Different headwinds across the globe have seriously affected digital assets directly or indirectly. These includes everything from inflation concerns, EU anti-crypto amendments to government bans. Whatever the reason be, investors want to reduce their exposure to risky assets.

I want this, not that

This year, price swings in January and February have pushed investor perceptions back, favoring large caps such as Bitcoin and Ethereum. A leading crypto-asset manager, CoinShares, Underline this scenario in a March 29 report.

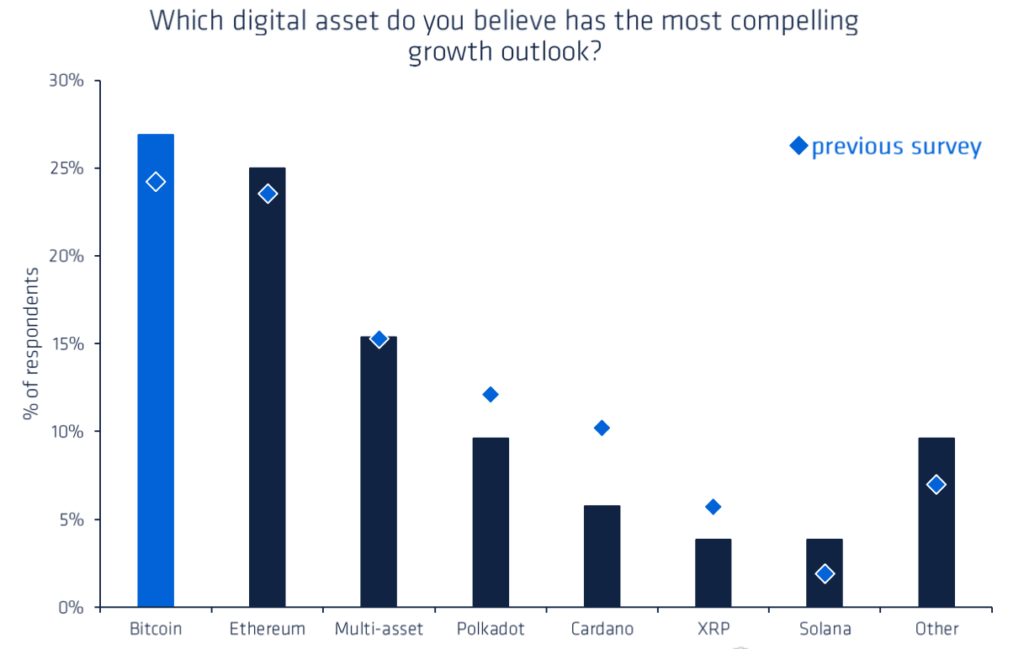

According to the report, investors tracked back into Bitcoin (BTC) and Ethereum(ETH) while reducing exposure to altcoins. Alt tokens such as XRP and smart contract-enabled blockchains Cardano (ADA) and Polkadot (DOT). This is evident in the graph below:

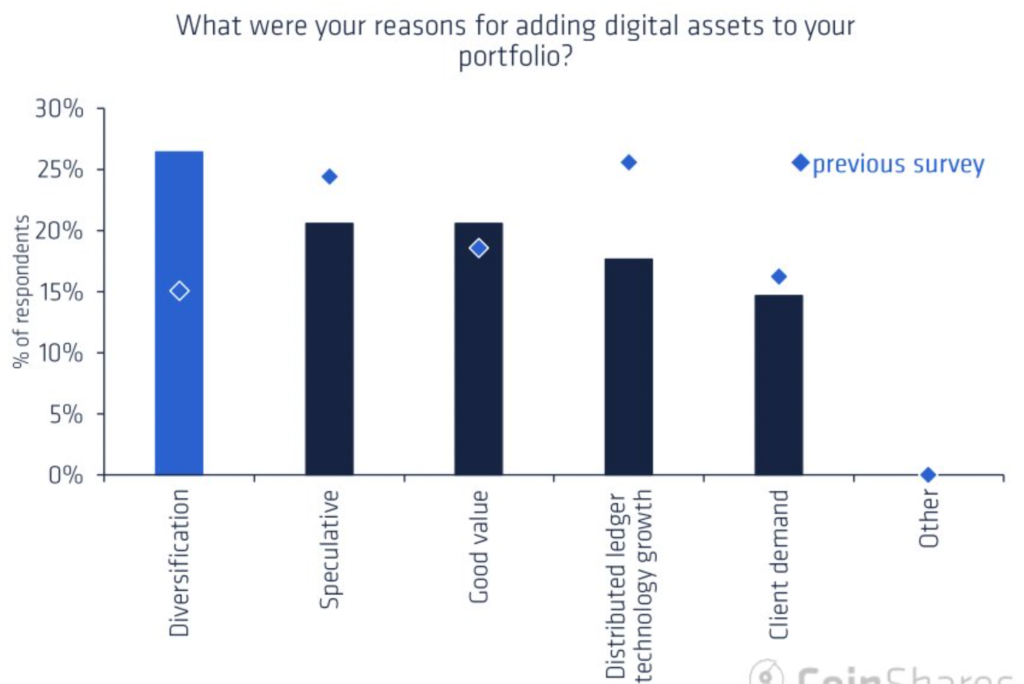

Nevertheless, a few altcoins have made headlines. Sentiment among Ethereum competitors such as Solana (SOL), Avalanche (AVAX), Cosmos (ATOM) and Terra (LUNA) has increased. Portfolio diversification is the main reason why investors consider such altcoins in their portfolios.

However, it is also interesting to see investors are putting their money into cryptocurrencies as they see value in the new asset class.

All good and not bad?

Cryptocurrencies have enjoyed a significant amount of love and affection – that’s a fact. However, over the years, regulatory censorships have created hiccups along the way. Investors have reduced their positions in digital assets with perceptions around politics.

Needless to say, government bans stood on the top of the list of critical risks.

The CoinShares survey found that the biggest risk in the eyes of investors was government bans on crypto assets.

“This survey was taken during the month of March 2022, when concerns over a Proof of Work (PoW) ban heightened due to the vote in the European Union parliament. Also, the anticipation around executive order from President Biden.

This has led to a political and governmental ban at the top of the list of major risks. As it happens, a PoW ban was not implemented and the executive order directed various ministries to further investigate digital assets.

Consider the decline in statistic to highlight this setback. The average portfolio weighting in digital assets declined from 0.8% to 0.5%. Looking in conjunction with the fund flows, the report suggested,

“This decline was the combination of the reduction in positions and the effect of negative price action.”