The crypto market is facing a testing start to May. With the Feds announcement, the market has faced two major dips already with the latest being a 3.7% dip. Amidst this, there has been yet another statistic has come out that can cause a bit of worry and raise a lot of eyebrows.

Stablecoins, namely Binance USD (BUSD) and USD Coin (USDC), are showing huge volumes today. Interestingly, such levels have not been seen for months.

At the same time, Bitcoin has been taking since the start of May. Initially, it was ranging around $38,500 but the market sentiment has turned for the worse. The leading market cap cryptocurrency is now hovering around the $35,000 zone. Ethereum has also dropped to a sideways movement around the $2500 zone.

What does the data say?

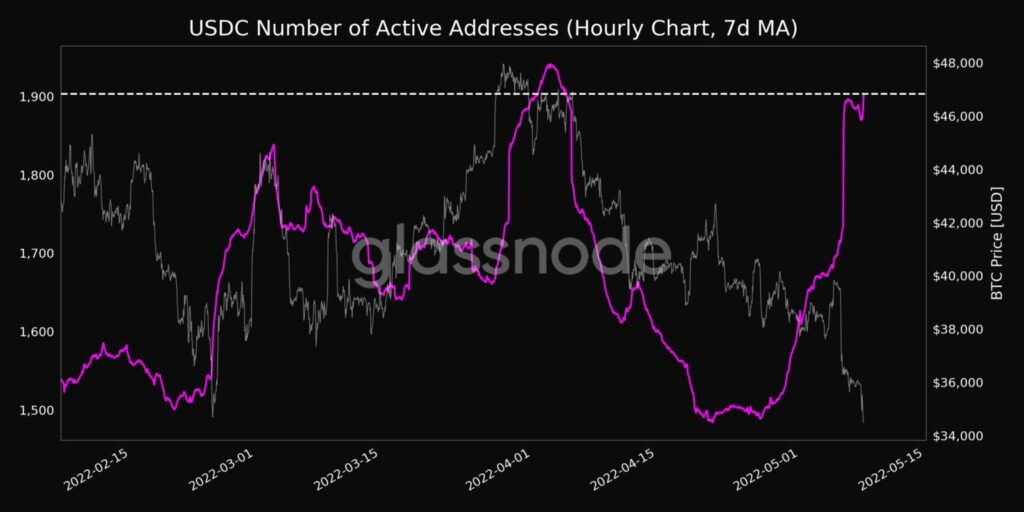

Starting with the USDC, this has really happened in the last 24 hours. According to glass knot Data, the number of active addresses on USDC has reached a new milestone. It sits at a one-month high of 1,903.4 after breaking the previous high of 1,896.7 on May 6.

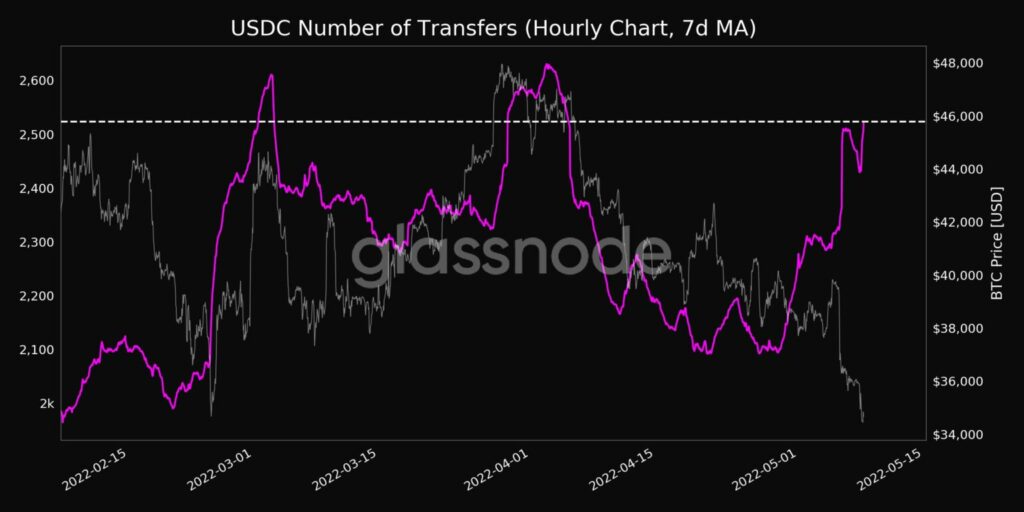

The number of transfers of USDC also hit a new high today. The previous 1-month of 2,510.8 transfers was observed on 6 May which has since been overtaken at today.

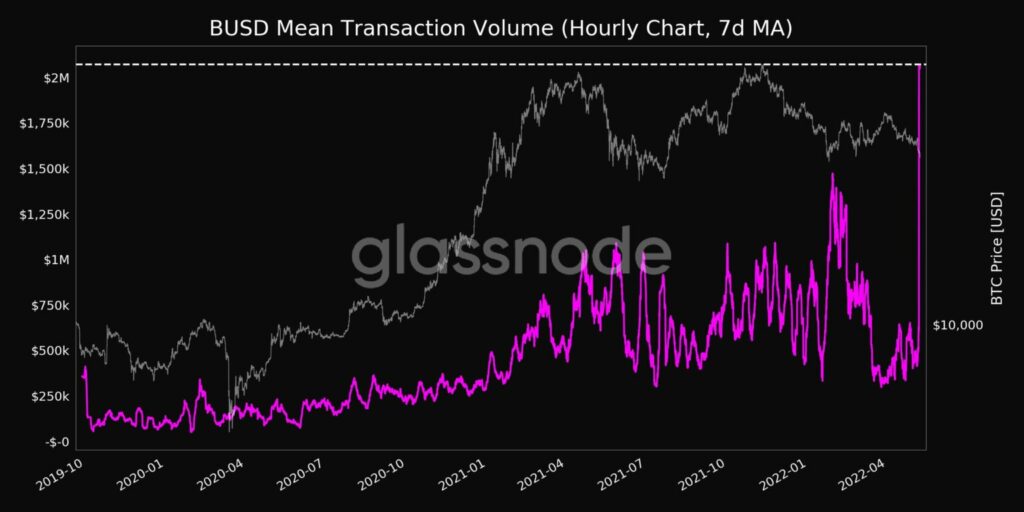

BUSD is another stablecoin that has shown a massive increase in activity. BUSD’s “Average Trading Volume” hit a record high of $2,072,063 today, eclipsing the previous all-time high.

What about the “big-shots” of crypto?

Bitcoin and Ethereum both suffered losses in the last 24 hours. While BTC fell by 3.7%, and ETH by 4.5%, both major cryptocurrencies have suffered recently.

With bearish sentiment in the market, BTC “trade entry volume” hit a 3-month high of $57,349,095, as Glassnode reports. ETH, on the other hand, fell to a new low with the number of lost addresses hitting a 2-year high of 24,881,546.7.

So overall this increase in stablecoin activity amid poor market sentiments and falling prices of flagship tokens across the board doesn’t bode too well for the short term future of cryptos.