ETH achieved a healthy pump during 4 May’s trading session after a 50 basis point rate hike was announced. The cryptocurrency has been trading within a falling wedge pattern for almost four weeks but it broke out of its resistance line after the announcement.

ETH rallied 6.2% after the Federal Reserve announced a rate hike within the expected healthy range. The rally was enough to pull ETH out of its descending wedge pattern by breaking through resistance in its four-hour chart. However, the price rally was short-lived and the price has so far fallen slightly.

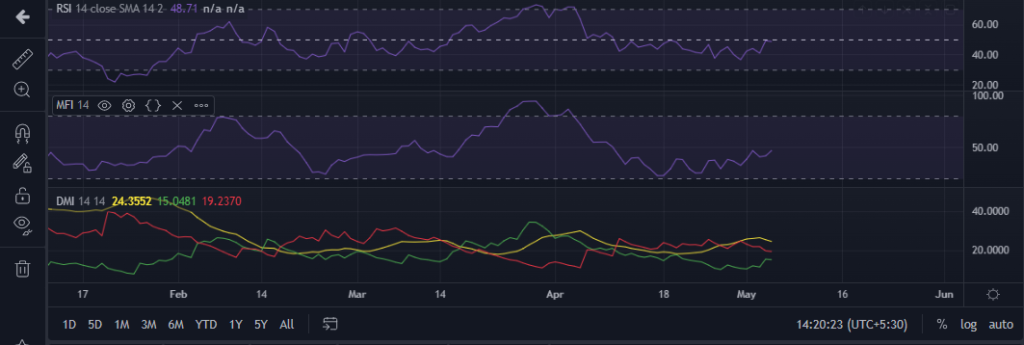

A look at ETH’s indicators on the four-hour chart reveals that its RSI bounced from the neutral zone and approached the overbought zone. However, it still has some wiggle room before entering the overbought zone. Its MFI highlighted a bit of accumulation during the 4 May trading session. But some downside in the last few hours were registered, this was likely due to profit-taking after the rally.

What does the macro trend say?

ETH’s 1-day chart reveals that its RSI is currently in the neutral zone, so resistance is at its current level. A break above the neutral zone would likely mean more upside.

Meanwhile, the DMI indicator reveals that the bears are losing their momentum and bulls are gaining traction. Well, the cryptocurrency enjoyed healthy accumulation in the last few days according to the MFI.

The observed accumulation is also supported by healthy growth according to some of ETH’s on-chain metrics. For example, the active addresses metric hit a low of 446,078 addresses on May 3. It recorded a slight increase to 486,765 addresses in yesterday’s trading session.

The number of ETH addresses holding more than 10k ETH dropped to the lowest four-week level on 2 May with roughly 1,175 addresses. They have since then increased to 1,184, which means whales accumulated ETH in the last two days.

An increase in addresses holding more than 10,000 ETH is a sign that large accounts are piling up. ETH could therefore be prepared for a bit more upside, but this also presents a chance for some bear traps, from where short-term sell-offs are expected. More accumulation heading into the weekend will confirm an uptrend.