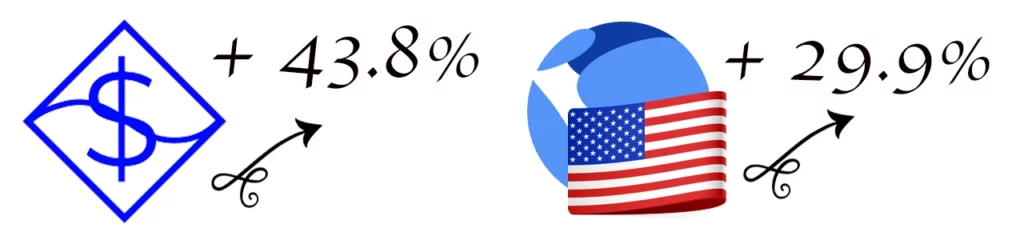

During the last 12 months the stablecoin economy has grown massive and the current valuation today is only $13 billion away from tapping the $200 billion mark. This month, the two biggest gainers in terms of 30-day issuance include Terra’s UST jumping 29.9% and Neutrino Protocol’s USDN spiking 43.8%.

Stablecoin Market Cap Continues to Inflate, Tether Crosses $80 Billion

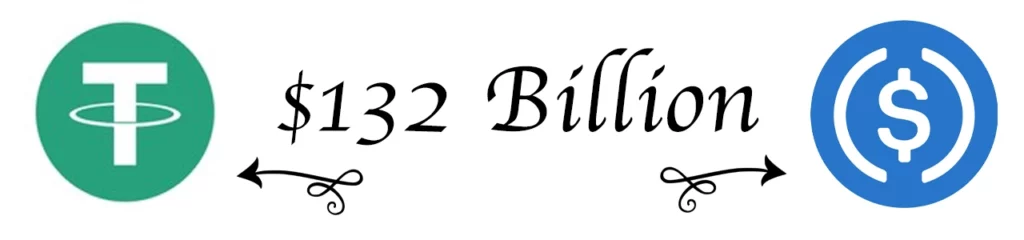

Monthly statistics show that the largest stablecoin by market capitalization, tether (USDT), rose 2% this month as the valuation crossed the $80 billion mark. USDT is huge compared to the rest of the stablecoins in the crypto economy, as its valuation represents 42.78% of the $187 billion stablecoin economy today.

Furthermore, tether’s $80 billion market capitalization equates to 4.46% of the entire $1.83 trillion crypto economy. The second-largest stablecoin in terms of market capitalization, usd coin (USDC) only increased by 0.3% this past month.

USDC has a market valuation of approximately $52.3 billion today, which equates to 2.92% of the crypto economy and 27.96% of the stablecoin economy. Measurements from March 14, 2022 indicate that between USDC and USDT, the combined market caps represent over 70% of the entire stablecoin economy.

The top assets exchanging hands with tether (USDT) is the U.S. dollar with 42.16% of today’s share and the Turkisk lira (TRY) with 17.41% of tether trades. TRY is followed by the euro, WBNB, and HUSD. USDC trades a lot with tether as USDT represents 64.18% of Monday’s tether swaps. BUSD, USD, EUR, and WETH all follow tether as the top pairs trading with usd coin (USDC).

USDN, UST, and FRAX See 30-Day Issuance Increases, Stablecoins Command 10% of Entire Crypto Economy’s Net Worth

While USDT and USDC saw no significant increases over the past month, UST, FRAX and USDN saw their 30-day issue rate increase. Terra’s UST grew by 29.8% and today the stablecoin has a market capitalization of approximately $14.7 billion at the time of writing.

Frax (FRAX), saw its 30-day issuance rate jump by 9.6% and Neutrino Protocol’s USDN rose by 43.8% during the last month. FRAX has a $2.9 billion market valuation and USDN commands a $638 million market capitalization today.

Makerdao’s stablecoin DAI saw its issuance levels fall by 4.6% over the past month and Magic Internet Money (MIM) saw a loss of 0.2% last month. The Ethereum-based DAI has a market valuation of $9.3 billion, while the Avalanche-based MIM has a market cap of $2.7 billion.

Overall, the entire stablecoin economy only has $13 billion more to rise before crossing the $200 billion zone. At the time of writing, the $187 billion stablecoin economy represents over 10% of the $1.83 trillion crypto economy.