Ethereum, the crypto-market’s undisputed altcoin king, is active again. Over the last two weeks, it appreciated by over 36%. However, it seems like this was just the beginning. With the ‘Merge’ on the way – between Ethereum‘s mainnet and the beacon chain proof-of-stake system – traders are getting excited.

Optimism in the charts

2022 has started on a dark note for the cryptocurrency market as a whole, and Ethereum in particular as well. But, that seems to be changing.

Ethereum is just some distance away from breaching the highest point of 2022. Ethereum hit a high of $3900 in the beginning of the year before hitting lows of $2200. It is now trading over $3400. Technically speaking, it has broken out of the broader downtrend in price and also the 50 DMA.

The 2022 high zone also roughly coincides with the 200 DMA. Therefore, a break above these two levels may signal a major confirmation of a trend reversal and may pave the way for a major Ethereum rally. However, it should be noted that the RSI is quite close to the overbought levels, so an immediate minor correction may take place before a further rally.

Two major regions of supply lie ahead – $4000 and the ATH of $4800 – and both these will prove to be a tough nuts to crack.

Brilliant Derivatives

However, a review of derivatives data, especially options data, shows that there is a lot of optimism among market participants for this coin.

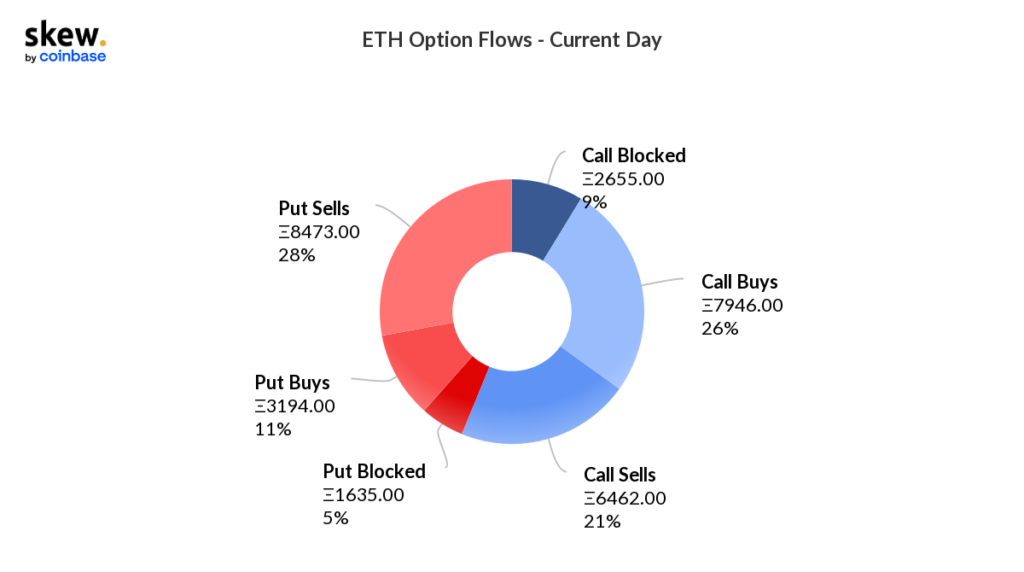

ETH Option flows data revealed that put contract sellers have been the most active followed by call buyers. Now, both these set of participants in the Options market hold bullish positions – suggesting a majority see ETH going up in the near future.

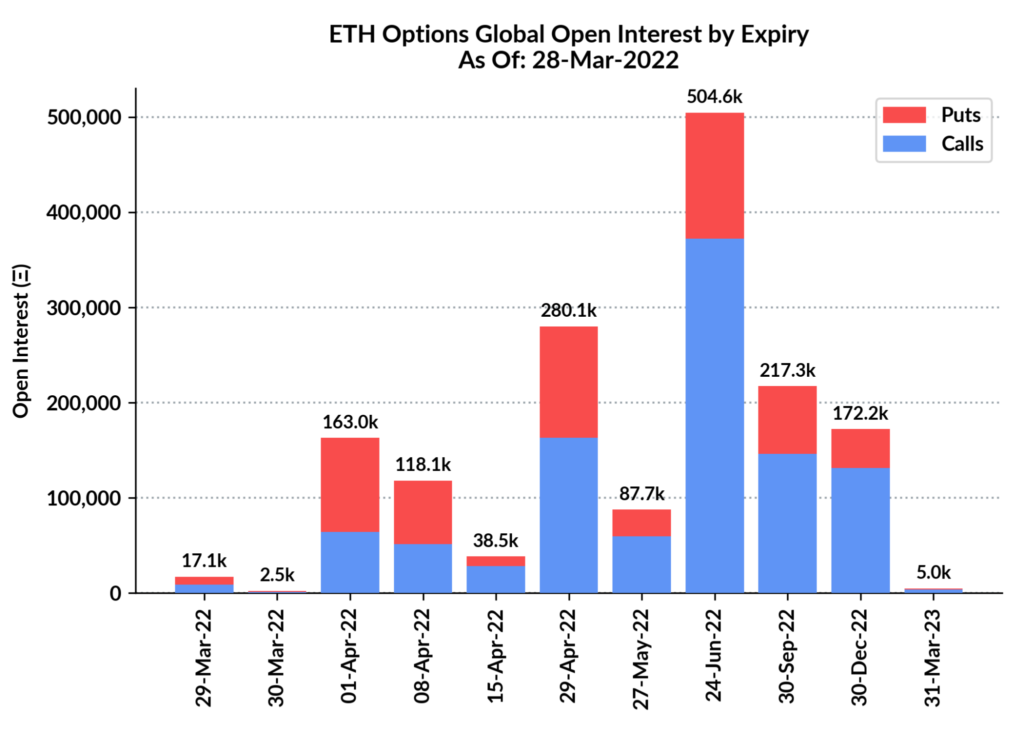

Also, ahead of options expiration on April 1, put OI is significantly higher than calls – this may seem counter-intuitive – but this data shows that put option sellers are more dominant in the current cycle. .

Especially since put option sellers are strong hands with significantly more capital at their disposal and have bullish bets in place.

According to data from Coinoptionstrack.com, for option contract expiration on April 1, the overall sell OI is much larger than the call OI – with a sell to call ratio of 1.54 . This requires a small short-term correction and profit booking, but should not alter the overall bullish structure on the charts. With peak pain near $3000, a 9% drop to the expiration can be seen.

However, the active put OI will help sustain the price at realistic levels.

Therefore, from the perspective of derivatives, market participants seem very optimistic about the king of altcoin and a new upward movement can be seen in the future. As we mentioned yesterday, there is a good chance of reaching $4,000 thanks to the fundamentals of the channel.

This bodes well for the broader crypto-market as this would lead the altcoin season, where the real money is made. Several alts have already begun their runs, the latest one being WAVES. A broader altcoin season might just be around the corner.