Bitcoin and Ethereum miners, both have made a significant chuck in revenues over the years as demand skyrocketed. However, 2022 might come as a surprise especially for the largest cryptocurrency. January proved to be a tough month for Bitcoin miners. Miners generated approximately $1.2 billion in revenue during the first month of 2022.

While the numbers look impressive, total January revenue was down $220 million from December 2021. A staggering 15% drop in mining revenue.

From BTC to ETH, here’s the journey

Bitcoin miners took a tumble in mining profitability during the month of April. However, Ethereum miners saw $224 million more revenue than Bitcoin miners. The reason?

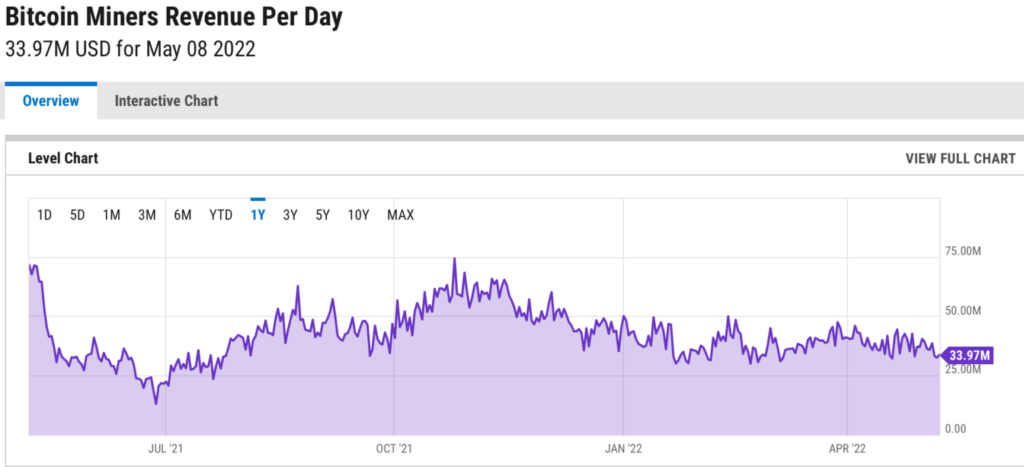

According to the Ycharts chart information below, at press time, BTC miners have seen a significant drop from the prior year. In fact, April revenue fell to $34 million from the March 2022 value of around $1.21 billion.

Investors rooted to gain at least the Bitcoin mining profits, but the BTC network suffered drastically as Bitcoin mining difficulty spiked, touching 29.79T. Overall, the total profitability of Bitcoin over the past year went down by 31% since April 2021.

walk ahead

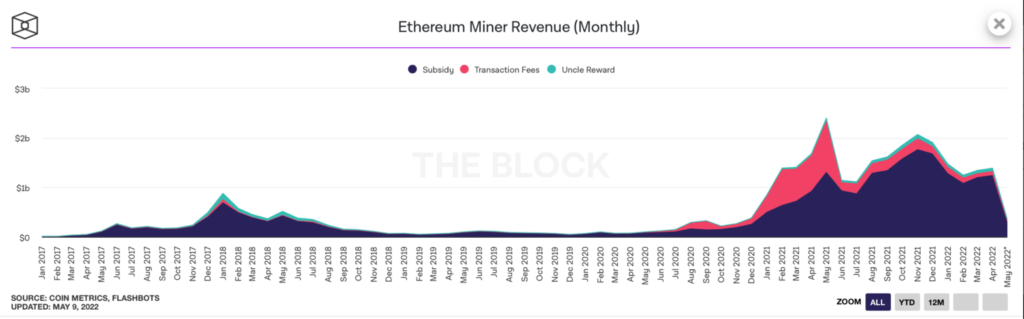

Ethereum and the largest altcoin miners took this opportunity to take the lead. Ethereum mining became even more profitable when the crypto broke through the $4,000 resistance in 2021. And currently, with the upcoming meltdown, it has become increasingly difficult for Bitcoin to remain the king of mining. crypto. More and more miners have migrated to the Ether network with these ongoing developments.

Ethereum miners’ revenue surpassed Bitcoin’s because the total number of coins earned was multiplied by a relatively higher ETH price than BTC in April 2022.

ETH miners recorded $1.39 billion in April’s revenues, while BTC miners took in around $1.16 billion. Unlike Bitcoin, Ethereum revenue increased by 3% from March.

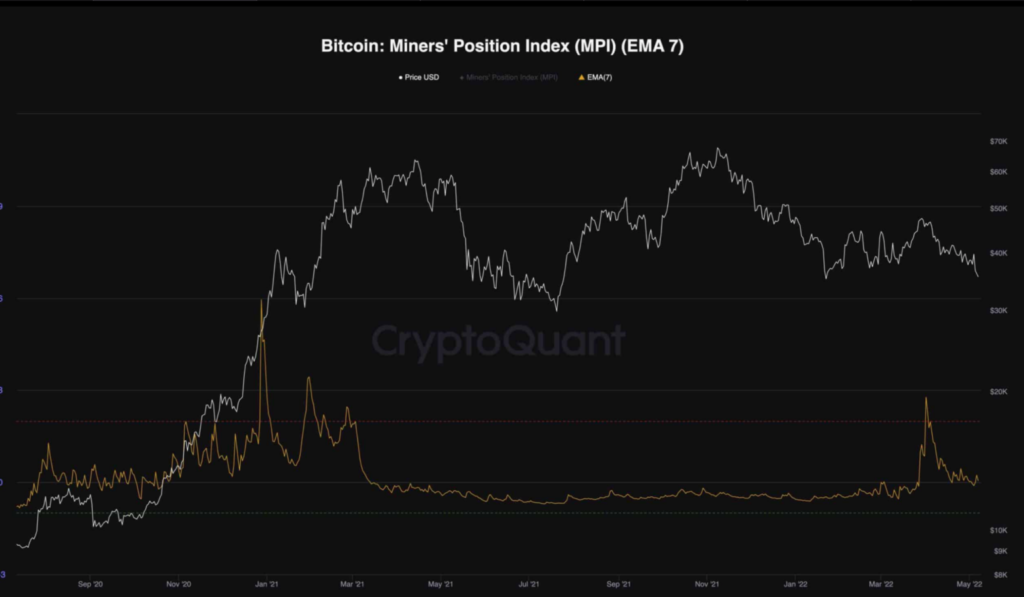

Overall, miner earnings are dictated using the price of a cryptocurrency and the number of coins earned in a given period. To make matters worse, BTC miners even sold off a large portion of their BTC coins when the selloff hit the market.