in the last 20 hours. The most recent buy is of an Ethereum whale ranking 35th among the top 1,000 wallets, who acquired 99,990 LINK, or $1,364,863 worth.

Several projects currently leverage Chainlink’s network, and companies such as AccuWeather and many others have launched oracle nodes to monetize their data.

LINK, the network’s native token, is the 23rd largest cryptocurrency and was down 18.53% in the last 24 hours at a present price of $11.53, as per CoinMarketCap data.