Crypto bulls losing almost half a billion in long orders

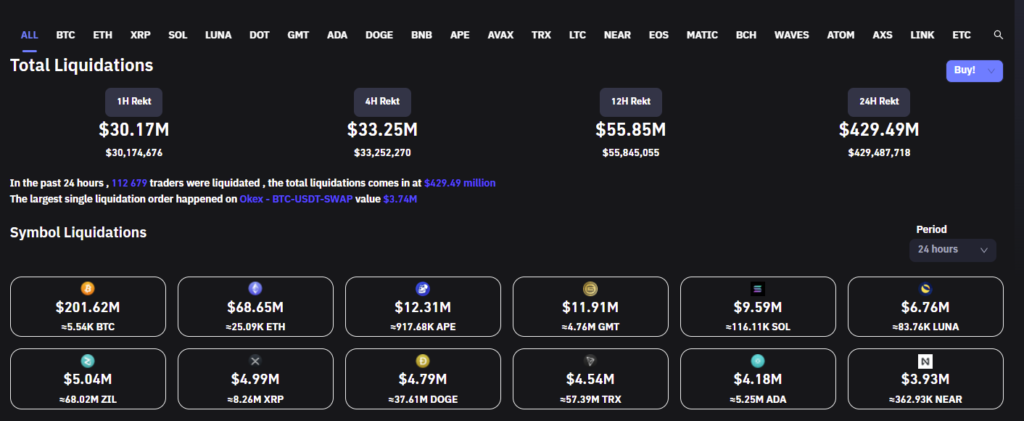

A total of $400 million in long orders have been liquidated in the cryptocurrency market in the past 24 hours following Bitcoin’s massive drop to $36,000, per CoinGlass. The first cryptocurrency even managed to briefly test the $35,000 range before a slight recovery.

As the market tracker suggests, $420 million worth of orders on various cryptocurrencies were liquidated during Bitcoin’s drop to almost $35,000. On average, 65% of all liquidated orders on various exchanges were longs, which may appear surprising since Bitcoin has not moved upwards after falling to $36,000.

The largest liquidation volume was provided by Okex, with the platform reporting $150 million in liquidated longs. On May 5, liquidated long positions accounted for 85% of all liquidated orders.

As for liquidations by symbols, Bitcoin traditionally remains in first place with $200 million worth of orders liquidated. Second place is also traditionally taken by Ethereum, and third place goes to a newcomer, ApeCoin, which provided $12 million in liquidations.

Bitcoin Market Performance

After the drop below the ascending range, Bitcoin is rapidly descending while searching for the next support yet to be determined by the cryptocurrency market. Some traders are betting on a reversal of around $33,500, according to TradingView.

The zone correlates with the beginning of the previous short-term rally on Jan. 24. The next technical resistance is the 200-week moving average, which currently sits at around $27,000.

The lowest point Bitcoin reached after October 2020 is $28,000, reached in June 2021, which was the point of a massive reversal and the start of the ATH rally that took BTC to $69,000.