As the market saw red again, the king coin and the top alt both took a dive in order to revisit levels that some investors had assumed would never be seen again. At press time, Bitcoin had fallen below $42k. Meanwhile, Ether [ETH] was changing hands at $3,048.36 after dropping by 6.27% in the past 24 hours and losing 12.39% of its value in a week.

Never ETH me go

So how did investors, from minnows to whales, react to the news? Data from Santiment showed that as the supply on exchanges decreased, the supply of ETH held by top addresses increased. This clearly shows that a number of high profile investors are taking the opportunity to accumulate while prices are still relatively low.

Indeed, on-chain exchange flows also attested to this as the past week saw outflows of $261.1 million.

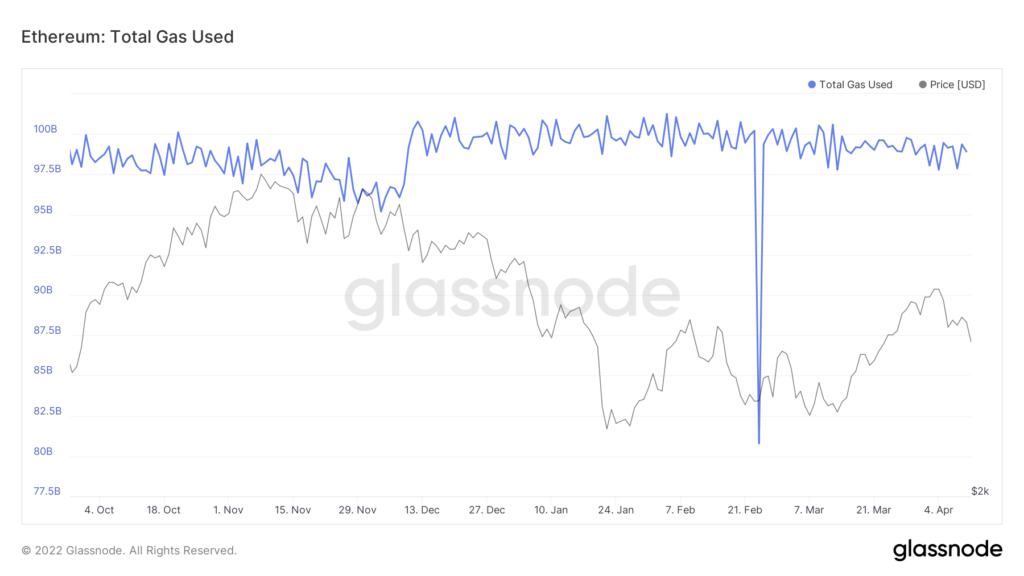

That said, exchange flows only tell part of the story. A particularly curious trend has been Ethereum’s recent gas guzzling. Data from Glassnode revealed that while gas consumption is up from 2021, there was a significant drop in late February, which quickly recovered. But at press time, gas consumption was moving sideways.

While this may not seem significant on its own, gas usage remained consistent despite a noteworthy fall in average gas price.

Does that mean developers are looking elsewhere? Not necessarily, as development activity on Ethereum was still stable at the time of publication.

Around the same time, the top gas guzzlers were OpenSea: Wyvern Exchange v2, Uniswap V3: Router 2, and Tether [USDT], according to Etherscan.

Look through a “Hayes” of uncertainty

While many analysts have big ambitions for crypto assets, BitMEX co-founder and entrepreneur Arthur Hayes predicted “crypto carnage to come” – even before the Federal Reserve could ease its policies.

He further predicted that Bitcoin would test a level of $30,000 while Ether would hit $2,500 before the end of June this year. Hayes added,

“As such, I’m buying June 2022 crash stakes on both Bitcoin and Ether.”

However, it’s important to note that Hayes based these predictions on a “gut feeling.”