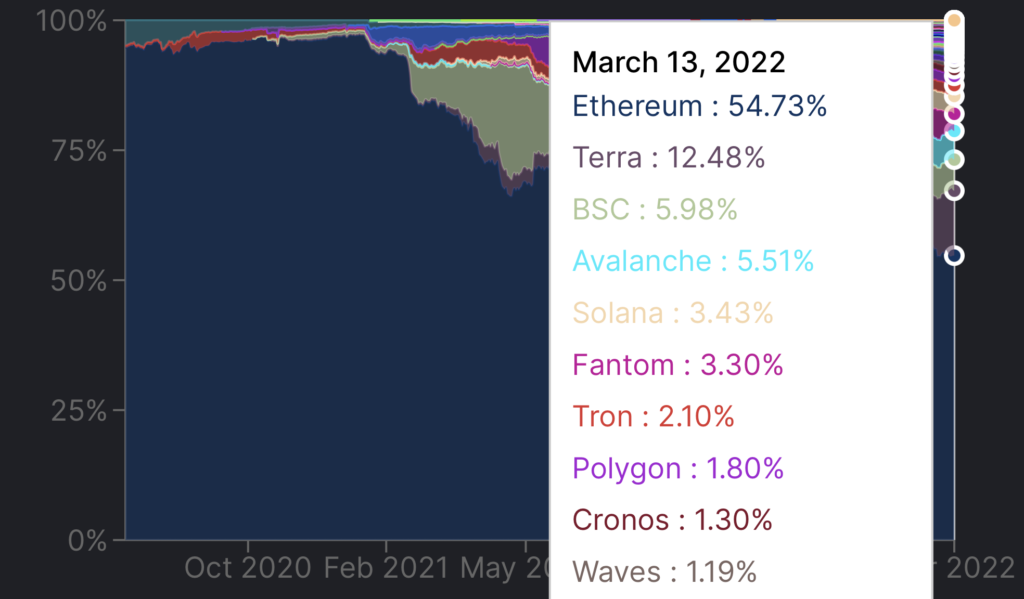

Chains are keen to hike their total value locked [TVL] dominance as this is a way to amp up adoption and boost their presence in the space. Ethereum is thought to be the reigning DeFi alt, but as the markets grow larger and more bridges and links are formed, what are investors choosing?

The shock of the alts

The 2o21 Annual Crypto Review by Token Insight revealed some notable coin trends in the multi-chain DeFi space. First and foremost, the report looked at Ethereum’s slippery dominance, which hasn’t been subtle. The report stated,

“Compared to 2020, Ethereum dominance declined from 99% to 70%.”

Examination of the 2022 data shows that this decline only continued for the first three months of the year. As of March 13, Ethereum’s TVL was only 54.73% of the total. Chains with growing dominance include Terra with a 12.48% share and Avalanche with a 5.51% share.

The report added,

“Terra, Solana and Avalanche became later competitors since September.”

That said, 2022 stats showed BSC and Solana dropping in terms of TVL share.

Time to spread your wings?

Naturally, these changes in TVL dominance raise the question of whether or not Terra and Avalanche could be the new winners. TokenInsight reported that Avalanche had a “good summer wave” in 2021 and since then, Avalanche’s TVL has grown, dipped, and then recovered to hit 5.51%.

Meanwhile, Terra’s LUNA has been the apple of many investors’ eyes since its 2022 rallies. The asset has also won over DeFi players thanks to its rising TVL. However, according to Token Insight, Terra’s Anchor lending protocol – now with a TVL of $12.6 billion – appears to be struggling to maintain its high yield.

But despite these changes, it might not be time to throw Ethereum out the window just yet. The biggest alt by market cap and TVL has been seeing a month with average gas fees each day falling well below 100 gwei. With high fees often being a reason for investors to turn away from Ethereum, it remains to be seen whether this fall in prices will lead to a resurgence in Ethereum’s TVL dominance.

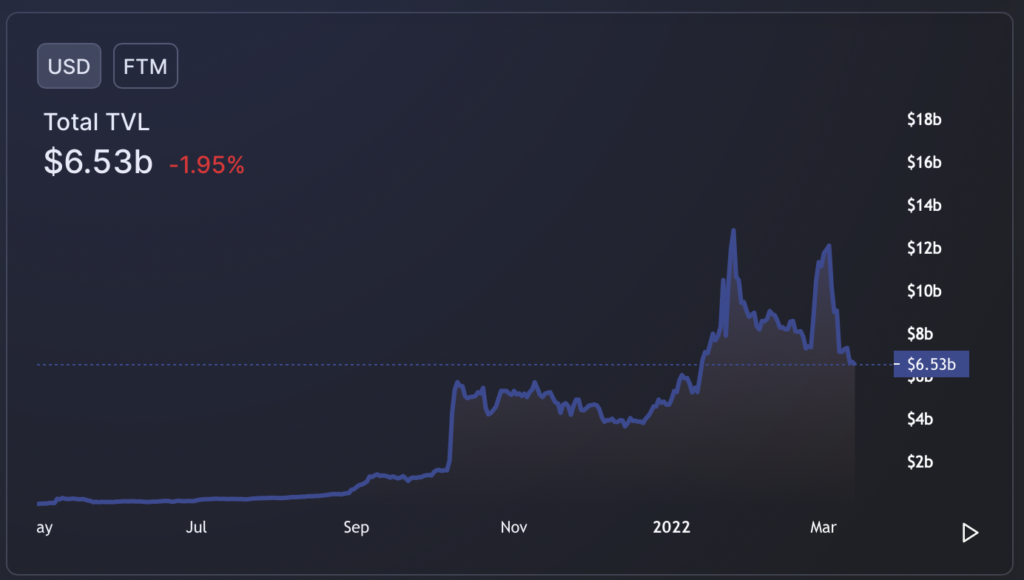

Ghost of TVL

The TokenInsight report revealed that Fantom is one of the “highly successful” channels. However, since the shock departures of André Cronje and Anton Nell – members of the Fantom Foundation – Fantom’s TVL has seen a sharp decline.

This goes to show that in spite of billions in TVL, DeFi projects can be fragile and highly susceptible to change.