Technical Analysis

Daily timeframe:

Bitcoin has been dropping impulsively in the past couple of weeks after being rejected from the 200-day moving average. This level has historically acted as a strong resistance during previous bear markets, and the price failing to break back above it may be considered a bad sign.

The price also broke below the 50 and 100 day moving averages and is currently testing them again from below. These levels printed a bullish crossover last week, but overwhelming bearish momentum led to the breakout of both to the downside.

If the price fails to break back above them, a retest of the $36K area in the short term would be more probable. On the other hand, if the price could break back above, the $47K supply zone and the 200-day moving average remain significant resistance levels.

4-hour timeframe:

On the 4-hour timeframe, it is evident that the price failed to hold above the short-term support level ($42,000) and is currently pulling back and could potentially continue lower . The large bearish flag pattern has worked well so far as a bearish reversal occurred when price tested the upper trendline for the third time.

The RSI indicator is also showing values below 50 which indicates that the bears are in full control at the moment. The $36K area and the lower boundary of the bearish flag remain as key support levels, and if the price breaks below them, a continuation and a lower low than the recent $33K bottom would be more probable. Furthermore, the $42K zone has currently transformed into resistance after being broken, and the price should trade above this level before any bullish move could be anticipated in the short-term.

On-Chain Analysis

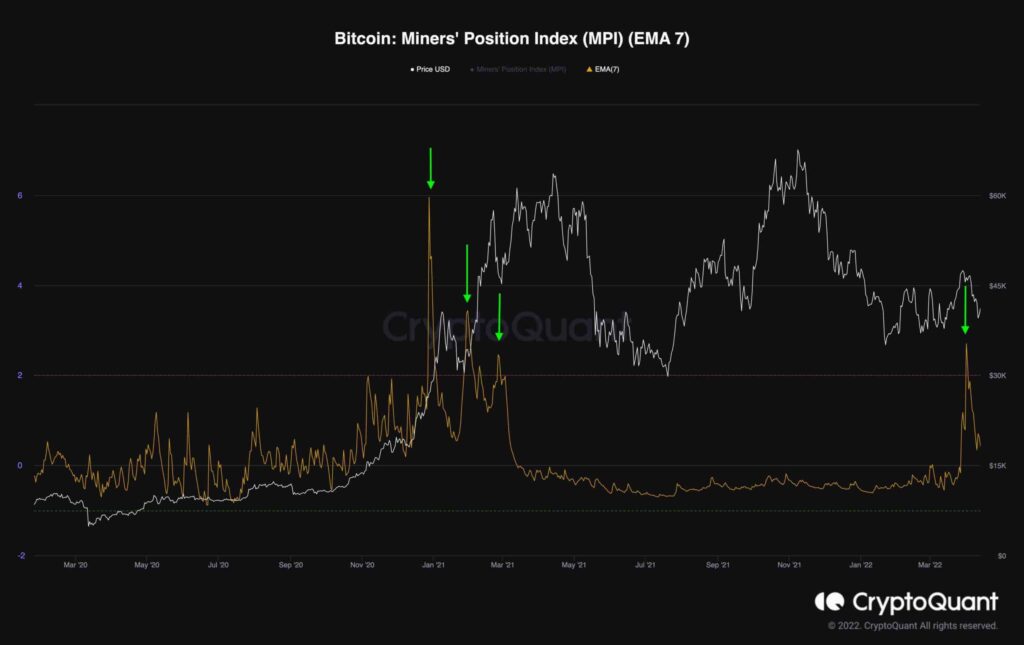

The Miner Position Index (MPI) is one of the most important indicators for gauging Bitcoin miner activity and sentiment. Following a price increase to $48,000, the MPI metric showed a sharp increase over the past few days, indicating that miners are selling off some of their holdings and taking profits.

This type of behavior was also seen three times during the bull market in early 2021. Miners’ selling pressure tends to bring bull markets to a close or exacerbate bearish movements. This is a bearish signal, indicating that the miners believe these prices are suitable for profit-taking.